Md 433 a Form

What is the Md 433 A

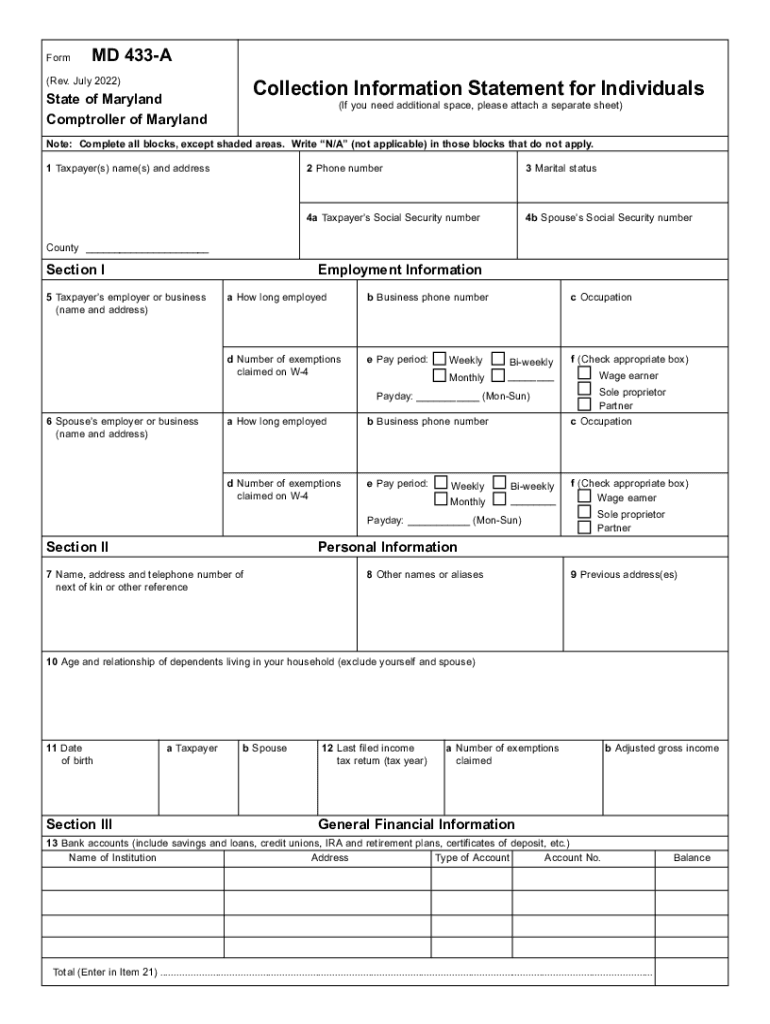

The Maryland Form 433 A is a collection information statement used primarily by the Maryland State Comptroller's Office. This form is essential for individuals seeking to provide detailed financial information regarding their income, expenses, and assets. It is typically utilized in situations where taxpayers are negotiating payment plans or settling tax liabilities. The form helps the state assess a taxpayer's financial situation to determine eligibility for various tax relief options.

Steps to complete the Md 433 A

Completing the Maryland Form 433 A involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, bank statements, and expense records. Next, fill out the personal information section, which includes your name, address, and Social Security number. Then, provide detailed information about your income sources, monthly expenses, and assets. It is crucial to be thorough and honest, as any discrepancies may affect your eligibility for tax relief. Finally, review the completed form for accuracy before submission.

Legal use of the Md 433 A

The Maryland Form 433 A is legally binding when filled out correctly and submitted to the appropriate state authorities. It must comply with the guidelines set forth by the Maryland Comptroller's Office. The information provided on the form is used to evaluate a taxpayer's financial status and determine their ability to pay outstanding tax liabilities. Misrepresentation or failure to provide complete information can lead to penalties or legal repercussions, making it vital to ensure that all details are accurate and truthful.

Required Documents

When completing the Maryland Form 433 A, several supporting documents are required to substantiate the financial information provided. These documents include:

- Recent pay stubs or income statements

- Bank statements for all accounts

- Documentation of monthly expenses, such as rent or mortgage statements

- Records of any other income sources, such as dividends or rental income

- Proof of assets, including property deeds or vehicle titles

Having these documents ready will facilitate the completion of the form and help ensure its accuracy.

Form Submission Methods

The Maryland Form 433 A can be submitted through various methods to accommodate different preferences. Taxpayers have the option to:

- Submit the form online through the Maryland Comptroller's website

- Mail the completed form to the designated address provided by the Comptroller's Office

- Deliver the form in person at a local Comptroller's office

Choosing the appropriate submission method can help expedite the processing of your request.

Quick guide on how to complete md 433 a

Complete Md 433 A effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Md 433 A on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Md 433 A effortlessly

- Find Md 433 A and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device. Modify and eSign Md 433 A while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the md form 433 a and how can it be used with airSlate SignNow?

The md form 433 a is a document often required for financial disclosures and agreements. With airSlate SignNow, you can easily upload, eSign, and manage the md form 433 a, ensuring compliance and efficiency in your transactions.

-

How does airSlate SignNow simplify the signing process for the md form 433 a?

airSlate SignNow simplifies the signing process for the md form 433 a by providing a user-friendly interface that allows for quick document preparation and eSigning. Users can invite others to sign via email or a shared link, making the process seamless and secure.

-

Is there any cost associated with using airSlate SignNow for md form 433 a?

Yes, airSlate SignNow offers various pricing plans to accommodate different business sizes and needs when handling the md form 433 a. Each plan includes features that enable efficient document management, eSigning, and compliance tracking.

-

Can I integrate airSlate SignNow with other applications for processing the md form 433 a?

Absolutely! airSlate SignNow can be integrated with various applications, enhancing the workflow for processing the md form 433 a. This integration ensures that your documents flow smoothly across platforms, reducing the time needed for approvals and signatures.

-

What are the benefits of using airSlate SignNow for my md form 433 a?

Using airSlate SignNow for your md form 433 a offers numerous benefits, including faster turnaround times and improved document security. Additionally, you gain access to features such as tracking, reminders, and templates, which streamline the signing process.

-

How secure is my data when using airSlate SignNow for the md form 433 a?

airSlate SignNow prioritizes the security of your data when processing the md form 433 a. The platform employs advanced encryption methods and adheres to industry standards to protect your documents and sensitive information throughout the signing process.

-

Can I track the status of my md form 433 a documents in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking capabilities for your md form 433 a documents. You can easily monitor who has signed, who still needs to sign, and receive notifications for any updates, ensuring you stay informed throughout the process.

Get more for Md 433 A

- Mississippi promissory 497315650 form

- Mississippi installments fixed rate promissory note secured by personal property mississippi form

- Mississippi note 497315652 form

- Notice of option for recording mississippi form

- Life documents planning package including will power of attorney and living will mississippi form

- Ms attorney form

- Essential legal life documents for baby boomers mississippi form

- Revocation of general durable power of attorney mississippi form

Find out other Md 433 A

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement