Form 433I Payment Agreement Application Revenue

What is the Form 433I Payment Agreement Application Revenue

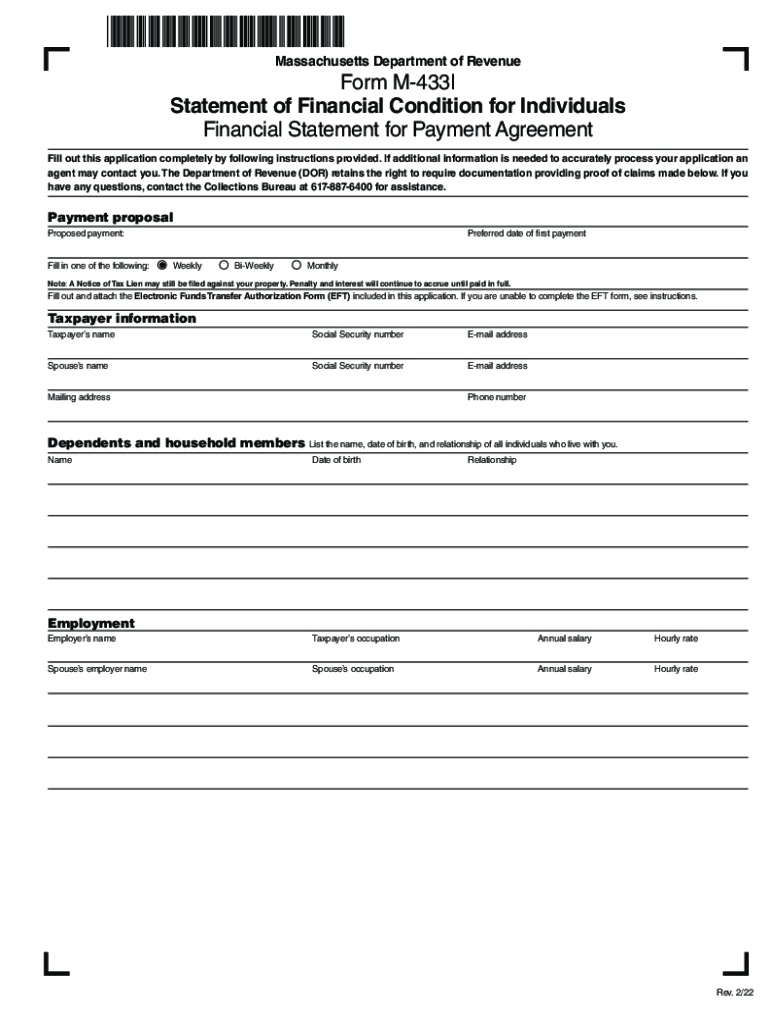

The Form 433I is a crucial document used by individuals seeking to establish a payment agreement with the Massachusetts Department of Revenue (DOR). This form provides a comprehensive overview of the taxpayer's financial situation, including income, expenses, and assets. By submitting this form, taxpayers can formally request a manageable payment plan for any outstanding tax liabilities. It is essential for those facing financial hardship, as it outlines the taxpayer's ability to pay and helps the DOR assess the most suitable repayment options.

Steps to Complete the Form 433I Payment Agreement Application Revenue

Completing the Form 433I requires careful attention to detail to ensure accuracy and compliance. Here are the steps to follow:

- Gather necessary financial documents, including pay stubs, bank statements, and expense reports.

- Fill out personal information, including name, address, and Social Security number.

- Provide detailed information on income sources, such as wages, self-employment income, and any other earnings.

- List all monthly expenses, including housing, utilities, and other necessary costs.

- Detail assets, including bank accounts, real estate, and other valuable property.

- Review the completed form for accuracy and completeness.

- Submit the form to the Massachusetts DOR through the appropriate channels.

Legal Use of the Form 433I Payment Agreement Application Revenue

The legal use of the Form 433I is governed by both state and federal regulations. This form must be filled out accurately to ensure that the taxpayer's financial disclosures are valid and can be verified by the Massachusetts DOR. It serves as a formal request for a payment agreement and must be submitted in accordance with the guidelines set forth by the DOR. Failure to comply with these regulations may result in delays or denial of the payment agreement.

Eligibility Criteria

To qualify for submitting the Form 433I, taxpayers must demonstrate financial hardship. Eligibility criteria typically include:

- Being a resident of Massachusetts.

- Having outstanding tax liabilities that cannot be paid in full.

- Providing accurate and complete financial information on the form.

- Demonstrating an inability to meet current tax obligations due to financial constraints.

Required Documents

When completing the Form 433I, certain documents are required to substantiate the information provided. These may include:

- Recent pay stubs or proof of income.

- Bank statements for the last few months.

- Documentation of monthly expenses, such as utility bills and lease agreements.

- Statements for any assets, including property deeds or vehicle titles.

Form Submission Methods

The Form 433I can be submitted to the Massachusetts DOR through various methods, ensuring flexibility for taxpayers. Options include:

- Online submission through the Massachusetts DOR's official website.

- Mailing the completed form to the designated DOR address.

- In-person submission at a local DOR office, if preferred.

Quick guide on how to complete form 433i payment agreement application revenue

Complete Form 433I Payment Agreement Application Revenue effortlessly on any device

Digital document management has become widely adopted by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your files quickly without delays. Manage Form 433I Payment Agreement Application Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to alter and eSign Form 433I Payment Agreement Application Revenue effortlessly

- Obtain Form 433I Payment Agreement Application Revenue and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and eSign Form 433I Payment Agreement Application Revenue while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a mass dor hardship form?

The mass dor hardship form is a document provided by the Massachusetts Department of Revenue that allows taxpayers to request a waiver on certain penalties and interest due to financial hardship. This form is essential for those who find it difficult to meet their tax obligations due to unforeseen circumstances.

-

How can airSlate SignNow help with submitting the mass dor hardship form?

airSlate SignNow streamlines the process of filling out and submitting the mass dor hardship form by enabling users to eSign documents securely and easily. This platform allows for fast submission directly to the Massachusetts Department of Revenue, enhancing efficiency and reducing frustration in the process.

-

Is there a cost associated with using airSlate SignNow for the mass dor hardship form?

Yes, airSlate SignNow offers various pricing plans to cater to different business sizes and needs. However, the savings in time and effort spent on processing the mass dor hardship form can signNowly outweigh the cost, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for handling the mass dor hardship form?

airSlate SignNow provides features such as document templates, customizable workflows, and secure eSigning capabilities, which can signNowly simplify the management of the mass dor hardship form. Additionally, users can track the status of their submissions in real-time for better peace of mind.

-

Can I integrate airSlate SignNow with other software for the mass dor hardship form?

Yes, airSlate SignNow offers integrations with various applications, allowing you to easily incorporate the mass dor hardship form into your existing workflows. This ensures that your document management process is seamless and enhances efficiency overall.

-

Who should use the mass dor hardship form?

The mass dor hardship form is especially beneficial for individuals and businesses facing financial difficulties that affect their ability to pay taxes on time. By using this form, taxpayers can potentially receive relief from penalties and interest, making it a vital resource for those in need.

-

How do I fill out the mass dor hardship form using airSlate SignNow?

Filling out the mass dor hardship form using airSlate SignNow is user-friendly. Simply select the template for the hardship form, fill in the required fields, and use the eSigning feature to complete the document securely.

Get more for Form 433I Payment Agreement Application Revenue

- Mutual wills or last will and testaments for unmarried persons living together with minor children district of columbia form

- Non marital cohabitation living together agreement district of columbia form

- Paternity law and procedure handbook district of columbia form

- Bill of sale in connection with sale of business by individual or corporate seller district of columbia form

- Legal separation agreement form

- Office lease agreement district of columbia form

- Marital legal separation and property settlement agreement adult children district of columbia form

- Financial statement district of columbia form

Find out other Form 433I Payment Agreement Application Revenue

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free