Ie Irish Stock Transfer Form

What is the IE Irish Stock Transfer?

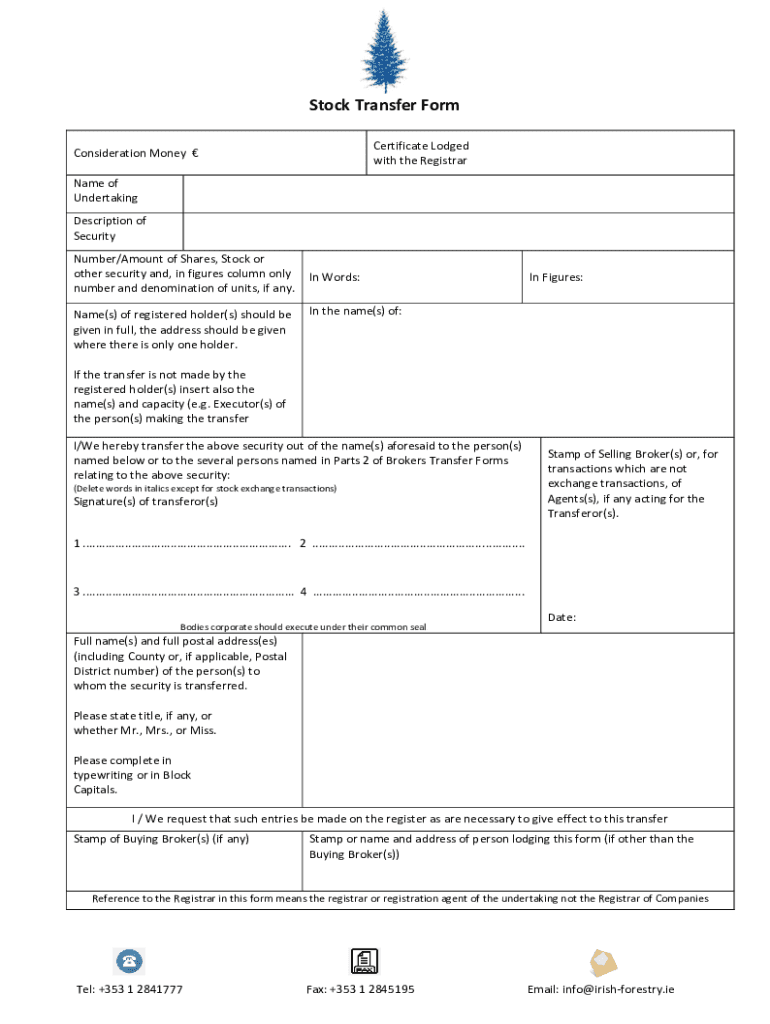

The IE Irish Stock Transfer is a legal document used to transfer ownership of shares from one party to another within Ireland. This form is essential for ensuring that the transfer is recorded accurately and complies with relevant laws. It serves as proof of the transaction and is particularly important for maintaining accurate shareholder records. The form typically includes details such as the names of the transferor and transferee, the number of shares being transferred, and the signature of the transferor.

Steps to Complete the IE Irish Stock Transfer

Filling out the IE Irish Stock Transfer requires careful attention to detail to ensure that all necessary information is provided. Here are the steps to complete the form:

- Begin by entering the name and address of the transferor (the current owner of the shares).

- Provide the name and address of the transferee (the new owner of the shares).

- Specify the number of shares being transferred and the class of shares, if applicable.

- Include the date of the transfer.

- Ensure the transferor's signature is present, as this is crucial for the validity of the transfer.

- Check all entries for accuracy before submitting the form.

Legal Use of the IE Irish Stock Transfer

The IE Irish Stock Transfer is legally binding when completed correctly. It must adhere to the relevant laws governing share transfers in Ireland. This includes compliance with the Companies Act and any specific regulations applicable to the company whose shares are being transferred. Proper execution of the form ensures that the transfer is recognized by the company and that the new owner is recorded as the shareholder. Failure to comply with legal requirements may result in disputes or invalidation of the transfer.

Key Elements of the IE Irish Stock Transfer

Understanding the key elements of the IE Irish Stock Transfer is vital for ensuring its effectiveness. Important components include:

- Transferor Information: Name and address of the current shareholder.

- Transferee Information: Name and address of the individual or entity receiving the shares.

- Share Details: Number and class of shares being transferred.

- Date of Transfer: The date on which the transfer takes place.

- Signature: The transferor's signature, which validates the document.

How to Obtain the IE Irish Stock Transfer

The IE Irish Stock Transfer form can typically be obtained from the company's registrar or the official website of the company whose shares are being transferred. It may also be available through legal or financial advisors who specialize in corporate transactions. Ensuring that you have the correct and most current version of the form is essential for a valid transfer.

Form Submission Methods

Once the IE Irish Stock Transfer is completed, it can be submitted in various ways, depending on the company's requirements. Common submission methods include:

- Online Submission: Some companies may allow electronic submission through their online portals.

- Mail: The completed form can be mailed to the company's registrar.

- In-Person: Delivering the form in person may be an option, especially for urgent transfers.

Quick guide on how to complete ie irish stock transfer

Effortlessly complete Ie Irish Stock Transfer on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly and without interruptions. Handle Ie Irish Stock Transfer seamlessly across any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to edit and eSign Ie Irish Stock Transfer effortlessly

- Obtain Ie Irish Stock Transfer and then click Get Form to begin.

- Make use of the tools we offer to finish your form.

- Emphasize important sections of the documents or conceal sensitive details with the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a standard handwritten signature.

- Review all the information and then click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate new prints. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Ie Irish Stock Transfer while ensuring strong communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the airSlate SignNow stock transfer form?

The airSlate SignNow stock transfer form is a digital document that allows you to transfer ownership of stocks easily and securely. It simplifies the process of transferring shares between parties, ensuring compliance with legal requirements. By using airSlate SignNow, businesses can streamline the stock transfer process with an easy-to-use solution.

-

How to fill in stock transfer form correctly?

To fill in the stock transfer form correctly, ensure that you provide accurate details such as the names of the transferor and transferee, the number of shares being transferred, and the stock certificate number. It's essential to follow the instructions carefully and review the details before submitting to avoid any errors. airSlate SignNow offers a guided approach to help you navigate this process effortlessly.

-

What features does airSlate SignNow offer for stock transfer forms?

airSlate SignNow provides features such as electronic signatures, real-time collaboration, and customizable templates. These features make it easy to create, fill in, and send stock transfer forms. Additionally, you can track the status of your documents, ensuring a smooth and efficient transfer process.

-

Is there a cost associated with using airSlate SignNow for stock transfer forms?

Yes, there is a pricing structure in place for using airSlate SignNow, which is designed to be cost-effective for businesses of all sizes. Different plans are available based on the features and volume of documents you need to manage. It's recommended to explore the pricing options to find the best fit for your needs, especially if you're frequently dealing with stock transfer forms.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers integration capabilities with numerous applications like Google Drive, Salesforce, and Dropbox. This feature allows you to streamline your workflow when filling in stock transfer forms and managing documents, enhancing your overall efficiency.

-

What benefits does airSlate SignNow provide for filling out stock transfer forms?

The primary benefits of using airSlate SignNow for stock transfer forms include time savings, enhanced security, and ease of access. With the ability to eSign and fill in documents online, you can complete transactions faster while maintaining compliance and record-keeping. This user-friendly solution enables your business to manage stock transfers efficiently.

-

How secure is airSlate SignNow for handling stock transfer forms?

Security is a top priority for airSlate SignNow, employing advanced encryption and authentication measures to protect your documents. When you fill in stock transfer forms, your data remains confidential and secure from unauthorized access. You can trust airSlate SignNow to maintain the integrity of your important financial transactions.

Get more for Ie Irish Stock Transfer

- Kansas summary administration or simplified estate package for small estates form

- Indiana summary administration package under 50000 personal property small estates form

- Transfer death deed 481369859 form

- Il llc form

- Iowa small estate affidavit form

- Georgia advance directive form

- Ct durable form

- Form 149 sales and use tax exemption certificate pdf

Find out other Ie Irish Stock Transfer

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online