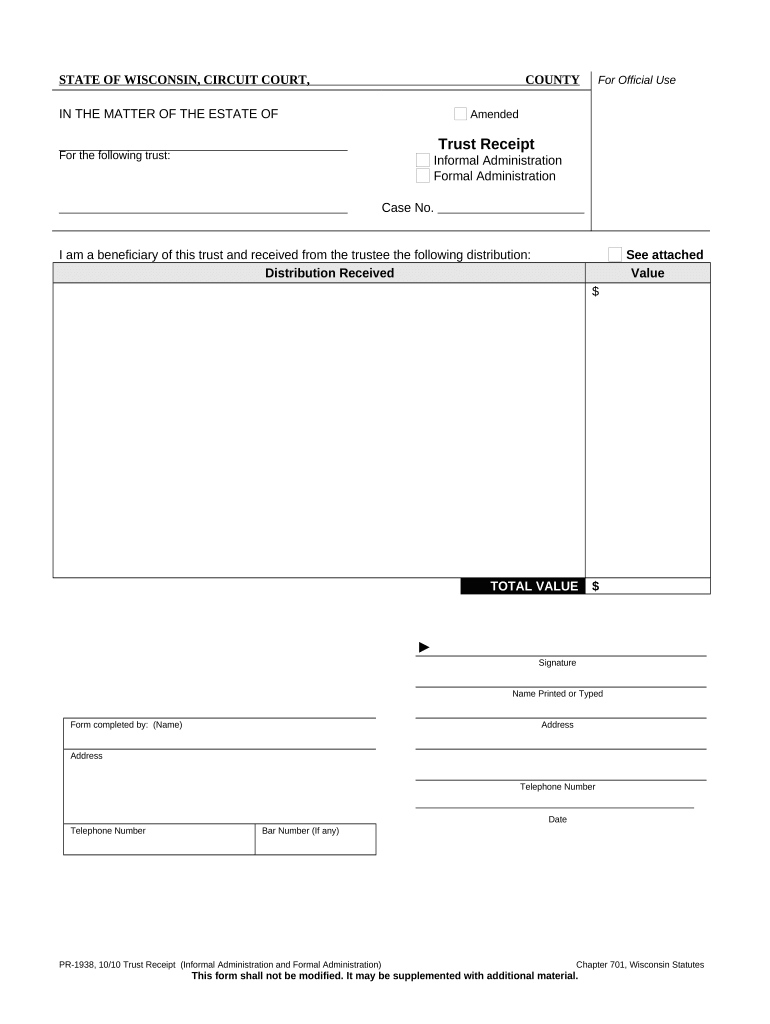

Wi Trust Form

What is the Wi Trust

The Wi Trust is a legal document used in estate planning that allows individuals to manage and distribute their assets according to their wishes. It serves as a foundational tool in establishing a trust, which can provide significant benefits such as avoiding probate and ensuring privacy. This document outlines the terms under which the assets will be held and distributed, making it essential for individuals looking to secure their financial legacy.

How to use the Wi Trust

Using the Wi Trust involves several key steps. First, individuals must clearly define their assets and beneficiaries. Next, they should outline the specific terms of the trust, including how and when assets will be distributed. Once the document is drafted, it should be signed and notarized to ensure its legal validity. Finally, it is crucial to fund the trust by transferring ownership of the specified assets into it, which solidifies the trust's purpose and effectiveness.

Key elements of the Wi Trust

The Wi Trust includes several critical components that ensure its effectiveness. These elements typically consist of:

- Grantor: The individual creating the trust.

- Trustee: The person or entity responsible for managing the trust.

- Beneficiaries: Those who will receive benefits from the trust.

- Terms of the trust: Specific instructions regarding asset management and distribution.

- Revocation clause: Conditions under which the trust can be altered or revoked.

Steps to complete the Wi Trust

Completing the Wi Trust involves a systematic approach to ensure all legal requirements are met. The steps include:

- Identify and list all assets to be included in the trust.

- Determine the beneficiaries and their respective shares.

- Draft the trust document, ensuring all necessary legal language is included.

- Review the document with a legal professional to ensure compliance with state laws.

- Sign the document in the presence of a notary public.

- Transfer ownership of assets into the trust.

Legal use of the Wi Trust

The Wi Trust is legally binding when it adheres to state laws governing trusts. It must be executed with proper formalities, including signatures and notarization. Additionally, the trust must comply with relevant tax regulations to ensure that it does not incur unnecessary penalties. Understanding these legal requirements is essential for the trust to serve its intended purpose effectively.

Who Issues the Form

The Wi Trust form is typically created by the grantor, often with the assistance of an attorney specializing in estate planning. While there is no specific government agency that issues the form, it must meet the legal requirements set forth by state laws. Legal professionals can provide templates and guidance to ensure that the trust is correctly established and compliant with local regulations.

Quick guide on how to complete wi trust

Complete Wi Trust effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Wi Trust on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign Wi Trust with ease

- Obtain Wi Trust and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Wi Trust and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is wi trust and how does it work with airSlate SignNow?

Wi trust is an essential component of the airSlate SignNow platform, allowing users to securely sign documents online. With wi trust technology, your documents are protected with advanced encryption methods. This ensures that your signatures and confidential information remain safe throughout the signing process.

-

How much does airSlate SignNow cost for using wi trust features?

Pricing for airSlate SignNow varies depending on the plan selected, with options that cater to different business sizes and needs. The wi trust feature is included in all plans, ensuring you have access to secure document signing no matter which subscription you choose. We recommend checking our pricing page for the most current details.

-

What are the main benefits of using airSlate SignNow with wi trust?

Using airSlate SignNow with wi trust offers numerous benefits, including enhanced security, improved efficiency, and the ability to manage documents seamlessly. Companies can streamline their workflows by utilizing wi trust for secure eSignatures, reducing processing time and paper waste. Ultimately, this leads to a more eco-friendly and organized document management system.

-

Can I integrate airSlate SignNow wi trust with other software?

Yes, airSlate SignNow offers various integration capabilities that allow you to connect with a wide range of applications. Whether it's CRM systems, cloud storage solutions, or productivity tools, you can enhance your workflow by integrating wi trust with your existing solutions. This flexibility ensures seamless document management that meets business needs.

-

Is wi trust compliant with industry regulations?

Absolutely! Wi trust functionalities within airSlate SignNow comply with industry standards and regulations, including ESIGN and UETA, ensuring legal validity of your eSignatures. This means that businesses can confidently use airSlate SignNow for document signing without worrying about compliance issues. Your trust in the process is paramount.

-

What types of documents can I sign using airSlate SignNow's wi trust feature?

With airSlate SignNow, you can sign a variety of document types using the wi trust feature, including contracts, agreements, and consent forms. The platform supports multiple file formats, making it easy to send and receive documents for signing. This versatility is what makes airSlate SignNow an ideal choice for diverse business needs.

-

How user-friendly is the airSlate SignNow interface for signing documents with wi trust?

The airSlate SignNow interface is designed with user experience in mind, making it incredibly easy to sign documents using the wi trust feature. Users can navigate the platform effortlessly, with straightforward options for uploading, signing, and sending documents. This intuitiveness helps businesses save time and reduce training costs.

Get more for Wi Trust

- Proxy disclosure recommendations harvard university form

- Borgwarner inc 2018 stock incentive plan secgov form

- 2019 stock option and incentive plan and forms of secgov

- The banker s note form

- To approve an employee stock option plan which recognizes eight levels of form

- Employees stock option plan form

- Manugistics group inc form

- The above summary is based upon an interpretation of present federal income form

Find out other Wi Trust

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors