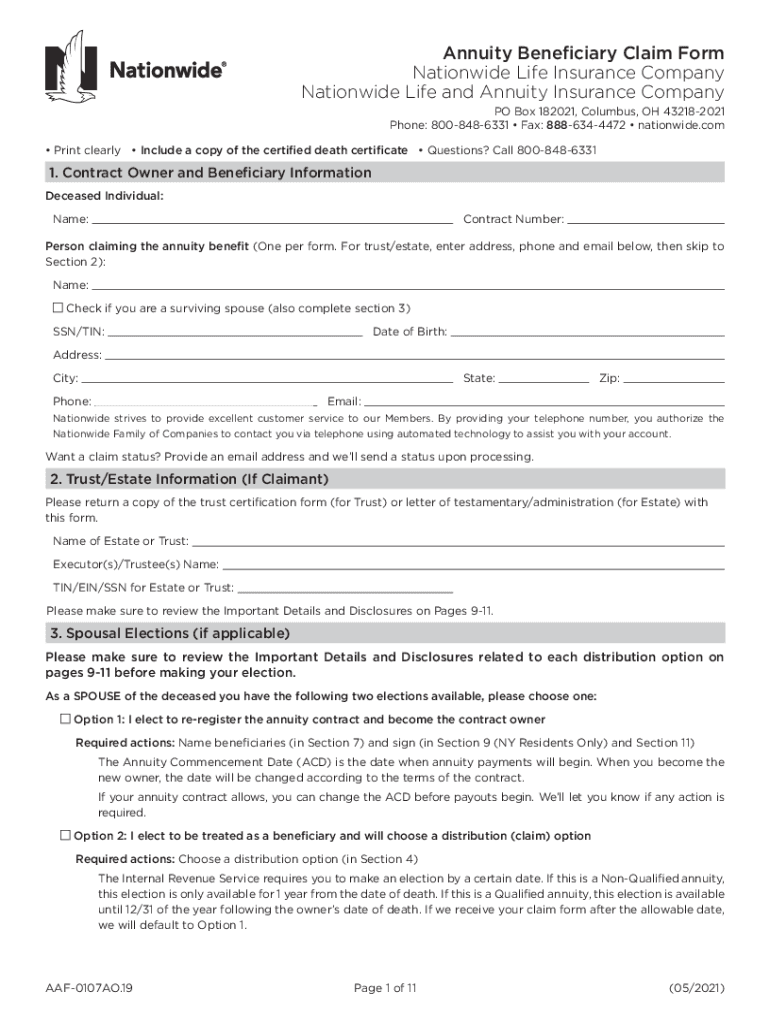

Annuity Beneficiary Claim Form Nationwide Life Insurance 2021-2026

What is the nationwide beneficiary claim form?

The nationwide beneficiary claim form is a crucial document used by individuals to claim benefits from life insurance policies or annuities after the policyholder's death. This form is designed to facilitate the transfer of funds to the designated beneficiaries, ensuring that they receive the financial support intended by the deceased. It typically requires information about the policyholder, the beneficiaries, and the specifics of the claim being made.

How to obtain the nationwide beneficiary claim form

To obtain the nationwide beneficiary claim form, beneficiaries can visit the official website of Nationwide or contact their customer service department. The form is often available for download in PDF format, allowing for easy access and completion. It is important to ensure that the correct version of the form is used, as different policies may have specific requirements.

Steps to complete the nationwide beneficiary claim form

Completing the nationwide beneficiary claim form involves several key steps:

- Gather necessary information about the policyholder and the beneficiaries.

- Fill out the form accurately, ensuring that all required fields are completed.

- Provide any supporting documentation, such as a death certificate or identification.

- Review the form for accuracy and completeness before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Required documents for the nationwide beneficiary claim form

When submitting the nationwide beneficiary claim form, certain documents are typically required to support the claim. These may include:

- A certified copy of the death certificate.

- Identification for the beneficiaries, such as a driver's license or Social Security card.

- Any relevant policy documents or statements.

- Additional forms as specified by Nationwide for specific claims.

Legal use of the nationwide beneficiary claim form

The nationwide beneficiary claim form is legally binding when completed and submitted according to the guidelines set forth by Nationwide. It is important for beneficiaries to understand that the form must be filled out accurately and submitted in a timely manner to ensure compliance with legal requirements. Failure to adhere to these guidelines may result in delays or denial of the claim.

Form submission methods

Beneficiaries have several options for submitting the nationwide beneficiary claim form. These methods typically include:

- Online submission through the Nationwide website.

- Mailing the completed form to the designated claims address.

- In-person submission at a local Nationwide office.

Choosing the most convenient method can help expedite the claims process.

Quick guide on how to complete annuity beneficiary claim form nationwide life insurance

Prepare Annuity Beneficiary Claim Form Nationwide Life Insurance smoothly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Annuity Beneficiary Claim Form Nationwide Life Insurance on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Annuity Beneficiary Claim Form Nationwide Life Insurance effortlessly

- Find Annuity Beneficiary Claim Form Nationwide Life Insurance and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important parts of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose your preferred method of submitting your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors requiring new printed copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Annuity Beneficiary Claim Form Nationwide Life Insurance and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct annuity beneficiary claim form nationwide life insurance

Create this form in 5 minutes!

People also ask

-

What is the nationwide contract owner withdrawal form?

The nationwide contract owner withdrawal form is a crucial document that allows contract owners to request withdrawals from their contracts. It is essential for ensuring that all withdrawal requests are processed efficiently and in compliance with industry regulations.

-

How do I complete the nationwide contract owner withdrawal form?

Completing the nationwide contract owner withdrawal form is straightforward. Simply fill out the necessary fields, providing detailed information about your contract and the desired withdrawal amount. Make sure to review your entries for accuracy before submitting the form.

-

What features does airSlate SignNow offer for the nationwide contract owner withdrawal form?

airSlate SignNow offers several features to streamline the process of managing the nationwide contract owner withdrawal form. Users can easily eSign documents, track the status of their submissions, and securely store all related files in one accessible location.

-

Is there a cost associated with using the nationwide contract owner withdrawal form?

Using the nationwide contract owner withdrawal form through airSlate SignNow is cost-effective. Our platform provides various pricing plans to accommodate different business needs, ensuring you can efficiently manage your contracts without breaking the bank.

-

Can I integrate the nationwide contract owner withdrawal form with other applications?

Yes, airSlate SignNow allows seamless integration with various applications, enhancing your workflow. You can connect the nationwide contract owner withdrawal form with CRM systems, document management tools, and other software to streamline your operations.

-

What are the benefits of using airSlate SignNow for the nationwide contract owner withdrawal form?

Using airSlate SignNow for the nationwide contract owner withdrawal form offers numerous benefits, including faster processing times and improved accuracy. Our user-friendly interface simplifies the signing process, making it easier for contract owners to submit their requests promptly.

-

Is my information secure when submitting the nationwide contract owner withdrawal form?

Absolutely! airSlate SignNow implements industry-leading security protocols to ensure that your information remains confidential when using the nationwide contract owner withdrawal form. Our end-to-end encryption protects your data at every stage of the process.

Get more for Annuity Beneficiary Claim Form Nationwide Life Insurance

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant missouri form

- Letter from tenant to landlord containing notice to landlord to withdraw retaliatory rent increase missouri form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services missouri form

- Temporary lease agreement to prospective buyer of residence prior to closing missouri form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497313175 form

- Letter from landlord to tenant returning security deposit less deductions missouri form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return missouri form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return missouri form

Find out other Annuity Beneficiary Claim Form Nationwide Life Insurance

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe