Johns Creek Business Occupation Tax Return Form

What is the Johns Creek Business Occupation Tax Return

The Johns Creek Business Occupation Tax Return is a required document for businesses operating within Johns Creek, Georgia. This form is essential for obtaining a business license and ensuring compliance with local regulations. It captures vital information about the business, including its name, address, and nature of operations. Completing this return accurately is crucial for maintaining good standing with the city and avoiding potential penalties.

Steps to complete the Johns Creek Business Occupation Tax Return

Completing the Johns Creek Business Occupation Tax Return involves several key steps:

- Gather necessary information: Collect details about your business, including its legal name, address, and the type of services or products offered.

- Access the form: Obtain the Business Occupation Tax Return form from the official city website or local government office.

- Fill out the form: Carefully complete all sections of the form, ensuring accuracy and clarity in your responses.

- Review your submission: Double-check your entries for any errors or omissions before submission.

- Submit the form: Follow the designated submission methods, whether online, by mail, or in person, as specified by the city.

Legal use of the Johns Creek Business Occupation Tax Return

The legal use of the Johns Creek Business Occupation Tax Return is vital for businesses to operate lawfully within the city. This form not only serves as a license application but also ensures that businesses comply with local tax regulations. By submitting this return, businesses affirm their commitment to adhering to Johns Creek's ordinances and contribute to the local economy.

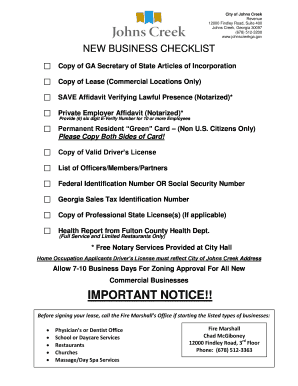

Required Documents

When completing the Johns Creek Business Occupation Tax Return, several documents may be required to support your application. These can include:

- Proof of business registration with the state of Georgia.

- Identification documents for the business owner or authorized representative.

- Any relevant permits or licenses specific to your business type.

Having these documents ready can streamline the process and ensure a smooth submission.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Johns Creek Business Occupation Tax Return is crucial for compliance. Typically, businesses are required to submit their returns by a specific date each year, which may vary. It is advisable to check with the local government for the exact deadlines to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The Johns Creek Business Occupation Tax Return can be submitted through various methods, providing flexibility for business owners:

- Online: Many businesses prefer to submit their forms electronically through the city’s official website.

- By Mail: You can also print the completed form and send it via postal service to the designated city office.

- In-Person: Submitting the form in person at the local government office allows for immediate processing and assistance if needed.

Quick guide on how to complete johns creek business occupation tax return

Complete Johns Creek Business Occupation Tax Return effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents since you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Johns Creek Business Occupation Tax Return on any device using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The simplest way to edit and eSign Johns Creek Business Occupation Tax Return with ease

- Find Johns Creek Business Occupation Tax Return and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Johns Creek Business Occupation Tax Return and ensure effective communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it help with business tax documentation?

airSlate SignNow is an intuitive eSignature solution designed to simplify the process of signing and managing documents. It can signNowly streamline your business tax documentation by allowing you to send, sign, and store necessary tax forms securely online. This reduces processing time and minimizes paperwork errors, ultimately saving you time during tax season.

-

How does airSlate SignNow ensure the security of sensitive business tax documents?

We prioritize the security of your business tax documents by implementing advanced encryption protocols and secure access controls. airSlate SignNow complies with industry standards such as GDPR and HIPAA, ensuring that your documents remain confidential. This way, you can confidently manage sensitive tax information without the fear of data bsignNowes.

-

What pricing plans does airSlate SignNow offer for businesses processing tax documents?

airSlate SignNow offers flexible pricing plans tailored to the needs of businesses handling tax documentation. Our plans are designed to be cost-effective, allowing you to choose a package that fits your operational size and volume of business tax documents. This enables seamless integration into your workflow without straining your budget.

-

Can airSlate SignNow integrate with my existing accounting software for business tax purposes?

Yes, airSlate SignNow seamlessly integrates with popular accounting software packages, making it easier to manage your business tax needs. Whether you're using QuickBooks, Xero, or other platforms, our integrations enhance data flow between systems, ensuring your tax documents are always up-to-date and accessible.

-

What features does airSlate SignNow provide for businesses dealing with complex tax forms?

airSlate SignNow offers features like customizable workflows, document templates, and signer roles to accommodate complex business tax forms. These tools help businesses automate their tax document processes, ensuring that all necessary signatures and information are collected efficiently. This minimizes the chances of errors while maximizing compliance.

-

How can airSlate SignNow improve my business tax filing process?

By utilizing airSlate SignNow, businesses can accelerate their tax filing process by eliminating the need for physical paperwork. Our platform allows you to manage all documents electronically, ensuring that tax submissions are completed swiftly and accurately. This results in timely filings and helps you avoid penalties associated with late submissions.

-

Is airSlate SignNow suitable for small businesses handling business tax documents?

Absolutely! airSlate SignNow is designed to support businesses of all sizes, including small businesses dealing with business tax documents. Our user-friendly interface and affordability make it easy for small enterprises to adopt eSignature solutions without overwhelming complexity or high costs, enhancing their operational efficiency.

Get more for Johns Creek Business Occupation Tax Return

- Partial release of property from mortgage by individual holder alabama form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy alabama form

- Warranty deed for parents to child with reservation of life estate alabama form

- Warranty deed for separate or joint property to joint tenancy alabama form

- Warranty deed to separate property of one spouse to both as joint tenants or as community property with right of survivorship 497296181 form

- Alabama warranty form

- Warranty deed from limited partnership or llc is the grantor or grantee alabama form

- Alabama husband wife 497296184 form

Find out other Johns Creek Business Occupation Tax Return

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe