T2201 Form

What is the T2201 Form

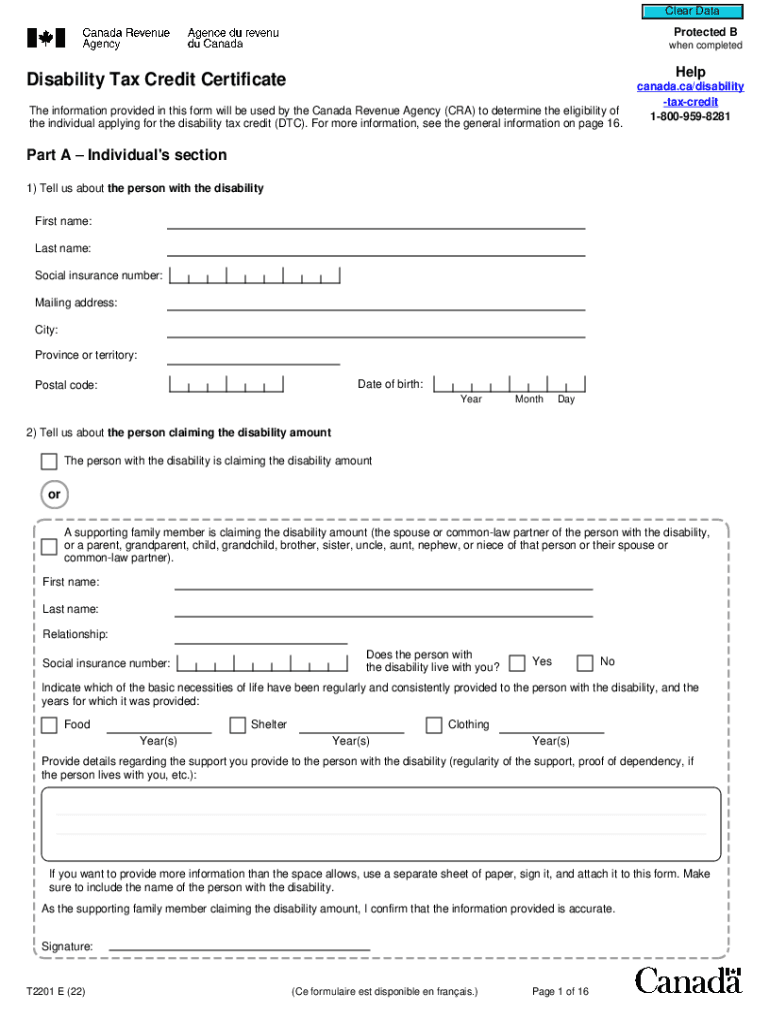

The T2201 form, also known as the disability tax credit form, is an official document used in the United States to apply for the Disability Tax Credit (DTC). This form is essential for individuals who have a severe and prolonged impairment in physical or mental functions. By completing and submitting the T2201, applicants can potentially reduce their tax burden, making it a valuable resource for those who qualify. The form is designed to gather specific information about the applicant's disability, ensuring that it meets the criteria set forth by the IRS.

How to use the T2201 Form

Using the T2201 form involves several steps to ensure that all necessary information is accurately provided. First, applicants should obtain the form, which can be accessed online or through tax professionals. Once in possession of the form, individuals must fill out personal details, including their name, address, and Social Security number. It is crucial to provide detailed information regarding the disability, including its nature, duration, and how it affects daily living activities. After completing the form, it should be signed and dated by the applicant and their healthcare provider, verifying the disability.

Steps to complete the T2201 Form

Completing the T2201 form requires careful attention to detail. Here are the steps to follow:

- Obtain the T2201 form from a reliable source.

- Fill in your personal information accurately.

- Provide a comprehensive description of your disability.

- Include information on how the disability limits your daily activities.

- Have your healthcare provider complete their section, confirming your disability.

- Review the form for completeness and accuracy.

- Sign and date the form before submission.

Key elements of the T2201 Form

The T2201 form includes several key elements that are critical for a successful application. These elements consist of:

- Personal Information: Name, address, and Social Security number of the applicant.

- Disability Description: Detailed account of the nature and extent of the disability.

- Impact on Daily Life: Explanation of how the disability affects daily activities.

- Healthcare Provider Information: Section for a qualified medical professional to validate the disability.

Legal use of the T2201 Form

The T2201 form must be completed in compliance with IRS regulations to be considered legally valid. Electronic signatures are acceptable, provided that they meet the legal standards set forth by the ESIGN Act and UETA. It is essential to ensure that the form is filled out accurately and submitted within the designated time frames to avoid any legal issues or penalties. The completion of this form can significantly impact the applicant's tax situation, making adherence to legal requirements vital.

Eligibility Criteria

To qualify for the Disability Tax Credit using the T2201 form, applicants must meet specific eligibility criteria. These include:

- The disability must be severe and prolonged, significantly affecting daily living activities.

- The condition must be verified by a qualified healthcare provider.

- Applicants must be able to demonstrate how their disability limits their ability to perform basic activities.

Quick guide on how to complete t2201 form

Effortlessly Prepare T2201 Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without any holdups. Manage T2201 Form across any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric task today.

How to Edit and eSign T2201 Form with Ease

- Locate T2201 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, time-consuming document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in a few clicks from your chosen device. Modify and eSign T2201 Form and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the disability tax credit form?

The disability tax credit form is a tax document that allows individuals with disabilities to apply for a non-refundable tax credit, which can reduce the amount of tax owed. This form helps those eligible to receive financial support, making it easier to cover necessary expenses linked to their disabilities. Understanding how to fill out the disability tax credit form is essential for maximizing your potential benefits.

-

How can airSlate SignNow help with the disability tax credit form?

airSlate SignNow simplifies the process of completing and signing the disability tax credit form. With our user-friendly eSignature platform, you can fill out the necessary fields, add your electronic signature, and send the document securely to relevant parties. This streamlines your experience, ensuring you stay compliant while focusing on your qualifications for the disability tax credit.

-

Is there a cost associated with using airSlate SignNow for the disability tax credit form?

Yes, airSlate SignNow offers various pricing plans to meet different business needs, including affordable options for those needing to manage documentation like the disability tax credit form. By investing in our services, you gain access to an efficient, cost-effective solution for eSigning and document management. Review our pricing page for specific details on our plans.

-

What features does airSlate SignNow provide for managing the disability tax credit form?

airSlate SignNow includes several features that enhance the management of the disability tax credit form. These include customizable templates, real-time tracking of document status, automated reminders for signatories, and secure cloud storage. With these tools, you can ensure efficient handling of your important tax documents.

-

How do I integrate airSlate SignNow with other tools to manage the disability tax credit form?

airSlate SignNow offers seamless integrations with various applications and platforms, allowing you to efficiently manage the disability tax credit form alongside your other business tools. Whether you use CRM systems, project management software, or cloud storage solutions, our integration capabilities ensure smooth workflows and enhanced productivity. Check our integration page for a complete list of compatible applications.

-

Can I use airSlate SignNow to store my completed disability tax credit form securely?

Absolutely! airSlate SignNow provides secure cloud storage options for all your documents, including the completed disability tax credit form. This ensures that your sensitive information is protected while remaining easily accessible whenever you need to retrieve or share it. Trust our platform to keep your documents organized and secure.

-

What benefits does airSlate SignNow offer for businesses dealing with the disability tax credit form?

Using airSlate SignNow for managing the disability tax credit form offers numerous benefits for businesses. It increases efficiency by reducing paperwork, speeds up the signing process, and ensures compliance with legal requirements. Additionally, our platform minimizes errors and enhances collaboration, leading to improved customer satisfaction and retention.

Get more for T2201 Form

- Commercial contractor package georgia form

- Excavation contractor package georgia form

- Renovation contractor package georgia form

- Concrete mason contractor package georgia form

- Demolition contractor package georgia form

- Security contractor package georgia form

- Insulation contractor package georgia form

- Paving contractor package georgia form

Find out other T2201 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors