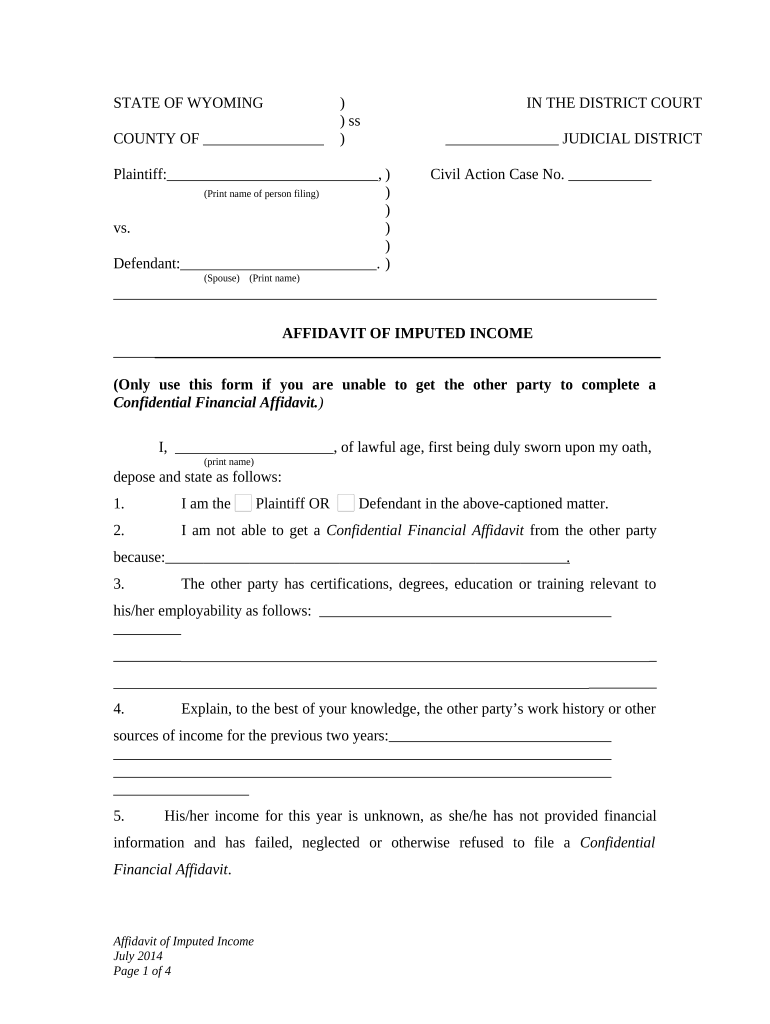

Imputed Income Form

What is the imputed income?

Imputed income refers to the value of benefits or services provided to an individual that are not paid in cash but are considered taxable income by the IRS. This can include items such as employer-provided health insurance, the use of a company car, or any other non-cash compensation. Understanding imputed income is essential for accurate tax reporting, as it can affect an individual’s overall tax liability.

How to use the imputed income

Utilizing imputed income involves recognizing it as part of your total income for tax purposes. When filing your taxes, you must report any imputed income along with your other income sources. This ensures compliance with IRS regulations and helps avoid potential penalties. It is advisable to consult tax guidelines or a tax professional to accurately assess and report imputed income.

Steps to complete the imputed income

Completing documentation related to imputed income involves several key steps:

- Identify all non-cash benefits received during the tax year.

- Calculate the fair market value of these benefits.

- Report the total imputed income on your tax return, typically on Form 1040 or relevant schedules.

- Keep records of any calculations and documentation for future reference or audits.

Legal use of the imputed income

The legal use of imputed income is governed by IRS guidelines, which require taxpayers to report all sources of income, including non-cash benefits. Failure to accurately report imputed income can lead to penalties, interest, and potential audits. It's important to adhere to federal and state regulations to ensure compliance and avoid legal issues.

Examples of using the imputed income

Common examples of imputed income include:

- The value of employer-sponsored health insurance plans.

- Company-provided vehicles used for personal purposes.

- Housing allowances or subsidies provided by an employer.

Each of these examples represents a financial benefit that must be accounted for when calculating taxable income.

IRS Guidelines

The IRS provides specific guidelines regarding imputed income, detailing what constitutes taxable benefits. Taxpayers must refer to IRS publications, such as Publication 15-B, which outlines the tax treatment of fringe benefits. Adhering to these guidelines is crucial for accurate tax reporting and compliance.

Quick guide on how to complete imputed income

Manage Imputed Income effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Imputed Income on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and electronically sign Imputed Income with ease

- Locate Imputed Income and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or censor sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, through email, SMS, or invite link, or download it to your computer.

Eliminate concerns about missing or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Adjust and electronically sign Imputed Income and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is imputed income and how does it affect my business?

Imputed income refers to the estimated income that is not directly received but is considered for tax purposes. For businesses using airSlate SignNow, understanding imputed income can help in properly managing tax liabilities associated with employee benefits and perks. Our platform can streamline the documentation process for calculating and reporting imputed income.

-

How can airSlate SignNow assist in managing documents related to imputed income?

airSlate SignNow offers tools for creating and managing contracts that may include imputed income considerations, such as employee compensation agreements. This ensures all documents are properly signed and stored securely, making it easier to track any imputed income calculations. Our electronic signature solution simplifies these processes for businesses.

-

Are there any pricing plans for airSlate SignNow that cater to businesses with specific imputed income needs?

Yes, airSlate SignNow offers various pricing plans suitable for businesses of all sizes, including those needing to address imputed income reporting. Our cost-effective solutions include features that help automate the signing process, ensuring compliance and accuracy in all related documentation. Custom plans can also be discussed to meet specific business requirements.

-

What features of airSlate SignNow can help in reducing errors related to imputed income documentation?

airSlate SignNow provides templates and automated workflows that reduce errors in documentation related to imputed income. By using e-signatures and automated notifications, the platform minimizes the risk of oversights and ensures that all documentation is complete and compliant with tax requirements. These features enhance accuracy and efficiency in managing imputed income.

-

Can airSlate SignNow integrate with other accounting systems for managing imputed income?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and HR systems, facilitating better management of imputed income tracking. This integration allows for automatic updates and synchronization of documents, ensuring that your records are always current. With these integrations, you can streamline your financial processes related to imputed income.

-

What are the benefits of using airSlate SignNow for handling imputed income agreements?

Using airSlate SignNow for handling imputed income agreements provides several benefits, including enhanced security, accessibility, and reduced paper usage. Our platform ensures that all agreements are securely signed and stored, making them easy to access when needed. This contributes to better compliance and management of imputed income across your organization.

-

Is airSlate SignNow compliant with legal standards regarding imputed income documentation?

Yes, airSlate SignNow is designed to comply with legal standards and regulations, including those related to imputed income documentation. Our electronic signatures are legally binding, ensuring that all agreements adhere to necessary laws and best practices. This compliance helps businesses avoid potential legal issues associated with imputed income reporting.

Get more for Imputed Income

Find out other Imputed Income

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast