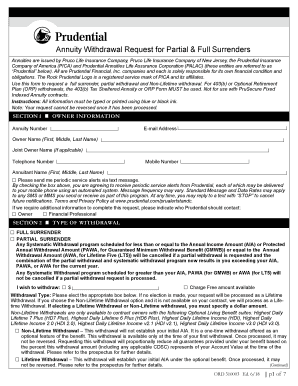

Annuity Contract Prudential Financial Form

What is the Annuity Contract Prudential Financial

An annuity contract from Prudential Financial is a financial product designed to provide a steady income stream, typically for retirement. This contract involves an agreement between an individual and Prudential, where the individual makes a lump sum payment or a series of payments in exchange for periodic disbursements in the future. Annuities can be classified into various types, such as fixed, variable, and indexed, each offering different benefits and risks. Understanding the specifics of your Prudential annuity contract is crucial for effective financial planning.

How to use the Annuity Contract Prudential Financial

Using an annuity contract from Prudential Financial involves understanding its terms and how they fit into your financial strategy. To utilize this contract effectively, you should first review the contract details, including payout options, fees, and any potential penalties for early withdrawal. You can access your account online through Prudential’s platform, where you can monitor your investment, request withdrawals, or make additional contributions. It is also advisable to consult with a financial advisor to align the annuity with your overall retirement goals.

Steps to complete the Annuity Contract Prudential Financial

Completing the annuity contract with Prudential Financial involves several key steps:

- Gather necessary personal information, including Social Security number and financial details.

- Choose the type of annuity that best suits your needs—fixed, variable, or indexed.

- Fill out the application form accurately, ensuring all information is complete.

- Review the contract terms, including payment options and fees.

- Submit the completed application through Prudential’s online portal or by mail.

- Receive confirmation of your application and keep track of any follow-up steps required.

Legal use of the Annuity Contract Prudential Financial

The legal use of an annuity contract with Prudential Financial is governed by various regulations that ensure the contract is valid and enforceable. It is essential to comply with state and federal laws regarding annuities, which may include disclosure requirements and consumer protection laws. Additionally, the contract must meet the standards set by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) if it involves securities. Understanding these legal frameworks can help protect your rights as a consumer.

Key elements of the Annuity Contract Prudential Financial

Key elements of the Prudential Financial annuity contract include:

- Premium Payments: The amount you pay to purchase the annuity, which can be a lump sum or periodic payments.

- Accumulation Phase: The period during which your investment grows, often tax-deferred.

- Distribution Phase: The time when you begin receiving payments from the annuity.

- Beneficiary Designation: The individual(s) who will receive benefits in the event of your passing.

- Fees and Charges: Any costs associated with the annuity, including management fees and surrender charges.

Eligibility Criteria

Eligibility for an annuity contract with Prudential Financial typically requires that the applicant be at least eighteen years old and a legal resident of the United States. Additionally, certain financial qualifications may be necessary, depending on the type of annuity chosen. It is essential to review Prudential’s specific guidelines to ensure you meet all requirements before applying.

Quick guide on how to complete annuity contract prudential financial

Complete Annuity Contract Prudential Financial seamlessly on any device

The management of online documents has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct version and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Annuity Contract Prudential Financial on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The simplest way to alter and eSign Annuity Contract Prudential Financial with ease

- Obtain Annuity Contract Prudential Financial and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device of your choice. Modify and eSign Annuity Contract Prudential Financial and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Annuity Contract Prudential Financial?

An Annuity Contract Prudential Financial is a financial product that provides a steady income stream, typically for retirement. It can be customized with various options to suit individual financial goals, offering peace of mind for long-term planning.

-

What are the benefits of choosing an Annuity Contract Prudential Financial?

Choosing an Annuity Contract Prudential Financial offers several benefits, including tax-deferred growth of your investment and guaranteed income. It can help manage risk in your retirement portfolio by providing predictable cash flow.

-

How much does an Annuity Contract Prudential Financial cost?

The cost of an Annuity Contract Prudential Financial varies based on several factors, including the type of annuity and the investment amount. It's best to consult with a Prudential Financial representative to get a personalized quote and understand the fees.

-

Can I customize my Annuity Contract Prudential Financial?

Yes, you can customize your Annuity Contract Prudential Financial with various options, such as different payout periods and investment strategies that align with your financial goals. This flexibility allows you to tailor the annuity to your specific needs.

-

Are there tax advantages with an Annuity Contract Prudential Financial?

Yes, one of the key advantages of an Annuity Contract Prudential Financial is its tax-deferred growth. This means you won't pay taxes on the earnings until you withdraw them, potentially allowing for greater accumulation of funds over time.

-

What features should I look for in an Annuity Contract Prudential Financial?

When considering an Annuity Contract Prudential Financial, look for features such as income options, investment choices, and withdrawal flexibility. Understanding these features will help you select an annuity that fits your retirement strategy.

-

How can I access my funds from an Annuity Contract Prudential Financial?

You can access your funds from an Annuity Contract Prudential Financial through various methods, such as lump-sum withdrawals or periodic payments. Review your contract for specific provisions regarding withdrawal policies and any applicable fees.

Get more for Annuity Contract Prudential Financial

Find out other Annuity Contract Prudential Financial

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document