Jis Gov Jmtax Administration Jamaica TajTax Administration Jamaica TAJ Jis Gov Jm Form

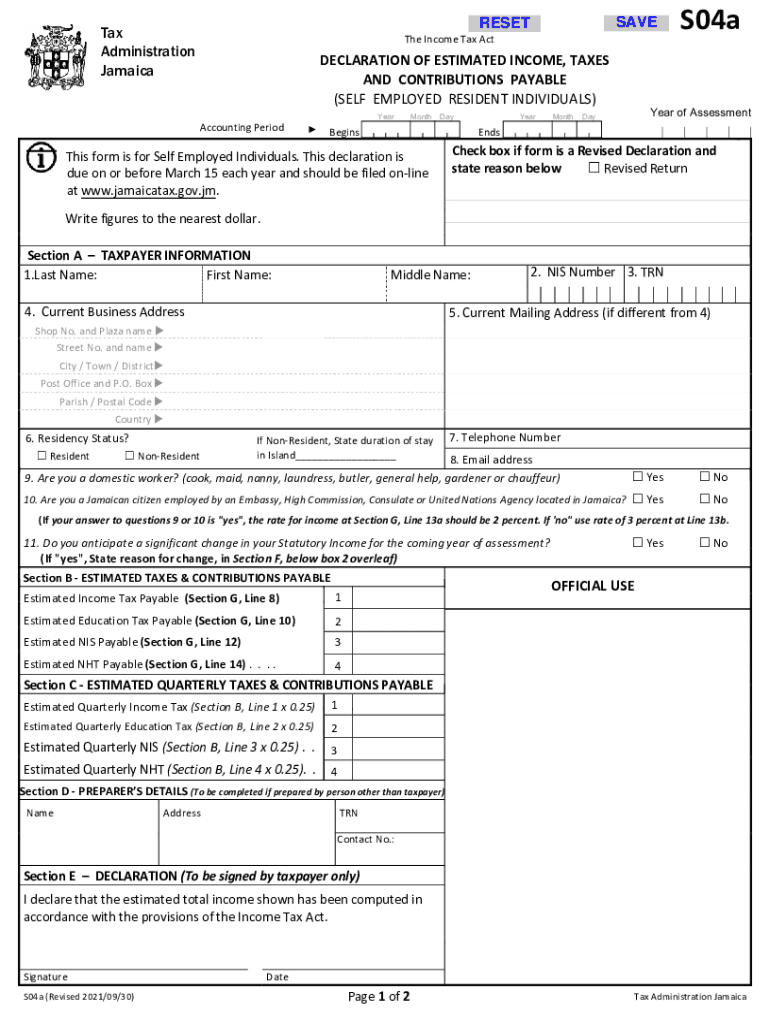

Understanding the Jamaica S04A Form

The Jamaica S04A form is a crucial document for individuals and businesses in Jamaica, particularly for tax purposes. It is primarily used for declaring income, claiming deductions, and reporting taxes owed. Understanding its structure and requirements is essential for compliance with Jamaican tax regulations.

Steps to Complete the Jamaica S04A Form

Completing the Jamaica S04A form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and proof of deductions. Next, carefully fill out each section of the form, ensuring that all entries are accurate and reflect your financial situation. Once completed, review the form for any errors before submission.

Legal Use of the Jamaica S04A Form

The Jamaica S04A form holds legal significance as it serves as an official record of income and tax obligations. For the form to be considered valid, it must be filled out completely and accurately. Additionally, it should be submitted by the designated deadlines to avoid penalties. Understanding the legal implications of this form is vital for all taxpayers.

Filing Deadlines for the Jamaica S04A Form

Timely submission of the Jamaica S04A form is essential to avoid late fees and penalties. The deadlines for filing typically align with the tax year, and it is important to stay informed about any changes in these dates. Mark your calendar with the relevant deadlines to ensure compliance and avoid unnecessary complications.

Required Documents for the Jamaica S04A Form

When preparing to fill out the Jamaica S04A form, it is important to have all required documents on hand. These may include income statements, receipts for deductible expenses, and any other relevant financial documentation. Having these documents ready will streamline the process and help ensure accuracy in your submission.

Penalties for Non-Compliance with the Jamaica S04A Form

Failure to comply with the requirements of the Jamaica S04A form can result in significant penalties. These may include fines, interest on unpaid taxes, and even legal action in severe cases. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate filing.

Digital vs. Paper Version of the Jamaica S04A Form

Both digital and paper versions of the Jamaica S04A form are available for taxpayers. The digital version offers several advantages, including ease of access and the ability to submit forms electronically. However, some individuals may prefer the traditional paper method. Understanding the benefits and limitations of each option can help taxpayers choose the best method for their needs.

Quick guide on how to complete jisgovjmtax administration jamaica tajtax administration jamaica taj jisgovjm

Effortlessly prepare Jis gov jmtax administration jamaica tajTax Administration Jamaica TAJ Jis gov jm on any device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly with no holdups. Handle Jis gov jmtax administration jamaica tajTax Administration Jamaica TAJ Jis gov jm on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The easiest method to edit and eSign Jis gov jmtax administration jamaica tajTax Administration Jamaica TAJ Jis gov jm seamlessly

- Obtain Jis gov jmtax administration jamaica tajTax Administration Jamaica TAJ Jis gov jm and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and eSign Jis gov jmtax administration jamaica tajTax Administration Jamaica TAJ Jis gov jm and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the jamaica s04a plan offered by airSlate SignNow?

The jamaica s04a plan is an affordable option provided by airSlate SignNow, designed to help businesses streamline their document signing processes. This plan includes essential features such as eSignature capabilities, document templates, and real-time tracking, making it an excellent choice for teams looking to enhance productivity.

-

How does the jamaica s04a enhance document security?

With the jamaica s04a plan, airSlate SignNow prioritizes document security by ensuring that all signed documents are encrypted and compliant with legal standards. Additionally, the platform employs advanced authentication methods to verify signer identities, ensuring that your documents remain confidential and secure at all times.

-

What features are included in the jamaica s04a package?

The jamaica s04a package includes a variety of essential features such as unlimited eSignatures, custom branding options, mobile compatibility, and integration with popular applications. These features allow users to create a seamless experience for both senders and signers, improving overall workflow efficiency.

-

Is the jamaica s04a plan suitable for small businesses?

Absolutely! The jamaica s04a plan is tailored specifically for small businesses that need a cost-effective solution for eSigning documents. Its user-friendly interface and essential features make it easy for small teams to manage their document workflows without extensive technical expertise.

-

Can I integrate the jamaica s04a with other software?

Yes, the jamaica s04a plan offers robust integration capabilities with various third-party applications, including CRM systems, cloud storage solutions, and project management tools. This flexibility helps businesses enhance their document management processes by connecting airSlate SignNow to their existing workflows.

-

How does the pricing of the jamaica s04a plan compare to competitors?

The pricing of the jamaica s04a plan is competitive and designed to offer great value for businesses seeking eSignature solutions. Compared to other providers, airSlate SignNow delivers more features at a similar or lower cost, making it an attractive option for organizations of all sizes.

-

What are the benefits of using the jamaica s04a for eSigning?

Using the jamaica s04a for eSigning offers numerous benefits, including faster turnaround times, reduced paper usage, and improved document tracking. Businesses can save time and resources by automating the signing process while ensuring compliance with legal requirements, thus enhancing operational efficiency.

Get more for Jis gov jmtax administration jamaica tajTax Administration Jamaica TAJ Jis gov jm

- Company employment policies and procedures package maryland form

- Revocation of power of attorney for care of child or children maryland form

- Statutory designation of standby guardian maryland form

- Newly divorced individuals package maryland form

- Maryland statutory form

- Contractors forms package maryland

- Md attorney form

- Wedding planning or consultant package maryland form

Find out other Jis gov jmtax administration jamaica tajTax Administration Jamaica TAJ Jis gov jm

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word