Bank Writ Form

What is the Bank Writ

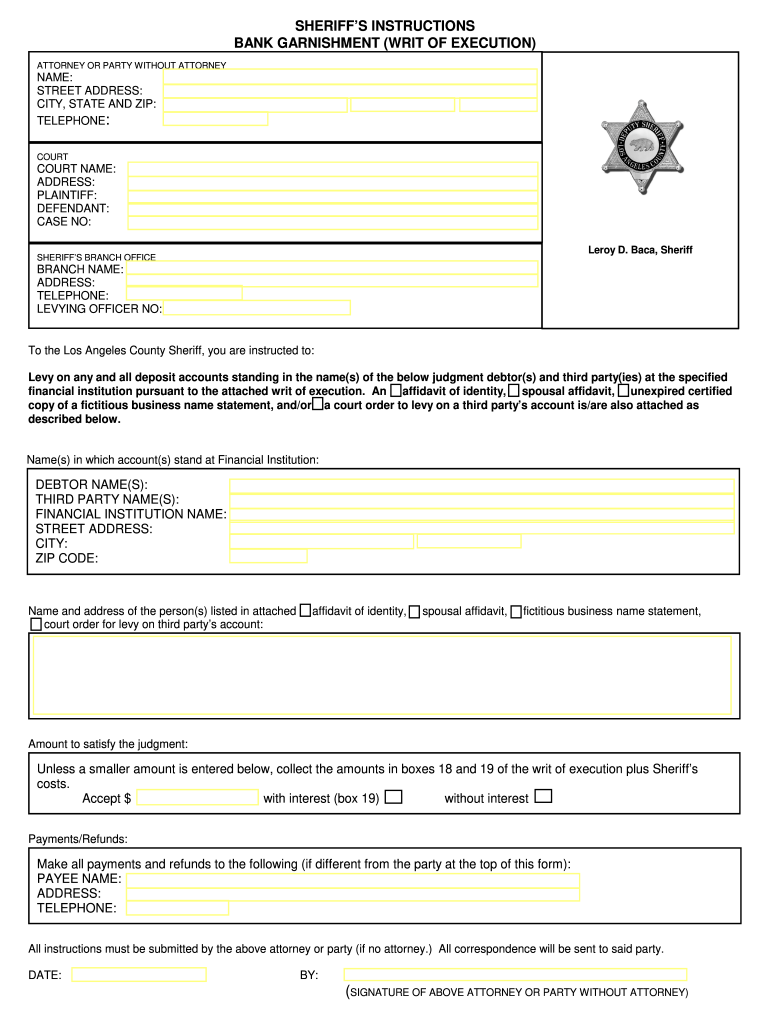

The bank garnishment writ execution is a legal document that allows a creditor to collect a debt by seizing funds directly from a debtor's bank account. This process is initiated after a court judgment has been obtained against the debtor. The writ serves as an order to the bank to freeze the specified amount in the debtor's account and transfer it to the creditor, ensuring that the creditor can recover the owed funds efficiently. Understanding the implications and processes associated with this writ is crucial for both creditors and debtors.

How to Obtain the Bank Writ

To obtain a bank garnishment writ execution, a creditor must first secure a judgment against the debtor in court. This involves filing a lawsuit and presenting evidence to support the claim. Once a judgment is granted, the creditor can request the writ from the court. The request typically requires filling out specific forms and providing details about the debtor's bank account. It is essential to ensure that all information is accurate to avoid delays in the garnishment process.

Steps to Complete the Bank Writ

Completing a bank garnishment writ execution involves several key steps:

- Gather necessary information, including the debtor's bank account details and the amount owed.

- Fill out the required forms accurately, ensuring all fields are completed as per the court's instructions.

- Submit the completed writ to the appropriate court for approval.

- Once approved, serve the writ to the bank where the debtor holds an account.

- Monitor the process to confirm that the funds have been successfully garnished and transferred.

Legal Use of the Bank Writ

The bank garnishment writ execution is legally binding and must be used in accordance with state laws and regulations. Creditors must ensure they comply with all legal requirements, including providing proper notice to the debtor and adhering to any limitations on the amount that can be garnished. Failure to follow legal procedures can result in penalties or the dismissal of the garnishment request.

Key Elements of the Bank Writ

Several key elements must be included in a bank garnishment writ execution for it to be valid:

- The name and contact information of the creditor.

- The name of the debtor and any relevant identification details.

- The amount to be garnished from the debtor's account.

- The bank's name and address where the debtor's account is held.

- The court's case number and the date of the judgment.

State-Specific Rules for the Bank Writ

Each state in the U.S. has its own rules and procedures governing bank garnishment writ executions. These rules can dictate the amount that can be garnished, the process for serving the writ, and the debtor's rights. It is important for creditors to familiarize themselves with their state's specific regulations to ensure compliance and avoid potential legal issues.

Quick guide on how to complete bank writ form

Finish and submit your Bank Writ swiftly

Strong resources for digital document interchange and endorsement are essential for optimizing processes and the ongoing enhancement of your forms. When managing legal documents and signing a Bank Writ, the appropriate signature solution can save you a signNow amount of time and paper with each submission.

Search, complete, modify, sign, and distribute your legal documents with airSlate SignNow. This platform encompasses everything you need to create elegant paper submission procedures. Its vast library of legal forms and intuitive navigation can assist you in locating your Bank Writ instantly, and the editor featuring our signature capability will enable you to complete and authorize it promptly.

Authorize your Bank Writ in a few easy steps

- Locate the Bank Writ you need in our library using the search function or catalog pages.

- Examine the form details and preview it to ensure it meets your requirements and state regulations.

- Click Get form to access it for modification.

- Complete the form using the detailed toolbar.

- Verify the information you entered and click the Sign tool to endorse your document.

- Choose one of three options to affix your signature.

- Finish editing, save the document in your files, and then either download it to your device or share it right away.

Optimize each phase of your document preparation and approval with airSlate SignNow. Experiment with a more effective online approach that considers all aspects of managing your paperwork.

Create this form in 5 minutes or less

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the dd form for SBI bank?

Write the name of the beneficiary in the space after “in favour of “ and the branch name where the beneficiary would encash it in the space “payable at”.Fill in the amount in words and figures and the appropriate exchange .Fill up your name and address in “Applicant's name” and sign at “ applicant's signature”

-

How do I fill out the Andhra Bank account opening form?

Follow the step by step process for filling up the Andhra Bank account opening form.Download Account Opening FormIf you don't want to read the article, watch this video tutorial or continue the post:Andhra Bank Account Opening Minimum Balance:The minimum amount required for opening Savings Account in Andhra Bank isRs. 150Andhra Bank Account Opening Required Documents:Two latest passport size photographsProof of identity - Passport, Driving license, Voter’s ID card, etc.Proof of address - Passport, Driving license, Voter’s ID card, etc. If temporary address and permanent address are different, then both addresses will have to submitted.PAN cardForm 16 (only if PAN card is not available)See More Acceptable Documents for Account OpeningNow Finally let's move to filling your Andhra Bank Account Opening Form:Step 1:Step 2:Read More…

-

How do I fill out the Axis Bank account closure form?

How To Fill Axis Bank Account Closure FormTo close your axis bank account, first you have to download the bank account closure form then submit it to your bank branch.Click the link and download the form:http://bit.ly/accntclosurepdfAfter downloading the account closure form, you have to fill up exactly as I have show below with detail. Kindly go through the filled form below and after filling the form, take all the kit like credit card, debit card, passbook and etc and submit it to your bank with the filled form.Source: How To Fill Axis Bank Account Closure Form

-

How do I fill out the Allahabad Bank account opening form?

Follow the step by step process for filling up the Allahabad Bank account opening form.Download Account Opening FormIf you don't want to read the article, watch this video tutorial or continue the post:Allahabad Bank Account Opening Minimum Balance:The minimum amount required to open a savings account is as follows: The minimum balance to open an account in rural and sub-urban branches isRs.500The minimum balance to open an account in all other branches isRs.1,000For issue of cheque book, an additional Rs.100 is to be paid in rural and sub-urban branches.Allahabad Bank Account Opening Required Documents:Two latest passport size photographsProof of identity - Passport, Driving license, Voter’s ID card, etc.Proof of address - Passport, Driving license, Voter’s ID card, etc. If temporary address and permanent address are different, then both addresses will have to submitted.PAN cardForm 16 (only if PAN card is not available)Step 1:Continue Reading…

-

Do I need a bank account to fill out the MHT CET application form?

To apply, you need to pay through online mode. This doesn't necessarily need you to have a bank account. You can ask anyone kind-hearted who is having a bank account to pay and handover the hard cash to that person.Hope this helps.

Create this form in 5 minutes!

How to create an eSignature for the bank writ form

How to create an eSignature for the Bank Writ Form in the online mode

How to create an eSignature for the Bank Writ Form in Chrome

How to make an eSignature for signing the Bank Writ Form in Gmail

How to make an eSignature for the Bank Writ Form straight from your smart phone

How to generate an eSignature for the Bank Writ Form on iOS devices

How to create an electronic signature for the Bank Writ Form on Android OS

People also ask

-

What is a Bank Writ and how does it work with airSlate SignNow?

A Bank Writ is a legal document that allows a creditor to collect funds through a court order. With airSlate SignNow, you can easily create and eSign Bank Writ documents, ensuring that the process is not only streamlined but also secure and compliant with legal standards.

-

How can airSlate SignNow help me manage my Bank Writ documents?

airSlate SignNow provides a user-friendly platform for managing Bank Writ documents, allowing you to store, edit, and eSign them all in one place. Our solution simplifies tracking and managing the status of your documents, making it easier to handle legal processes efficiently.

-

Is airSlate SignNow cost-effective for handling Bank Writ documents?

Yes, airSlate SignNow offers competitive pricing plans that make it a cost-effective solution for managing Bank Writ documents. With our affordable subscription options, you can access powerful features without breaking the bank, ensuring you can focus on your business.

-

What features does airSlate SignNow offer for creating Bank Writ documents?

airSlate SignNow includes features like customizable templates, document collaboration, and secure eSigning specifically designed for Bank Writ documents. These tools help you create legally binding documents quickly and efficiently, enhancing your workflow.

-

Can I integrate airSlate SignNow with other tools for Bank Writ management?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and more, allowing you to manage your Bank Writ documents alongside your existing systems. This interoperability enhances productivity and streamlines your document processes.

-

What security measures does airSlate SignNow implement for Bank Writ documents?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols and secure storage to protect your Bank Writ documents, ensuring that your sensitive information remains confidential and secure throughout the entire signing process.

-

How can I ensure my Bank Writ documents are legally binding with airSlate SignNow?

Documents signed through airSlate SignNow are compliant with eSignature laws and regulations, making your Bank Writ documents legally binding. Our platform provides an audit trail and verification features, giving you peace of mind that your signed documents hold up in court.

Get more for Bank Writ

- Warranty deed from individual to llc new mexico form

- Conditional lien waiver form

- New mexico deed 497319938 form

- Warranty deed from husband and wife to corporation new mexico form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form new mexico

- Unconditional lien final payment form

- Quitclaim deed from husband and wife to llc new mexico form

- Warranty deed from husband and wife to llc new mexico form

Find out other Bank Writ

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple