Alberta Seniors Benefit Income Estimate Form

What is the Alberta Seniors Benefit Income Estimate Form

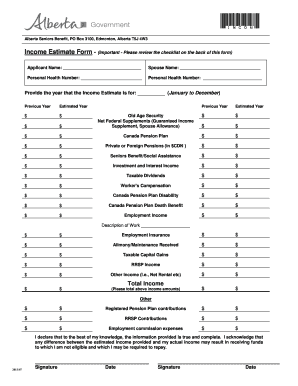

The Alberta Seniors Benefit Income Estimate Form is a crucial document designed to assist seniors in Alberta in estimating their eligibility for various benefits. This form collects essential financial information to determine the amount of assistance a senior may receive. It is tailored to support seniors in understanding their financial standing and accessing benefits that can enhance their quality of life. The form is specifically structured to gather income details, which are vital for the assessment process.

How to use the Alberta Seniors Benefit Income Estimate Form

Using the Alberta Seniors Benefit Income Estimate Form involves a straightforward process. First, seniors should obtain the form, which can typically be accessed online or through local government offices. Once in possession of the form, individuals need to fill out their personal and financial information accurately. This includes details about income sources, such as pensions, investments, and any other earnings. After completing the form, it should be submitted according to the specified guidelines, ensuring that all required information is provided for a thorough evaluation.

Steps to complete the Alberta Seniors Benefit Income Estimate Form

Completing the Alberta Seniors Benefit Income Estimate Form requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the form from a reliable source.

- Fill in your personal information, including name, address, and contact details.

- Provide accurate income information, detailing all sources of income.

- Review the form for any errors or omissions.

- Submit the completed form as instructed, either online or by mail.

Key elements of the Alberta Seniors Benefit Income Estimate Form

The Alberta Seniors Benefit Income Estimate Form contains several key elements that are essential for accurate assessment. These include:

- Personal Information: Name, address, and contact details of the applicant.

- Income Details: Comprehensive information regarding all sources of income.

- Eligibility Criteria: Specific guidelines that determine qualification for benefits.

- Signature Section: A space for the applicant to sign, affirming the accuracy of the information provided.

Legal use of the Alberta Seniors Benefit Income Estimate Form

The legal use of the Alberta Seniors Benefit Income Estimate Form is governed by regulations that ensure the integrity and confidentiality of the information submitted. It is important for users to understand that the form must be filled out truthfully, as providing false information can lead to penalties. The form is considered legally binding once submitted, and it plays a vital role in determining eligibility for benefits. Compliance with all relevant laws and regulations is essential to ensure that the benefits are awarded appropriately.

Eligibility Criteria

Eligibility for benefits through the Alberta Seniors Benefit Income Estimate Form is based on specific criteria. Generally, applicants must be residents of Alberta and meet age requirements, typically being sixty-five years or older. Additionally, the income reported on the form must fall within certain thresholds to qualify for assistance. It is crucial for seniors to review these criteria carefully to ensure they meet the necessary qualifications before submitting the form.

Quick guide on how to complete alberta seniors benefit income estimate form

Complete Alberta Seniors Benefit Income Estimate Form seamlessly on any device

Online document organization has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate template and securely store it online. airSlate SignNow equips you with the necessary tools to create, alter, and eSign your files quickly without interruptions. Manage Alberta Seniors Benefit Income Estimate Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to alter and eSign Alberta Seniors Benefit Income Estimate Form effortlessly

- Obtain Alberta Seniors Benefit Income Estimate Form and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate creating new document copies. airSlate SignNow fulfills all your document management requirements in a few clicks from any device you prefer. Alter and eSign Alberta Seniors Benefit Income Estimate Form and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Alberta seniors benefit income estimate form?

The Alberta seniors benefit income estimate form is a key document that helps determine eligibility for financial benefits available to seniors in Alberta. This form collects income information to assess the level of support seniors may receive. Completing this form accurately can ensure that seniors maximize their benefits.

-

How can airSlate SignNow help with the Alberta seniors benefit income estimate form?

airSlate SignNow simplifies the process of completing and submitting the Alberta seniors benefit income estimate form by providing an easy-to-use eSigning platform. Users can fill out the form digitally, sign it securely, and send it with minimal hassle. This streamlines the process, making it faster and more efficient for seniors.

-

Is there a cost associated with using airSlate SignNow for the Alberta seniors benefit income estimate form?

There is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for individuals and businesses. Different pricing plans are available based on usage needs, allowing you to choose the right option for handling the Alberta seniors benefit income estimate form. A free trial is also available for new users.

-

What features does airSlate SignNow offer for managing the Alberta seniors benefit income estimate form?

airSlate SignNow offers several features that enhance the management of the Alberta seniors benefit income estimate form. These include customizable templates, secure cloud storage, and multi-party signing capabilities. This ensures that users can manage their documentation efficiently, with complete control over the signing process.

-

Are there any integrations available with airSlate SignNow for other tools?

Yes, airSlate SignNow offers various integrations with popular tools and software, making it easier to manage the Alberta seniors benefit income estimate form in your existing workflow. Integrations with platforms like Google Drive, Dropbox, and CRM systems help streamline the document management process. This allows users to access their forms seamlessly across different applications.

-

Can I track the status of my Alberta seniors benefit income estimate form submission?

Yes, airSlate SignNow provides tracking capabilities for the status of your Alberta seniors benefit income estimate form submission. Users can receive notifications when their forms have been viewed or signed, keeping them informed throughout the process. This feature enhances transparency and ensures nothing is overlooked.

-

How secure is my information when using airSlate SignNow for the Alberta seniors benefit income estimate form?

Security is a top priority with airSlate SignNow. When filling out the Alberta seniors benefit income estimate form, your data is protected with advanced encryption protocols. This ensures that sensitive information remains confidential and secure during transmission and storage.

Get more for Alberta Seniors Benefit Income Estimate Form

- Warranty deed from corporation to corporation illinois form

- Illinois day notice template form

- Quitclaim deed from corporation to two individuals illinois form

- Warranty deed from corporation to two individuals illinois form

- Illinois modification form

- Illinois corporation llc form

- Il lien search form

- Illinois warranty form

Find out other Alberta Seniors Benefit Income Estimate Form

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement