Expenses Child Form

What is the Expenses Child

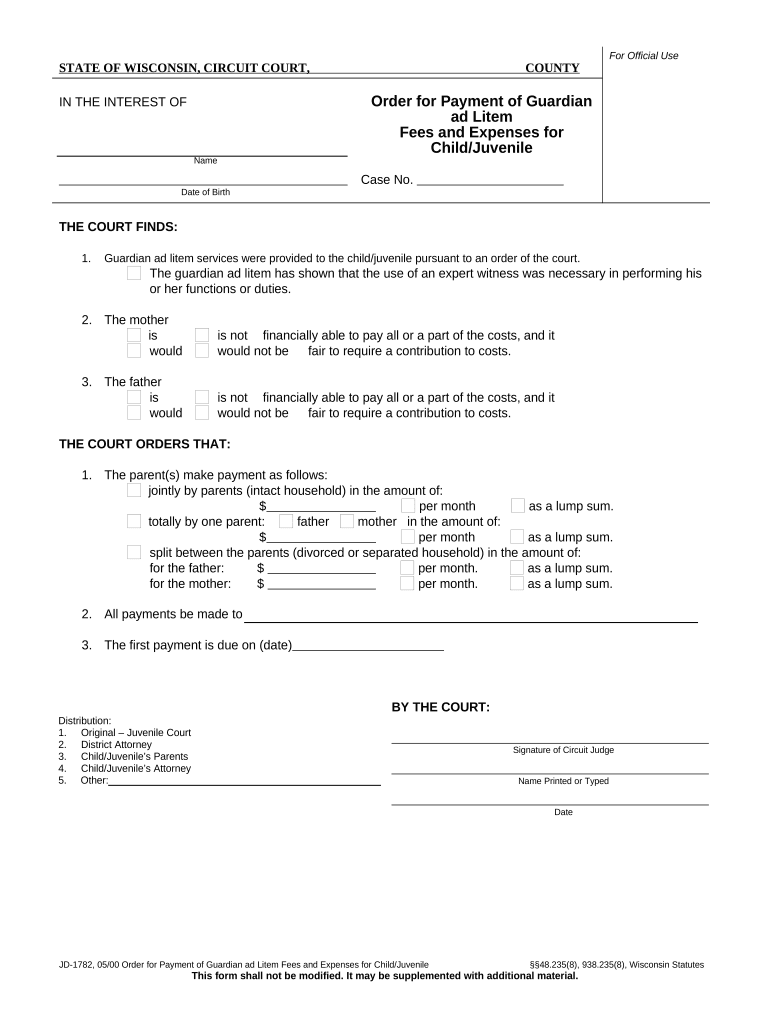

The Expenses Child form is a specific document designed for families with children who have disabilities. This form allows parents or guardians to report and claim various expenses incurred for the care and support of their child. These expenses may include medical costs, educational resources, and other necessary services that contribute to the child's well-being. Understanding the purpose of this form is crucial for ensuring that families can access the financial support they need.

How to use the Expenses Child

Using the Expenses Child form involves several steps to ensure accurate reporting of expenses. First, gather all relevant documentation that supports the expenses you intend to claim. This may include receipts, invoices, and any other proof of payment. Next, fill out the form with detailed information regarding each expense, including dates, amounts, and descriptions. It is essential to be thorough and precise, as this will facilitate a smoother review process.

Steps to complete the Expenses Child

Completing the Expenses Child form requires careful attention to detail. Here are the steps to follow:

- Collect all necessary documents that verify the expenses.

- Fill in your personal information, including your name, address, and relationship to the child.

- List each expense separately, providing the date, amount, and a brief description.

- Review the form for accuracy and completeness.

- Sign and date the form to certify that the information provided is true.

Legal use of the Expenses Child

The Expenses Child form must be completed in compliance with local and federal regulations. It is legally binding, meaning that any false information can lead to penalties. Families should ensure that they are familiar with the legal requirements surrounding the form, including eligibility criteria and documentation standards. Adhering to these regulations not only protects the family but also ensures that the expenses claimed are valid and justifiable.

Required Documents

To successfully complete the Expenses Child form, several documents are required. These typically include:

- Receipts for all claimed expenses.

- Invoices from service providers.

- Medical records or educational assessments, if applicable.

- Any relevant correspondence from government agencies regarding support or funding.

Having these documents readily available will streamline the process and help substantiate your claims.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Expenses Child form. Generally, this form needs to be submitted twice yearly, with specific deadlines set by state or federal guidelines. Missing these deadlines can result in delays or denial of claims. Families should mark their calendars and prepare their documentation in advance to ensure timely submission.

Quick guide on how to complete expenses child

Effortlessly Complete Expenses Child on Any Device

Managing documents online has seen a surge in popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Expenses Child on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Alter and Electronically Sign Expenses Child with Ease

- Find Expenses Child and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a standard handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors requiring you to print new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Expenses Child to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What form needs to be filled out twice yearly on expenses for child with disability?

The form that needs to be filled out twice yearly on expenses for a child with a disability typically includes documentation of all related expenses. This may involve collecting various receipts and invoices to ensure accurate reporting. airSlate SignNow can streamline this process by allowing you to sign and send documents electronically, making your workflow more efficient.

-

How can airSlate SignNow help with filling out forms for a child with a disability?

With airSlate SignNow, you can easily create, manage, and sign forms related to expenses for a child with a disability. The platform enables you to streamline the document collection process, making it simpler to ensure you have all the necessary paperwork in one place. This can save you time and reduce stress when fulfilling the requirement of what form needs to be filled out twice yearly on expenses for child with disability.

-

Is airSlate SignNow cost-effective for individuals and families?

Yes, airSlate SignNow is designed to be a cost-effective solution for both individuals and businesses. It offers various pricing plans that cater to different needs, ensuring that everyone can find a suitable option. Whether you're dealing with what form needs to be filled out twice yearly on expenses for child with disability or other documentation, you'll find the service affordable.

-

What are the key features of airSlate SignNow?

AirSlate SignNow provides a range of features including eSigning, document templates, and cloud storage. These tools make it easy to create and manage documents necessary for reporting what form needs to be filled out twice yearly on expenses for child with disability. Additionally, you can track document status and send reminders for signed documents.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow can integrate with a variety of other software, making it easy to manage your documents alongside your other tools. This collaboration can enhance your ability to track what form needs to be filled out twice yearly on expenses for child with disability, ensuring all your documentation is up-to-date and accessible.

-

How secure is airSlate SignNow for handling sensitive information?

Security is a top priority for airSlate SignNow. The platform utilizes advanced encryption and complies with industry standards to protect sensitive information, such as that pertaining to what form needs to be filled out twice yearly on expenses for child with disability. You can trust that your data is kept safe and secure throughout the signing process.

-

What support options does airSlate SignNow offer?

airSlate SignNow provides various support options, including online resources, tutorials, and customer service representatives. Whether you have questions about using the platform or need assistance with what form needs to be filled out twice yearly on expenses for child with disability, the support team is there to assist you every step of the way.

Get more for Expenses Child

- Motionfor release on personal recognizance form

- Sample licensing agreementsharvard office of technology form

- Personal training program waiver ampamp registration form

- Application and affidavit for case number form c 25a rev 6

- Sample contract eagle home inspections form

- Dealership legal name date address street city state zip form

- Congratulations on increased sales form

- Enclosed is copy of the buyers guide which relates to the warranty form

Find out other Expenses Child

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement