Bdadj Form

What is the Bdadj

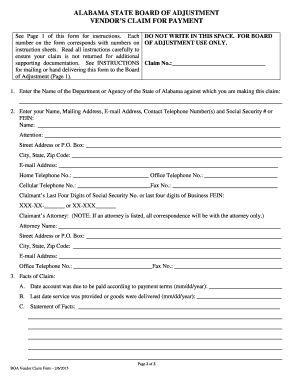

The Bdadj, or Alabama Adjustment Form, is a crucial document used by individuals and businesses in Alabama to report adjustments to income, deductions, or credits on their tax returns. This form allows taxpayers to correct previously filed returns or to claim refunds for overpayments. Understanding the purpose of the Bdadj is essential for ensuring compliance with state tax regulations and for maintaining accurate financial records.

Steps to complete the Bdadj

Completing the Bdadj involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation, including previous tax returns and any supporting documents related to the adjustments being made. Next, carefully fill out the form, ensuring all information is accurate and complete. Double-check calculations to avoid errors that could lead to delays or penalties. Finally, sign and date the form before submitting it to the appropriate state tax authority.

Legal use of the Bdadj

The Bdadj must be used in accordance with Alabama state tax laws to ensure that any adjustments made are legally recognized. The form is designed to facilitate transparency and accuracy in tax reporting. It is important to adhere to the guidelines set forth by the Alabama Department of Revenue to avoid potential legal issues or penalties. Utilizing the Bdadj correctly can help taxpayers maintain compliance and protect their rights as taxpayers.

Required Documents

When filing the Bdadj, certain documents are required to support the adjustments being claimed. These may include:

- Copy of the original tax return being amended

- Documentation for any changes, such as W-2s, 1099s, or receipts

- Any correspondence received from the Alabama Department of Revenue regarding the original return

Having these documents on hand will streamline the filing process and help substantiate the claims made on the Bdadj.

Form Submission Methods

The Bdadj can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file the form online, which is often the quickest method, or they can choose to mail it to the Alabama Department of Revenue. In-person submissions may also be possible at designated tax offices. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits individual needs.

Filing Deadlines / Important Dates

Filing deadlines for the Bdadj are crucial for ensuring timely adjustments and avoiding penalties. Generally, taxpayers must submit the form within three years from the original due date of the return being amended. It is important to stay informed about specific dates and any changes to filing requirements set by the Alabama Department of Revenue to ensure compliance and avoid unnecessary complications.

Quick guide on how to complete bdadj

Effortlessly Prepare Bdadj on Any Device

The management of online documents has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the essential tools to create, modify, and eSign your documents quickly and without interruptions. Manage Bdadj on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and eSign Bdadj with Ease

- Find Bdadj and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or redact confidential information with the features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form navigation, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Bdadj while ensuring exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an al instructions form?

An al instructions form is a document that outlines specific procedural instructions for actions or processes within a business. airSlate SignNow enables users to create and manage these forms efficiently through an intuitive interface, ensuring clarity and compliance in organizational operations.

-

How can I use airSlate SignNow to create an al instructions form?

Creating an al instructions form with airSlate SignNow is simple. You can start with a template or design your own from scratch, incorporate fields for eSignature, and customize it to suit your needs. This flexibility makes it easy to streamline your documentation process.

-

Is airSlate SignNow affordable for small businesses looking to implement al instructions forms?

Yes, airSlate SignNow offers competitive pricing plans suitable for small businesses. With a cost-effective solution for sending and signing documents, you can implement al instructions forms without breaking the bank, providing great value for your investment.

-

What features does airSlate SignNow offer for managing al instructions forms?

airSlate SignNow includes features like customizable templates, automated workflows, and secure eSigning capabilities, all essential for creating and managing al instructions forms. These functionalities enhance efficiency and ensure your forms are handled correctly and promptly.

-

Can I integrate airSlate SignNow with other software for al instructions forms?

Absolutely, airSlate SignNow offers a variety of integrations with popular software platforms. This means you can connect your existing tools to enhance the management of your al instructions forms, making it easier to sync data and improve workflow efficiency.

-

What benefits does airSlate SignNow provide for using al instructions forms?

Using al instructions forms with airSlate SignNow can greatly enhance business productivity. The platform allows for quick turnaround times, reduced paperwork errors, and ensures compliance, helping your team focus on what matters most—growing the business.

-

Is it easy to track the status of an al instructions form once sent?

Yes, airSlate SignNow makes it very easy to track the status of your al instructions forms. You’ll receive real-time notifications when a form is viewed, signed, or completed, ensuring you are always updated on your documents’ progress.

Get more for Bdadj

- Al company form

- Alabama disclaimer 497295403 form

- Al lien form

- Quitclaim deed from individual to husband and wife alabama form

- Warranty deed from individual to husband and wife alabama form

- Quitclaim deed from corporation to husband and wife alabama form

- Warranty deed from corporation to husband and wife alabama form

- Quitclaim deed from corporation to individual alabama form

Find out other Bdadj

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast