Vt Code R 1 5862 D 6 C Form

Understanding the Vt Code R 1 5862 D 6 C

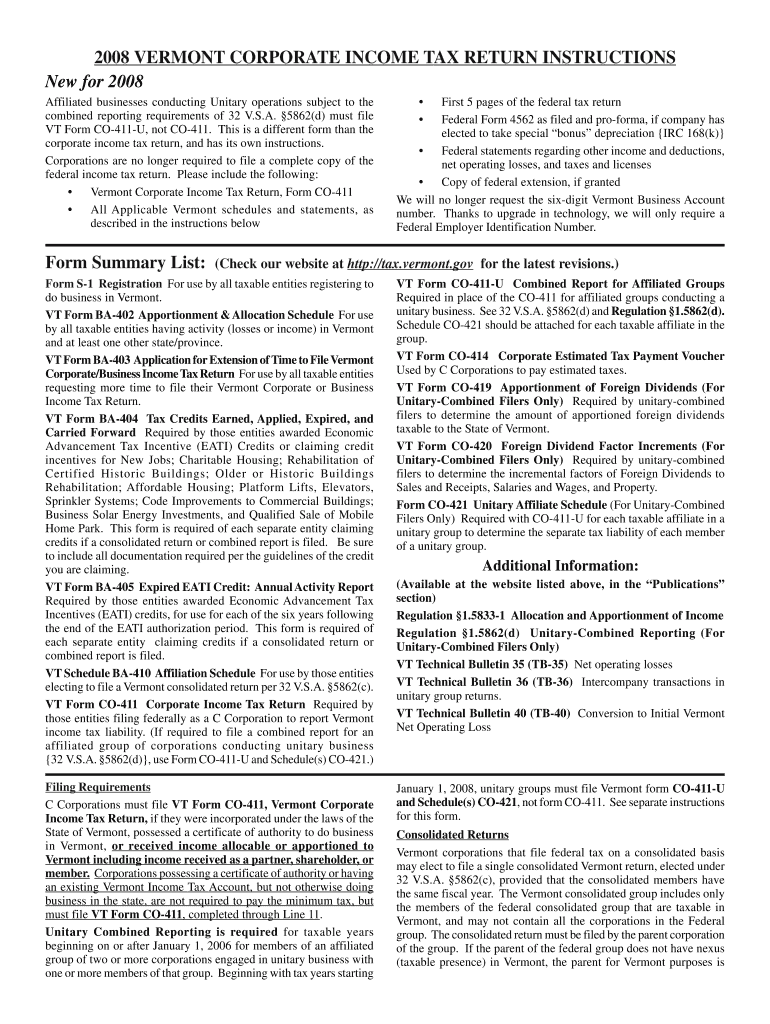

The Vt Code R 1 5862 D 6 C refers to the Vermont Combined Report for Unitary Groups, specifically designed for businesses operating in multiple states. This form enables companies to report their income, deductions, and credits collectively, ensuring compliance with Vermont tax regulations. Understanding this code is essential for businesses to accurately file their taxes and avoid potential penalties.

Steps to Complete the Vt Code R 1 5862 D 6 C

Completing the Vt Code R 1 5862 D 6 C involves several key steps:

- Gather all necessary financial documents, including income statements and balance sheets for each entity in the unitary group.

- Calculate the combined income for the group, ensuring that intercompany transactions are eliminated.

- Fill out the form accurately, paying attention to the specific lines that pertain to your business structure.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the Vt Code R 1 5862 D 6 C

The Vt Code R 1 5862 D 6 C is legally binding when completed and submitted according to Vermont state law. It is crucial for businesses to ensure that all information is truthful and accurate to avoid legal repercussions. The form must be signed by an authorized representative of the business, affirming that the information provided is correct.

Filing Deadlines for the Vt Code R 1 5862 D 6 C

Timely filing of the Vt Code R 1 5862 D 6 C is essential to avoid penalties. Generally, the deadline for submission aligns with the federal tax return due date. Businesses should be aware of any state-specific extensions or changes to the filing schedule to ensure compliance.

Required Documents for the Vt Code R 1 5862 D 6 C

To complete the Vt Code R 1 5862 D 6 C, businesses need to gather specific documents, including:

- Financial statements for each entity in the unitary group.

- Records of intercompany transactions.

- Details of any tax credits or deductions claimed.

Form Submission Methods for the Vt Code R 1 5862 D 6 C

The Vt Code R 1 5862 D 6 C can be submitted through various methods, providing flexibility for businesses:

- Online submission through the Vermont Department of Taxes website.

- Mailing a paper form to the appropriate state tax office.

- In-person submission at designated tax offices, if necessary.

Quick guide on how to complete 2008 ba 402 vermont combined report for unitary group form

Manage Vt Code R 1 5862 D 6 C effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents quickly without any delays. Handle Vt Code R 1 5862 D 6 C on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Vt Code R 1 5862 D 6 C with ease

- Obtain Vt Code R 1 5862 D 6 C and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Vt Code R 1 5862 D 6 C and ensure outstanding communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the form for admission to a BA (Honours) in English at Allahabad University?

English is an arts subject,Shruty.As you're applying for Bachelor of Arts programme, it will definitely come under arts. In a central university, every subject is having a separate department and that doesn't mean it will change the subject's credibility.

Create this form in 5 minutes!

How to create an eSignature for the 2008 ba 402 vermont combined report for unitary group form

How to make an electronic signature for your 2008 Ba 402 Vermont Combined Report For Unitary Group Form in the online mode

How to make an eSignature for your 2008 Ba 402 Vermont Combined Report For Unitary Group Form in Google Chrome

How to create an electronic signature for putting it on the 2008 Ba 402 Vermont Combined Report For Unitary Group Form in Gmail

How to create an electronic signature for the 2008 Ba 402 Vermont Combined Report For Unitary Group Form from your mobile device

How to make an eSignature for the 2008 Ba 402 Vermont Combined Report For Unitary Group Form on iOS devices

How to generate an eSignature for the 2008 Ba 402 Vermont Combined Report For Unitary Group Form on Android OS

People also ask

-

What is the ba 402 and how does it work with airSlate SignNow?

The ba 402 is a specific feature within airSlate SignNow that streamlines the signing process for businesses. It allows users to easily send, sign, and manage documents electronically, ensuring a fast and secure workflow. By leveraging the capabilities of the ba 402, companies can enhance their document management efficiency.

-

What pricing plans are available for the ba 402 feature?

AirSlate SignNow offers flexible pricing plans which include access to the ba 402 feature. Depending on your business needs, you can choose from individual, business, or enterprise plans. Each plan is designed to provide cost-effective solutions while maximizing the power of the ba 402 for document management.

-

Can the ba 402 integrate with other software I use?

Yes, the ba 402 feature integrates seamlessly with various third-party applications and software, enhancing your overall workflow. Whether you're using CRM systems, cloud storage, or project management tools, the ba 402 can help connect these platforms for a more streamlined document management experience.

-

What are the key benefits of using the ba 402 in my business?

Utilizing the ba 402 through airSlate SignNow signNowly improves efficiency by reducing time spent on document handling. It enhances security with robust encryption, ensures compliance with e-signature regulations, and increases collaboration through easy sharing options. These benefits make the ba 402 an essential tool for modern business environments.

-

Is the ba 402 suitable for small businesses?

Absolutely! The ba 402 feature is designed to be user-friendly and cost-effective, making it ideal for small businesses. It allows smaller teams to manage documents efficiently without the need for extensive resources, while still providing all the powerful capabilities found in larger solutions.

-

How does the ba 402 improve document security?

With the ba 402 feature, airSlate SignNow implements advanced security measures, including encryption and secure access protocols. This ensures that all documents processed are protected against unauthorized access, maintaining confidentiality and compliance with data protection regulations. The focus on security within the ba 402 helps businesses operate with peace of mind.

-

What types of documents can be signed using the ba 402?

The ba 402 supports a wide range of documents that can be electronically signed, including contracts, agreements, and forms. Whether you are handling legal documents or internal memos, the ba 402 ensures that your signing experience is efficient and straightforward. This versatility makes it an invaluable feature for any business.

Get more for Vt Code R 1 5862 D 6 C

- Income amp expense survey form city of alexandria alexandriava

- City of chesapeake leak adjustment form

- Aflac critical illness health screening form

- Limited liability company information x business licensing service bls dor wa

- Public records request form city of lacey

- Bampo quarterly tax report city of lacey form

- Sepa checklist app city of lakewood form

- Single trip oversize load permit the city of lakewood washington form

Find out other Vt Code R 1 5862 D 6 C

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself