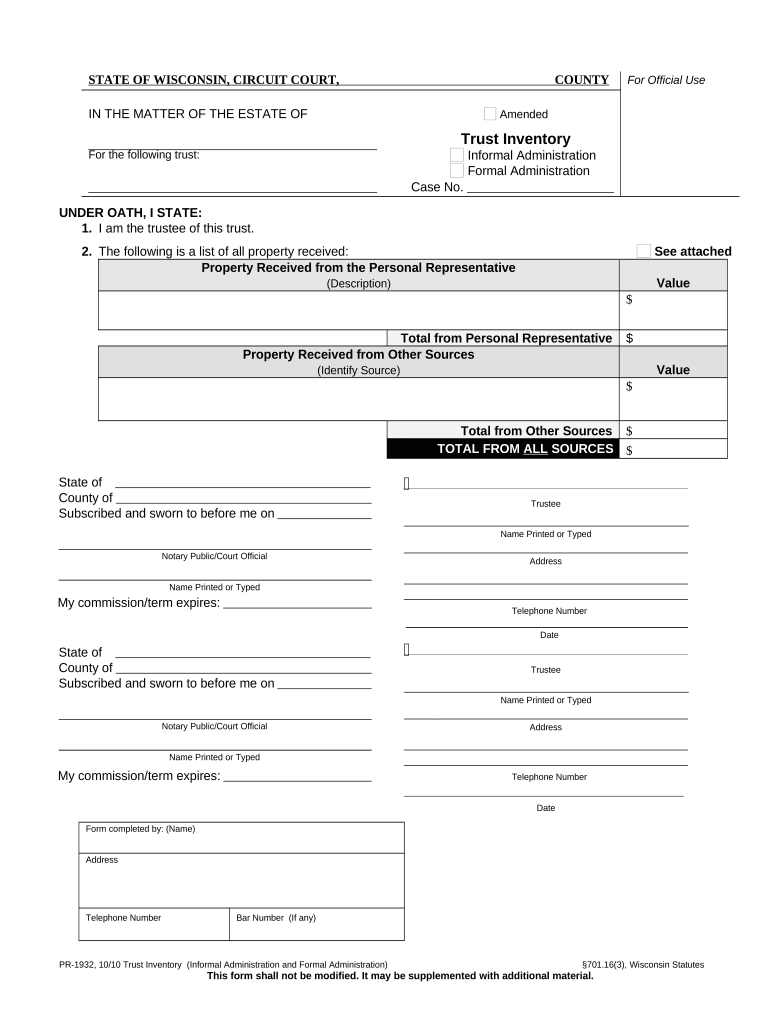

Wisconsin Trust Form

What is the Wisconsin Trust

The Wisconsin Trust is a legal arrangement that allows individuals to manage their assets during their lifetime and designate how those assets will be distributed after their death. This form of trust can help avoid probate, provide tax benefits, and ensure that specific wishes regarding asset distribution are honored. Trusts can be revocable or irrevocable, with revocable trusts allowing the grantor to make changes or dissolve the trust during their lifetime, while irrevocable trusts cannot be altered once established.

How to use the Wisconsin Trust

Using the Wisconsin Trust involves several steps, including drafting the trust document, transferring assets into the trust, and designating beneficiaries. It is essential to clearly outline the terms of the trust, including who will manage the trust and how the assets will be distributed. Consulting with a legal professional is advisable to ensure that the trust complies with state laws and meets the specific needs of the grantor.

Steps to complete the Wisconsin Trust

To complete a Wisconsin Trust, follow these steps:

- Determine the type of trust needed (revocable or irrevocable).

- Draft the trust document, specifying terms, beneficiaries, and trustee responsibilities.

- Sign the document in the presence of a notary public to ensure its legality.

- Transfer assets into the trust by changing titles and ownership as necessary.

- Communicate with beneficiaries about the trust's existence and terms.

Legal use of the Wisconsin Trust

The legal use of the Wisconsin Trust is governed by state laws that outline the requirements for creating and maintaining a trust. It must be established with clear intent and proper documentation to be recognized by the courts. Trusts can be used for various purposes, including estate planning, asset protection, and charitable giving, provided they adhere to legal standards set forth in Wisconsin statutes.

Key elements of the Wisconsin Trust

Key elements of the Wisconsin Trust include:

- Grantor: The person who creates the trust and transfers assets into it.

- Trustee: The individual or entity responsible for managing the trust assets and ensuring compliance with the trust terms.

- Beneficiaries: Individuals or entities designated to receive benefits from the trust.

- Trust document: The legal document that outlines the terms, conditions, and provisions of the trust.

State-specific rules for the Wisconsin Trust

Wisconsin has specific rules governing the creation and management of trusts. These include requirements for the trust document, the powers of the trustee, and the rights of beneficiaries. It is crucial to be aware of these regulations to ensure that the trust is valid and enforceable. Legal counsel can provide guidance on state-specific nuances that may affect the trust's operation.

Quick guide on how to complete wisconsin trust 497431378

Complete Wisconsin Trust effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely preserve it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Wisconsin Trust on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to alter and eSign Wisconsin Trust with ease

- Locate Wisconsin Trust and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your updates.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device. Edit and eSign Wisconsin Trust and ensure seamless communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a wi trust printable and how does it work?

A wi trust printable is a document that can be printed and signed using airSlate SignNow's eSignature platform. It simplifies the signing process, allowing users to fill out forms digitally and print them as needed. This combination of digital and printable options makes it user-friendly for various businesses.

-

How much does it cost to use airSlate SignNow for wi trust printable?

The pricing for airSlate SignNow who need wi trust printable solutions is competitive and varies based on the plan selected. Plans typically include features for document creation, eSigning, and integration with other tools. Check the pricing page for detailed information and find a plan that fits your business needs.

-

What features does airSlate SignNow offer for wi trust printable documents?

airSlate SignNow offers robust features for creating and managing wi trust printable documents, including template creation, real-time collaboration, and customizable signing workflows. These features streamline the process and enhance document accuracy. Additionally, users can track the signing status of documents for better management.

-

Is airSlate SignNow secure for handling wi trust printable documents?

Yes, airSlate SignNow ensures the security of your wi trust printable documents with industry-standard encryption and compliance with regulations such as GDPR. Your documents are protected throughout the signing process, and each signature is securely stored to prevent tampering. This makes it a reliable choice for businesses.

-

Can I integrate airSlate SignNow with other tools for managing wi trust printable transactions?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, enhancing the management of wi trust printable transactions. You can connect it with platforms like Salesforce, Google Drive, and more to streamline your workflow. This flexibility makes it easy to incorporate into existing business processes.

-

What are the benefits of using wi trust printable with airSlate SignNow?

Using wi trust printable with airSlate SignNow offers numerous benefits, such as efficiency, cost savings, and ease of use. You can quickly create, send, and obtain signatures without the hassles of physical paperwork. Additionally, the ability to print as needed adds flexibility, making it suitable for a variety of business scenarios.

-

How can I get started with wi trust printable in airSlate SignNow?

Getting started with wi trust printable in airSlate SignNow is easy. Simply sign up for an account, select the wi trust printable template or upload your document, and start customizing it for your needs. The user-friendly interface ensures that you can begin sending and signing documents quickly without a steep learning curve.

Get more for Wisconsin Trust

- Control number me sdeed 9 10 form

- Quitclaim deed with covenant and form

- Gas natural inc form 10 k march 12 2015

- Control number me sdeed 9 14 form

- Control number me sdeed 9 2 form

- From husband and wife to individual form

- Auto insurance from companies you trust best auto form

- From husband and wife to two individuals form

Find out other Wisconsin Trust

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement