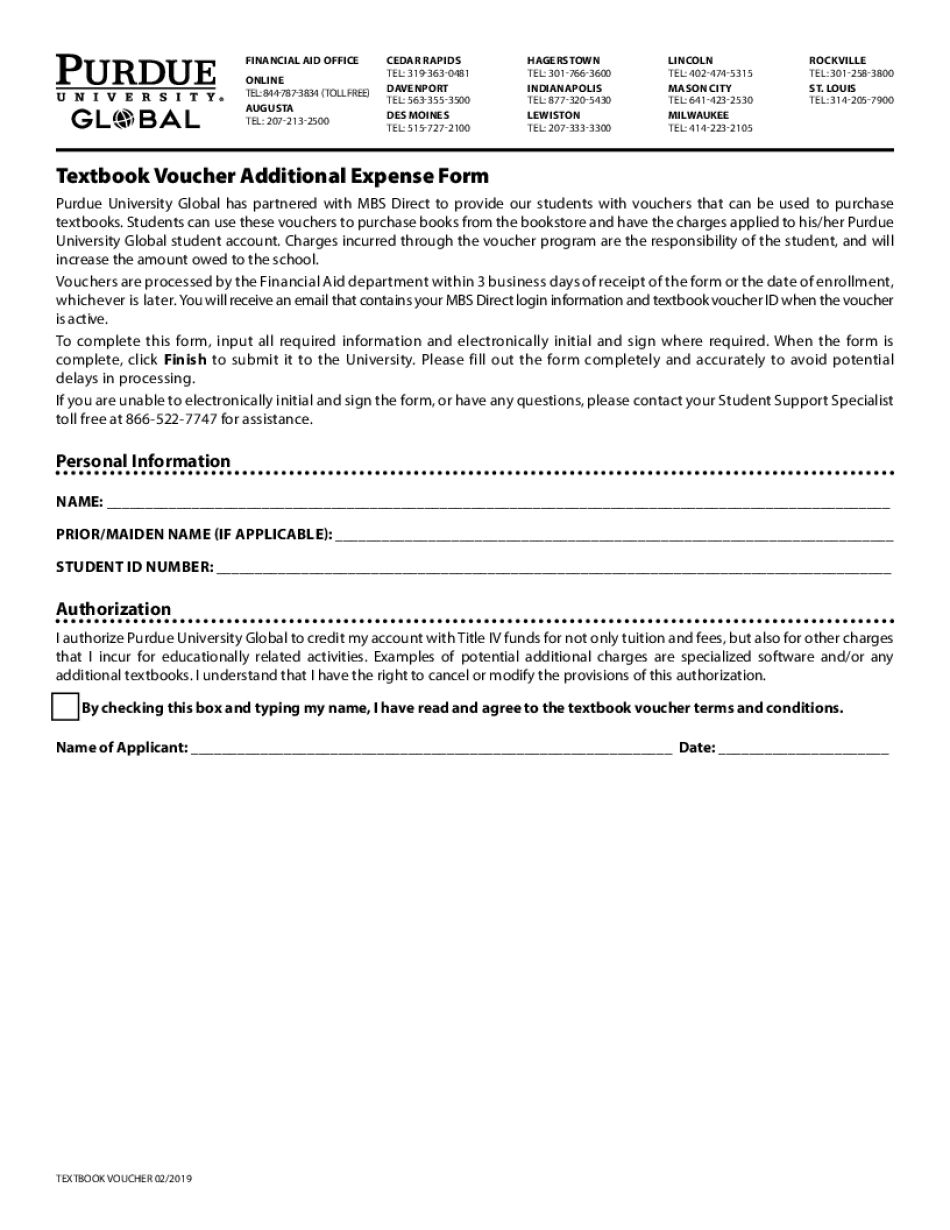

Textbook Voucher Form

What is the Textbook Voucher

The Textbook Voucher is a financial aid tool designed to assist students in covering the costs associated with purchasing textbooks and other educational materials. This voucher is typically issued by educational institutions and can be used at participating bookstores or online retailers. It helps alleviate the financial burden on students, ensuring they have access to necessary resources for their studies.

How to use the Textbook Voucher

Using the Textbook Voucher is a straightforward process. Students present the voucher at the time of purchase, either in-store or online. The voucher value is applied directly to the total cost of the textbooks. It is essential to ensure that the voucher is used within its validity period and adheres to any specific guidelines set by the issuing institution.

Steps to complete the Textbook Voucher

Completing the Textbook Voucher involves several key steps:

- Obtain the voucher from your educational institution.

- Review the terms and conditions associated with the voucher.

- Select the textbooks or materials needed for your courses.

- Present the voucher at the point of sale or enter the voucher code during online checkout.

- Ensure that any remaining balance, if applicable, is settled through other payment methods.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of educational vouchers, including the Textbook Voucher. Students should be aware that while these vouchers can help cover educational expenses, they may also have implications for tax deductions or credits. It is advisable to keep records of all transactions and consult IRS publications or a tax professional for detailed information on how these vouchers affect tax filings.

Eligibility Criteria

Eligibility for the Textbook Voucher typically depends on several factors, including enrollment status, financial need, and the specific policies of the educational institution. Students may need to demonstrate their eligibility through documentation such as financial aid applications or academic standing. It is important to check with the institution’s financial aid office for precise eligibility requirements.

Filing Deadlines / Important Dates

Students should be aware of important deadlines related to the Textbook Voucher, including application submission dates and the timeframe for voucher usage. These dates can vary by institution and academic term. Staying informed about these deadlines is crucial to ensure that students can take full advantage of the financial assistance offered by the voucher.

Form Submission Methods

Submitting the Textbook Voucher can typically be done through various methods, depending on the institution's policies. Common submission methods include:

- Online submission through the institution's financial aid portal.

- Mailing a physical copy to the financial aid office.

- In-person submission at designated locations on campus.

Quick guide on how to complete textbook voucher

Complete Textbook Voucher effortlessly on any device

Web-based document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to find the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without obstacles. Manage Textbook Voucher on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

The easiest method to modify and electronically sign Textbook Voucher with ease

- Find Textbook Voucher and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal standing as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you'd like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Textbook Voucher and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to tax income?

airSlate SignNow is a digital platform that allows businesses to electronically sign documents efficiently. By streamlining the signing process, it helps companies manage their tax income documents more effectively, ensuring compliance and accuracy in financial reporting.

-

How can airSlate SignNow help with tax income document management?

With airSlate SignNow, you can easily create, send, and track tax income-related documents. This platform minimizes the risk of errors and omissions, enabling you to keep your financial records organized and up-to-date for your tax income needs.

-

What are the key features of airSlate SignNow that benefit tax income reporting?

Key features of airSlate SignNow include customizable templates, automated reminders, and real-time tracking. These features ensure that tax income documents are completed promptly, which is crucial for accurate reporting and compliance.

-

Is airSlate SignNow a cost-effective solution for managing tax income paperwork?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By reducing the time and resources needed to manage tax income documents, it presents a cost-effective solution overall.

-

Can I integrate airSlate SignNow with other software for tax income management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and business software systems. This feature allows you to streamline your workflows and enhance the management of your tax income documents.

-

Does airSlate SignNow ensure the security of tax income documents?

Yes, airSlate SignNow prioritizes the security of all documents, including those related to tax income. The platform employs industry-standard encryption and security protocols to protect sensitive information.

-

What are the benefits of using airSlate SignNow for tax income-related workflows?

Using airSlate SignNow for tax income workflows can signNowly reduce processing time and paper use. It enhances collaboration among team members and ensures that all tax income documents are captured accurately.

Get more for Textbook Voucher

Find out other Textbook Voucher

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word