What Does a Mortgage Application Look Like Form

What does a mortgage application look like?

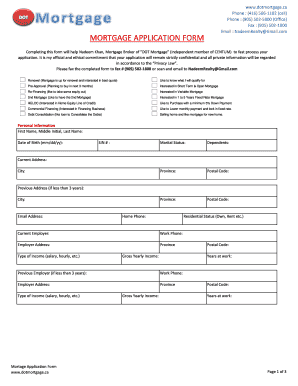

A mortgage application typically consists of several sections that collect essential information about the borrower and the property. Key components include:

- Personal information: This includes the applicant's name, address, Social Security number, and contact details.

- Employment details: Information about current and past employment, including job title, employer name, and income.

- Financial information: Details regarding assets, debts, and monthly expenses. This section may require documentation such as bank statements and tax returns.

- Property information: Description of the property being purchased, including its address, type, and estimated value.

Each section is designed to provide lenders with a comprehensive view of the applicant's financial situation and ability to repay the mortgage.

Steps to complete the mortgage application

Completing a mortgage application involves several steps to ensure accuracy and completeness:

- Gather necessary documents: Collect personal identification, income verification, and asset documentation.

- Fill out the application form: Provide detailed information as required in each section of the form.

- Review the application: Check for any errors or missing information before submission.

- Submit the application: Send the completed mortgage application form to the lender, either electronically or via mail.

Following these steps can help streamline the application process and improve the chances of approval.

Required documents for a mortgage application

When applying for a mortgage, certain documents are typically required to support your application. These may include:

- Proof of identity: A government-issued ID, such as a driver's license or passport.

- Income verification: Recent pay stubs, W-2 forms, or tax returns for self-employed individuals.

- Credit history: Lenders may conduct a credit check, so it's helpful to review your credit report beforehand.

- Bank statements: Recent statements that show your savings and checking account balances.

Providing all required documents can help facilitate a smoother application process and reduce delays.

Application process and approval time

The mortgage application process can vary by lender, but generally follows these stages:

- Application submission: After completing the mortgage application, submit it to the lender.

- Loan processing: The lender reviews your application, verifies your information, and assesses your creditworthiness.

- Underwriting: A thorough evaluation of your financial situation is conducted to determine loan approval.

- Closing: If approved, you will finalize the loan agreement and complete the necessary paperwork.

The approval time can range from a few days to several weeks, depending on the lender and the complexity of your application.

Digital vs. paper version of the mortgage application

Choosing between a digital and paper version of the mortgage application can impact your experience:

- Digital application: Often allows for quicker submission, easier document uploads, and faster processing times. Electronic signatures can streamline the signing process.

- Paper application: May require mailing or in-person delivery, which can lead to longer wait times. However, some individuals may prefer the tangible nature of paper forms.

Consider your comfort level with technology and the specific requirements of your lender when deciding which format to use.

Eligibility criteria for a mortgage application

Eligibility for a mortgage typically depends on various factors, including:

- Credit score: Lenders usually require a minimum credit score, which can vary based on the loan type.

- Debt-to-income ratio: This ratio compares your monthly debt payments to your gross monthly income, helping lenders assess your ability to manage additional debt.

- Employment history: A stable employment history is often preferred, with a minimum duration of employment in the same field.

- Down payment: The amount you can provide as a down payment can affect your eligibility and loan terms.

Understanding these criteria can help you prepare for the mortgage application process and improve your chances of approval.

Quick guide on how to complete what does a mortgage application look like

Prepare What Does A Mortgage Application Look Like effortlessly on any device

Web-based document management has surged in popularity among enterprises and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and electronically sign your documents quickly and without hassle. Manage What Does A Mortgage Application Look Like on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and eSign What Does A Mortgage Application Look Like with ease

- Locate What Does A Mortgage Application Look Like and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important portions of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign What Does A Mortgage Application Look Like and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the primary purpose of collecting Canada mortgage application information?

The primary purpose of collecting Canada mortgage application information is to assess a borrower's eligibility for a mortgage. By gathering this information, lenders can evaluate financial stability, creditworthiness, and the ability to repay the loan, ensuring a suitable match for both parties.

-

How does airSlate SignNow simplify the Canada mortgage application process?

airSlate SignNow simplifies the Canada mortgage application process by providing a streamlined, user-friendly platform for e-signing and sending documents. With its easy-to-use interface, applicants can complete and submit their mortgage applications quickly, reducing delays and enhancing efficiency.

-

What features does airSlate SignNow offer for managing Canada mortgage application information?

airSlate SignNow offers a range of features for managing Canada mortgage application information, including document templates, secure electronic signatures, and real-time tracking. These tools help both lenders and borrowers stay organized and informed throughout the application process.

-

Is airSlate SignNow a cost-effective solution for mortgage applications?

Yes, airSlate SignNow is a cost-effective solution for managing mortgage applications and associated Canada mortgage application information. The platform's affordable pricing tiers cater to businesses of all sizes, helping to minimize costs while maximizing productivity.

-

Can airSlate SignNow integrate with other mortgage processing tools?

Absolutely! airSlate SignNow can seamlessly integrate with various mortgage processing tools and CRMs, allowing lenders to efficiently handle Canada mortgage application information. This flexibility enhances workflows and ensures all necessary data is easily accessible.

-

What are the benefits of using airSlate SignNow for Canada mortgage applications?

The benefits of using airSlate SignNow for Canada mortgage applications include faster processing times, reduced paperwork, and enhanced security. By digitizing the application process, borrowers can quickly provide their information and track their application's status at any time.

-

How can I get started with airSlate SignNow for my Canada mortgage applications?

Getting started with airSlate SignNow for your Canada mortgage applications is simple. You can sign up for a free trial on the website, explore its features, and begin uploading your documents immediately to ease the application process.

Get more for What Does A Mortgage Application Look Like

- House to dishwasher form

- Such plans and specifications are hereby made a part of form

- Building codes and applicable laws form

- Electric dryer form

- Contractor agrees to remove all debris and leave the premises in broom clean condition form

- County state of vermont said property being described as follows type form

- Covenantsrestrictions form

- Such applications shall be itemized and supported by form

Find out other What Does A Mortgage Application Look Like

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement