Form 1120 St

What is the Form 1120 St

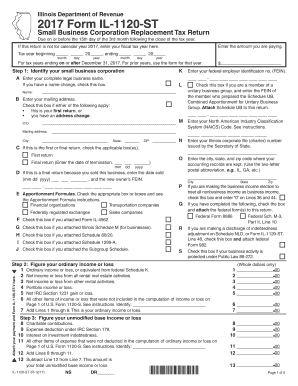

The Form 1120 St is a tax return form used by S corporations in the United States to report income, gains, losses, deductions, and credits. This form is essential for S corporations to comply with federal tax regulations. Unlike traditional corporations, S corporations pass their income, losses, and deductions through to their shareholders, who then report these amounts on their personal tax returns. Understanding the purpose and requirements of Form 1120 St is crucial for S corporations to ensure accurate tax reporting and compliance.

How to use the Form 1120 St

Using the Form 1120 St involves several key steps. First, gather all necessary financial information, including income statements, balance sheets, and any relevant deductions. Next, fill out the form accurately, ensuring that all figures are correct and reflect the corporation's financial status. After completing the form, review it for accuracy and completeness. Finally, submit the form to the IRS by the designated deadline. Utilizing digital tools can simplify this process, allowing for easy editing and electronic submission.

Steps to complete the Form 1120 St

Completing the Form 1120 St requires careful attention to detail. Follow these steps for a successful submission:

- Gather financial documents, including income statements and balance sheets.

- Begin filling out the form by entering the corporation's name, address, and Employer Identification Number (EIN).

- Report the corporation's income, including gross receipts and other income sources.

- Detail deductions, including business expenses and credits, to determine taxable income.

- Review all entries for accuracy and completeness.

- Sign and date the form, ensuring that it is submitted by the deadline.

Legal use of the Form 1120 St

The legal use of the Form 1120 St is governed by IRS regulations. To ensure the form is legally binding, it must be completed accurately and submitted on time. Electronic signatures are permissible if they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Utilizing a reliable eSignature platform can enhance the legal validity of the form, ensuring compliance with these regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 St are crucial for compliance. Generally, S corporations must file their tax return by the fifteenth day of the third month after the end of their tax year. For corporations operating on a calendar year, this means the deadline is March 15. Extensions may be available, but they must be requested before the original deadline. Keeping track of these important dates helps avoid penalties and ensures timely filing.

Required Documents

To complete the Form 1120 St, several documents are required. These include:

- Income statements detailing all sources of revenue.

- Balance sheets reflecting the corporation's assets, liabilities, and equity.

- Records of any deductions or credits claimed.

- Prior year tax returns for reference.

Having these documents ready will streamline the completion process and help ensure accuracy.

Quick guide on how to complete form 1120 st

Effortlessly Prepare Form 1120 St on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Handle Form 1120 St across any platform using the airSlate SignNow apps for Android or iOS, streamlining any document-related process today.

The Easiest Method to Edit and Electronically Sign Form 1120 St Effortlessly

- Find Form 1120 St and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information carefully and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 1120 St to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1120 st

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120 St and why do I need it?

Form 1120 St is the U.S. Corporation Income Tax Return for S corporations. Businesses use this form to report income, gains, losses, deductions, and credits, which is crucial for tax compliance. Understanding and filing Form 1120 St correctly can help ensure that your business meets IRS regulations without facing penalties.

-

How can airSlate SignNow assist me in signing Form 1120 St?

airSlate SignNow streamlines the process of electronically signing your Form 1120 St, making it faster and more efficient. Our platform allows you to prepare and send the form for e-signature seamlessly. By using airSlate SignNow, you can save time and reduce the hassle of paper documents.

-

What are the pricing plans for airSlate SignNow when handling Form 1120 St?

AirSlate SignNow offers competitive pricing plans that cater to different business needs. Our plans are designed to be cost-effective, providing robust features for e-signing and document management, including those needed for Form 1120 St. You can choose a plan that fits your budget without sacrificing quality.

-

What features should I expect when using airSlate SignNow for Form 1120 St?

When using airSlate SignNow for Form 1120 St, you can expect features such as customizable templates, secure e-signatures, and real-time document tracking. These features simplify your workflow, ensuring that your tax forms are signed on time with complete security and compliance.

-

Can I integrate airSlate SignNow with other software for Form 1120 St?

Yes, airSlate SignNow offers integrations with popular accounting and tax preparation software, enhancing the experience of managing your Form 1120 St. These integrations allow for a seamless flow of data, ensuring that all your information is synchronized and easily accessible.

-

What are the benefits of using airSlate SignNow for electronic signatures on Form 1120 St?

Using airSlate SignNow for electronic signatures on Form 1120 St offers several benefits, including increased efficiency, enhanced security, and better compliance with tax regulations. You can complete necessary signatures faster, ensuring that your corporate tax returns are filed promptly without the risk of losing important paperwork.

-

Is my data secure when using airSlate SignNow for Form 1120 St?

Absolutely, airSlate SignNow prioritizes the security of your documents, including Form 1120 St. We use industry-standard encryption and comply with all privacy regulations to protect your sensitive information during the signing process.

Get more for Form 1120 St

Find out other Form 1120 St

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast