Instructions for Form W 8BEN Rev February TD Ameritrade

Key elements of the Instructions For Form W-8BEN Rev February TD Ameritrade

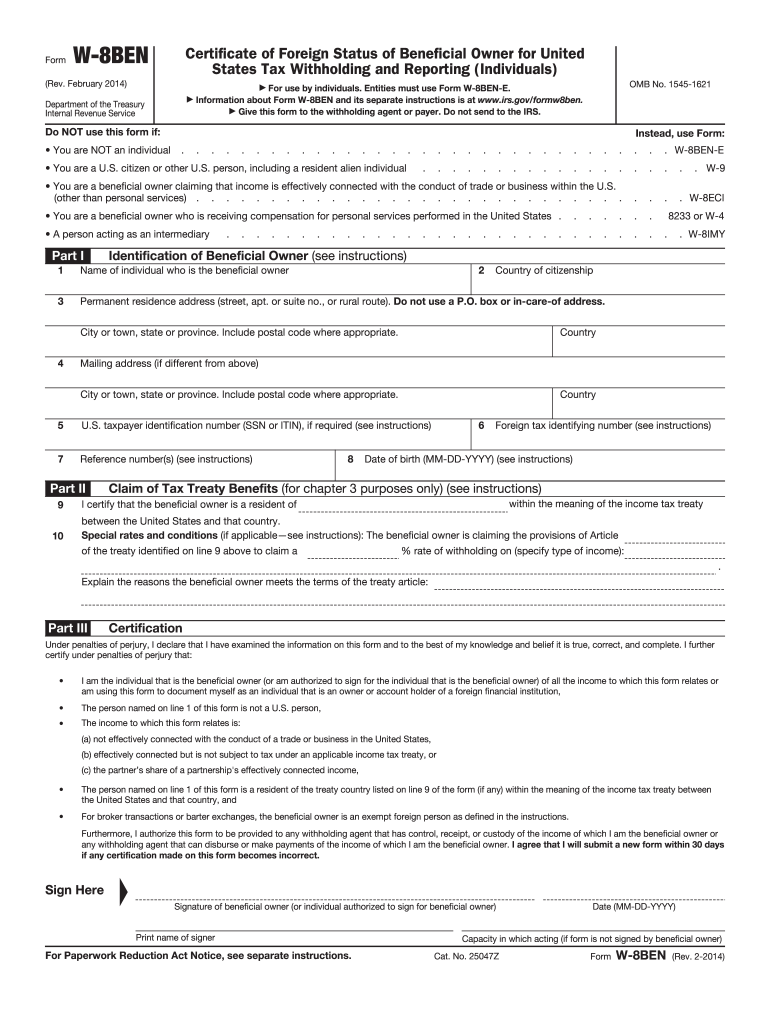

The Instructions for Form W-8BEN Rev February provide essential guidelines for non-U.S. persons to claim beneficial ownership of income and establish eligibility for reduced withholding rates under U.S. tax treaties. Key elements include:

- Identification of Beneficial Owner: The form requires the name, country of citizenship, and address of the individual or entity claiming the benefits.

- Claim of Tax Treaty Benefits: Taxpayers must indicate their eligibility for benefits under applicable tax treaties, which can reduce withholding rates.

- Certification: The signer must certify that the information provided is accurate and complete, affirming their status as a non-U.S. person.

- Signature and Date: A valid signature and date are necessary to validate the form, confirming the taxpayer's agreement with the provided information.

Steps to complete the Instructions For Form W-8BEN Rev February TD Ameritrade

Completing the W-8BEN form involves several straightforward steps to ensure accuracy and compliance. Follow these steps:

- Obtain the Form: Download the latest version of the W-8BEN form from the IRS website or through your TD Ameritrade account.

- Fill Out Personal Information: Enter your full name, country of citizenship, and permanent address. Ensure that the address is valid and corresponds to your country of residence.

- Claim Benefits: If applicable, indicate your eligibility for tax treaty benefits by providing the relevant country and treaty article.

- Sign and Date: After reviewing the information for accuracy, sign and date the form to validate it.

- Submit the Form: Send the completed form to TD Ameritrade as per their submission guidelines, ensuring you keep a copy for your records.

IRS Guidelines

The IRS provides specific guidelines for completing the W-8BEN form to ensure compliance with U.S. tax laws. These guidelines include:

- Eligibility Criteria: The form is intended for non-U.S. individuals or entities that receive income from U.S. sources.

- Tax Treaty Benefits: Taxpayers must refer to IRS Publication 515 to determine eligibility for benefits under tax treaties.

- Record Keeping: The IRS recommends maintaining records of all submitted forms and any correspondence related to the form for at least three years.

Required Documents

When completing the W-8BEN form, certain documents may be required to support your claims. These include:

- Proof of Identity: A valid passport or government-issued identification may be necessary to verify your identity.

- Tax Identification Number: If applicable, provide your foreign tax identification number to facilitate processing.

- Documentation for Tax Treaty Claims: If claiming benefits under a tax treaty, supporting documents may be required to substantiate your claim.

Form Submission Methods

There are various methods to submit the W-8BEN form to TD Ameritrade, ensuring convenience for users. These methods include:

- Online Submission: Users can upload the completed form directly through their TD Ameritrade online account.

- Mail Submission: Alternatively, the form can be printed and mailed to the designated TD Ameritrade address.

- In-Person Submission: For those who prefer face-to-face interactions, visiting a TD Ameritrade branch to submit the form is also an option.

Penalties for Non-Compliance

Failure to properly complete and submit the W-8BEN form can lead to significant penalties. These may include:

- Increased Withholding Rates: Without a valid W-8BEN, U.S. payers are required to withhold taxes at the maximum rate.

- IRS Audits: Non-compliance may trigger audits or further scrutiny from the IRS, leading to additional penalties.

- Legal Consequences: In severe cases, failure to comply with tax regulations can result in legal action.

Quick guide on how to complete w 8ben rev 2014 form

Effortlessly Prepare Instructions For Form W 8BEN Rev February TD Ameritrade on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to obtain the correct format and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents rapidly without hurdles. Handle Instructions For Form W 8BEN Rev February TD Ameritrade on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The simplest way to modify and electronically sign Instructions For Form W 8BEN Rev February TD Ameritrade with ease

- Locate Instructions For Form W 8BEN Rev February TD Ameritrade and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive content with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form – via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Instructions For Form W 8BEN Rev February TD Ameritrade and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can you fill out the W-8BEN form (no tax treaty)?

A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in settlement of payment card transactions that are not effectively connected with a U.S. trade or business of the payee.As stated by Mr. Ivanov below, Since Jordan is not one of the countries listed as a tax treaty country, it appears that you would only complete Part I of the Form W-8BEN, Sign your name and date the Certification in Part III.http://www.irs.gov/pub/irs-pdf/i...Hope this is helpful.

-

As a Canadian working in the US on a TN-1 visa should I fill out the IRS Form W-8BEN or W9?

Use the W-9. The W-8BEN is used for cases where you are not working in the U.S., but receiving income relating to a U.S. Corporation, Trust or Partnership.

-

Why do I have to fill out a W-8BEN form, sent by TD Bank, if I am an F1-student (from Canada) that is not working?

Of course you are not working. But the bank needs to notify the IRS of the account and it using the W-8BEN for to get the info it needs about you.

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

Create this form in 5 minutes!

How to create an eSignature for the w 8ben rev 2014 form

How to create an eSignature for the W 8ben Rev 2014 Form online

How to make an electronic signature for the W 8ben Rev 2014 Form in Google Chrome

How to create an eSignature for signing the W 8ben Rev 2014 Form in Gmail

How to make an eSignature for the W 8ben Rev 2014 Form from your smartphone

How to make an eSignature for the W 8ben Rev 2014 Form on iOS devices

How to create an eSignature for the W 8ben Rev 2014 Form on Android devices

People also ask

-

What is the TD Ameritrade W8BEN form, and why is it important?

The TD Ameritrade W8BEN form is a tax form used by non-U.S. residents to signNow their foreign status and claim any applicable tax treaty benefits. This form is essential for investors who wish to avoid unnecessary withholding taxes on income derived from U.S. investments. Understanding this form helps ensure compliance and maximizes your investment returns.

-

How can airSlate SignNow help me with the TD Ameritrade W8BEN form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending your TD Ameritrade W8BEN form. With its intuitive interface, you can complete and submit the form quickly, ensuring that your transactions proceed without delays. This digital solution simplifies the process and enhances your overall experience.

-

Is there a cost associated with using airSlate SignNow for the TD Ameritrade W8BEN form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs, including options for individual users. While there may be a fee for using the platform, the investment often pays off in terms of time saved and efficiency gained when handling documents like the TD Ameritrade W8BEN form. Additionally, the platform frequently offers free trials to explore its features.

-

What features does airSlate SignNow offer for managing the TD Ameritrade W8BEN form?

AirSlate SignNow offers a range of features specifically designed for document management, including customizable templates, eSignature capabilities, and secure cloud storage. These tools enable you to streamline the completion of your TD Ameritrade W8BEN form and manage all related paperwork efficiently. It also includes tracking options, so you can monitor the status of your submissions.

-

What are the benefits of using airSlate SignNow for my TD Ameritrade W8BEN form?

Using airSlate SignNow for your TD Ameritrade W8BEN form offers numerous benefits, including faster processing times and improved document security. It eliminates the need for printing and mailing, saving you both time and resources. The platform’s user-friendly design also makes it easy to ensure all necessary fields are completed correctly.

-

Can I integrate airSlate SignNow with other tools for processing the TD Ameritrade W8BEN form?

Yes, airSlate SignNow integrates seamlessly with various applications and software, allowing you to enhance your workflow when processing the TD Ameritrade W8BEN form. Integrations with CRM systems, cloud storage services, and other document management tools ensure that you can manage your documents efficiently. This capability increases productivity while handling important forms.

-

How secure is the data shared through airSlate SignNow for the TD Ameritrade W8BEN form?

AirSlate SignNow takes data security very seriously, employing advanced encryption and secure access protocols to protect your information while processing the TD Ameritrade W8BEN form. Your documents are stored in a secure environment, ensuring compliance with various regulatory requirements. This commitment to security gives you peace of mind while handling sensitive tax forms.

Get more for Instructions For Form W 8BEN Rev February TD Ameritrade

- Newly widowed individuals package new jersey form

- Employment interview package new jersey form

- Nj file form

- Nj mortgage form 497319608

- New jersey assignment 497319609 form

- Lease purchase agreements package new jersey form

- Cancellation release 497319611 form

- Premarital agreements package new jersey form

Find out other Instructions For Form W 8BEN Rev February TD Ameritrade

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors