B2400a B Alt Form 2400a B Alt 12 15

Understanding the Bankruptcy Reaffirmation Agreement

A bankruptcy reaffirmation agreement is a legal document that allows a debtor to retain certain secured debts, such as a car or home, after filing for bankruptcy. This agreement is crucial as it reaffirms the debtor's obligation to repay the debt, even after the bankruptcy discharge. The reaffirmation process requires careful consideration, as it can affect the debtor's financial future. It is important to understand the implications of reaffirming a debt, including the potential for continued liability and the impact on credit scores.

Key Elements of the Bankruptcy Reaffirmation Agreement

Several essential components make up a bankruptcy reaffirmation agreement. These elements include:

- Debtor Information: The agreement must clearly identify the debtor and the creditor involved.

- Details of the Debt: A description of the debt being reaffirmed, including the amount owed and the terms of repayment.

- Signatures: Both the debtor and creditor must sign the agreement to make it legally binding.

- Court Approval: In some cases, the agreement may require court approval, especially if it poses a risk to the debtor's ability to meet other financial obligations.

Steps to Complete the Bankruptcy Reaffirmation Agreement

Completing a bankruptcy reaffirmation agreement involves several steps:

- Review Financial Situation: Assess your financial status to determine if reaffirming the debt is in your best interest.

- Consult with Legal Counsel: Seek advice from a bankruptcy attorney to understand the implications of the agreement.

- Fill Out the Agreement: Complete the reaffirmation agreement form, ensuring all required information is accurate.

- Sign the Agreement: Both parties must sign the document to validate the reaffirmation.

- File with the Court: Submit the signed agreement to the bankruptcy court within the specified timeframe.

Legal Use of the Bankruptcy Reaffirmation Agreement

The reaffirmation agreement must comply with specific legal standards to be enforceable. It must be executed voluntarily, without coercion, and the debtor must be fully informed of the consequences. Courts typically review these agreements to ensure they do not impose undue hardship on the debtor. If the agreement meets all legal requirements, it can provide the debtor with the ability to retain essential assets while continuing to fulfill their financial obligations.

Examples of Using the Bankruptcy Reaffirmation Agreement

Common scenarios where a bankruptcy reaffirmation agreement may be utilized include:

- Vehicle Loans: A debtor may choose to reaffirm a car loan to keep their vehicle while continuing to make payments.

- Mortgage Loans: Homeowners may reaffirm their mortgage to retain their home and avoid foreclosure.

- Personal Loans: Some debtors may reaffirm personal loans if they wish to maintain a good relationship with the lender.

Eligibility Criteria for Reaffirmation Agreements

Not all debtors may be eligible to reaffirm debts. Eligibility criteria typically include:

- Type of Bankruptcy Filed: Reaffirmation agreements are more common in Chapter seven and Chapter thirteen bankruptcies.

- Financial Stability: Debtors must demonstrate the ability to make future payments on the reaffirmed debt.

- Asset Value: The value of the asset being retained must justify the reaffirmation of the debt.

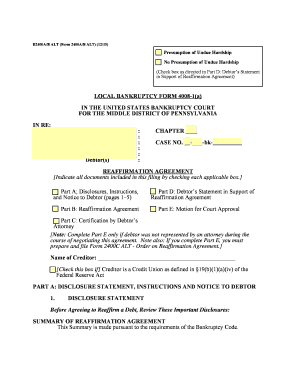

Quick guide on how to complete b2400a b alt form 2400a b alt 12 15

Effortlessly Prepare B2400a B Alt Form 2400a B Alt 12 15 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and without delays. Manage B2400a B Alt Form 2400a B Alt 12 15 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Easily Modify and eSign B2400a B Alt Form 2400a B Alt 12 15 without Stress

- Locate B2400a B Alt Form 2400a B Alt 12 15 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign B2400a B Alt Form 2400a B Alt 12 15 and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is bankruptcy reaffirmation and how does it work?

Bankruptcy reaffirmation is a legal process that allows debtors to retain certain assets, like a home or car, after filing for bankruptcy. By signing a reaffirmation agreement, debtors agree to continue making payments on those assets, even though the debt could have been discharged. This process can help individuals rebuild their credit post-bankruptcy while keeping their valuable property.

-

How can airSlate SignNow assist with bankruptcy reaffirmation documents?

airSlate SignNow offers a seamless solution for managing bankruptcy reaffirmation documents. Our platform allows users to easily create, send, and eSign reaffirmation agreements, making the process faster and more efficient. With our user-friendly interface, you can ensure that all necessary parties sign and return documents without hassle.

-

What are the benefits of using airSlate SignNow for bankruptcy reaffirmation?

Using airSlate SignNow for bankruptcy reaffirmation provides numerous benefits, including reduced processing time and enhanced document security. Our solution is cost-effective and designed to streamline the eSigning process, enabling users to focus on rebuilding their credit instead of getting bogged down in paperwork. Plus, our platform ensures compliance with legal standards.

-

Is there a cost associated with using airSlate SignNow for bankruptcy reaffirmation?

airSlate SignNow offers competitive pricing tailored to different business needs. Users can select from various subscription models to find the one that best fits their budget for managing bankruptcy reaffirmation documents. We also provide a free trial to help you evaluate our features without commitment.

-

What features are included for bankruptcy reaffirmation on airSlate SignNow?

airSlate SignNow includes a suite of features ideal for bankruptcy reaffirmation, including customizable templates, secure eSigning, and real-time document tracking. Users can conveniently manage their reaffirmation agreements, ensuring all necessary signatures are obtained and documents are stored securely in the cloud.

-

Can I integrate airSlate SignNow with other tools for bankruptcy reaffirmation processes?

Absolutely! airSlate SignNow seamlessly integrates with a variety of third-party applications, enhancing your bankruptcy reaffirmation processes. Whether you use CRM systems, document management tools, or workflow automation software, our integrations provide versatility and efficiency for handling your documents.

-

How does airSlate SignNow ensure the security of bankruptcy reaffirmation documents?

Security is a top priority at airSlate SignNow. We protect your bankruptcy reaffirmation documents with encryption, multi-factor authentication, and secure data storage. Our compliance with industry standards ensures that your sensitive information remains confidential and safe from unauthorized access.

Get more for B2400a B Alt Form 2400a B Alt 12 15

- Security contractor package alaska form

- Insulation contractor package alaska form

- Paving contractor package alaska form

- Site work contractor package alaska form

- Siding contractor package alaska form

- Refrigeration contractor package alaska form

- Drainage contractor package alaska form

- Tax free exchange package alaska form

Find out other B2400a B Alt Form 2400a B Alt 12 15

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form