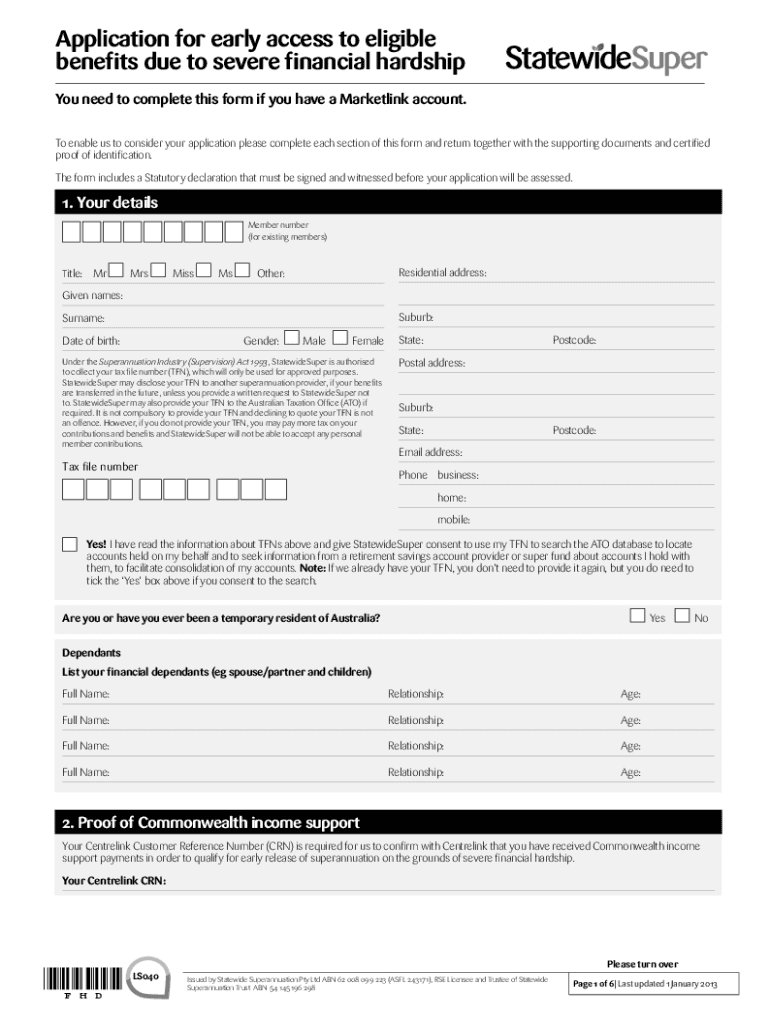

Statewide Super Withdrawal Form 2013-2026

What is the care super withdrawal form?

The care super withdrawal form is a critical document used by individuals seeking to access their superannuation funds under specific circumstances, such as financial hardship. This form allows members to formally request the early release of their superannuation savings, ensuring compliance with the relevant regulations governing superannuation in the United States. Understanding this form is essential for anyone considering a withdrawal due to personal financial challenges.

Eligibility criteria for the care super withdrawal form

To successfully complete the care super withdrawal form, applicants must meet certain eligibility criteria. Generally, individuals must demonstrate that they are experiencing significant financial hardship, which may include situations such as unemployment, medical expenses, or other critical financial burdens. It is important to review the specific requirements outlined by the superannuation fund to ensure compliance and increase the chances of approval.

Steps to complete the care super withdrawal form

Completing the care super withdrawal form involves several straightforward steps. First, gather all necessary documentation that supports your claim for financial hardship. Next, accurately fill out the form, ensuring that all required fields are completed. Be sure to include any additional information or documents that may be requested, such as proof of income or medical bills. Finally, submit the form through the designated method, which may include online submission, mail, or in-person delivery.

Required documents for the care super withdrawal form

When preparing to submit the care super withdrawal form, it is essential to compile the necessary documents that will support your application. Commonly required documents may include proof of identity, evidence of financial hardship such as recent bank statements, and any relevant medical documentation if applicable. Ensuring that all required documents are included will help facilitate a smoother review process.

Form submission methods for the care super withdrawal form

The care super withdrawal form can typically be submitted through various methods, depending on the superannuation fund's protocols. Common submission methods include online submission via the fund's website, mailing the completed form to the designated address, or delivering it in person at a local office. It is advisable to check the specific submission guidelines provided by the superannuation fund to ensure compliance with their requirements.

Legal use of the care super withdrawal form

The legal use of the care super withdrawal form is governed by regulations that dictate when and how individuals can access their superannuation funds. It is crucial to understand that the form must be completed accurately and submitted in accordance with the fund's guidelines to ensure that the withdrawal is legally recognized. Compliance with these regulations helps protect both the applicant and the superannuation fund from potential legal issues.

Quick guide on how to complete claiming financial hardship for statewide super form

The optimal method to obtain and sign Statewide Super Withdrawal Form

On a company-wide scale, ineffective procedures related to paper authorization can expend numerous working hours. Signing documents like Statewide Super Withdrawal Form is a standard aspect of operations in any organization, which is why the efficiency of each agreement’s lifecycle signNowly impacts the overall performance of the company. With airSlate SignNow, signing your Statewide Super Withdrawal Form can be as straightforward and quick as possible. You'll discover with this platform the latest version of almost any form. Even better, you can sign it instantly without needing to install any external software on your computer or printing any physical copies.

How to obtain and sign your Statewide Super Withdrawal Form

- Browse our collection by category or use the search bar to find the form you require.

- View the form preview by clicking on Learn more to confirm it’s the correct one.

- Click Get form to start editing immediately.

- Fill out your form and include any necessary information using the toolbar.

- When finished, click the Sign tool to sign your Statewide Super Withdrawal Form.

- Select the signature option that is most suitable for you: Draw, Generate initials, or upload a photo of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options if needed.

With airSlate SignNow, you possess everything required to manage your paperwork efficiently. You can find, fill out, edit, and even send your Statewide Super Withdrawal Form in a single tab with ease. Simplify your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Do I have to fill out both the FAFSA (since I'm a US citizen living abroad) and a CSS profile form to get financial aid for colleges?

There’s nothing about the FAFSA that is exclusive or required for US citizens living abroad. The FAFSA is simply the most commonly used application form for student aid applications GENERALLY, and almost every college and university asks for it rather than go to the trouble of inventing their own - even though, in fact, many of them DO have their own application, and STILL want to see a FAFSA.What you actually should do, is go to the website OF THE COLLEGES you are interested in, and check the parts where financial aid is discussed, and see what they want to see.Probably 90% or more will want a FAFSA, maybe 10% will want their own form IN ADDITION to the FAFSA, and a certain number will also want to see the CSS profile.So fill out the FAFSA online. There is part of it which asks for the codes (every college has one) for the colleges you want to have them send the form to. You can send a FAFSA to TEN colleges when you fill out the FAFSA in the first place - AND, you can go back later, and add more colleges.Fill out the FAFSA. The one for fall semester 2018- spring 2019 is available to be filled out beginning, I believe, around October 2017. Most colleges want to have that in their possession by January 2018.Unless, of course, you are independently wealthy, and can afford to pay for college by yourself.Other notes:you fill out the FAFSA every year for the next college year.you can link to the IRS website to pre-fill in a lot of the information the FAFSA asks for (this saves time).you need your own tax return data (if you have such a thing yet) and your parents’ information also.It looks intimidating, but it really isn’t terribly difficult - I would suggest going through the FAFSA website and reading most of the information there before you start, because there are various documents and numbers you will need to have to fill out the form, and it is easier if you have collected all that stuff before you sit down to fill the form out.By the way - I see this idea often and it is wrong - ‘FAFSA’ does NOT give anybody any money. It is an APPLICATION FOR AID. The college you apply to and get accepted at will look at your application, your FAFSA form, all the other required forms you supply to them, and THEN the Financial Aid office will decide a) whether to offer you an aid package and b) what that aid package will contain.It could be a mix of scholarships (great!), grants (wonderful!), student loans of various kinds (read the fine print) and perhaps an offer of work-study. You can accept or refuse any of those, individually.Good luck!

-

When is it mandatory to fill out a personal financial statement for one's bank? The form states no deadline about when it must be returned.

The only time I know that financial statements are asked for is when one applies for a business or personal loan, or applying for a mortgage. Each bank or credit union can have their own document requirements, however for each transaction. It really is at their discretion.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

Create this form in 5 minutes!

How to create an eSignature for the claiming financial hardship for statewide super form

How to generate an eSignature for the Claiming Financial Hardship For Statewide Super Form in the online mode

How to create an eSignature for your Claiming Financial Hardship For Statewide Super Form in Chrome

How to make an eSignature for putting it on the Claiming Financial Hardship For Statewide Super Form in Gmail

How to create an electronic signature for the Claiming Financial Hardship For Statewide Super Form straight from your mobile device

How to make an electronic signature for the Claiming Financial Hardship For Statewide Super Form on iOS devices

How to create an eSignature for the Claiming Financial Hardship For Statewide Super Form on Android OS

People also ask

-

What is caresuperlogin?

caresuperlogin is a secure login gateway designed for users of airSlate SignNow. It allows businesses to quickly and safely access their document signing and management needs. With an easy-to-use interface, caresuperlogin enhances user experience while ensuring the safety of sensitive information.

-

How does caresuperlogin benefit businesses?

By using caresuperlogin, businesses streamline their document signing processes, improving efficiency and reducing turnaround times. The secure login ensures that all parties have access to necessary documents, enabling faster decision-making. This ultimately leads to increased productivity and business growth.

-

Is there a cost associated with using caresuperlogin?

The caresuperlogin feature comes as part of the competitive pricing plans offered by airSlate SignNow. Users can choose from various subscription levels to find the plan that best fits their needs and budget. This cost-effective solution allows businesses of all sizes to leverage eSigning capabilities without breaking the bank.

-

What features are included with caresuperlogin?

Caresuperlogin provides a range of features including secure access, real-time document monitoring, and status notifications. Users benefit from the ability to sign documents remotely, track progress, and manage multiple documents effortlessly. These features enhance the overall user experience and streamline workflows.

-

Can I integrate caresuperlogin with other applications?

Yes, caresuperlogin can be integrated with various third-party applications to enhance functionality. This allows businesses to sync data and improve collaboration across different platforms. Seamless integrations with popular tools ensure that users can maximize their productivity while managing documents.

-

What advantages does caresuperlogin offer for remote teams?

For remote teams, caresuperlogin provides a secure and efficient way to handle document signing without the need for physical presence. This flexibility enables teams to work from anywhere while ensuring security and compliance. The streamlined process reduces delays, making teamwork more effective.

-

How is the security handled in caresuperlogin?

Caresuperlogin prioritizes security by employing advanced encryption and authentication protocols. This ensures that all documents and user data are protected from unauthorized access. Users can confidently manage sensitive information while adhering to compliance regulations.

Get more for Statewide Super Withdrawal Form

Find out other Statewide Super Withdrawal Form

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple