Nebraska Sales and Use Tax Statement for Motorboat Sales 6MB 2022-2026

What is the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB

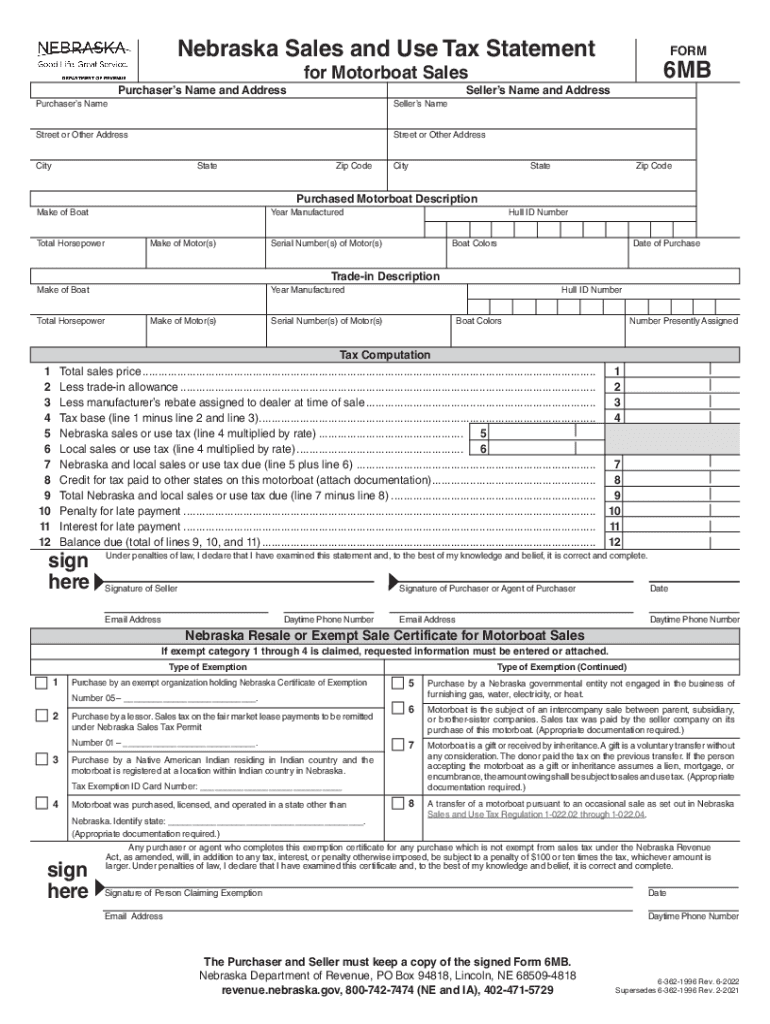

The Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB is a specific form used for reporting and paying sales and use tax on motorboat sales in Nebraska. This document is essential for both buyers and sellers in the motorboat market, as it ensures compliance with state tax regulations. By accurately completing this form, individuals and businesses can facilitate the proper assessment of taxes owed on motorboat transactions, thereby avoiding potential legal issues.

Steps to complete the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB

Completing the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB involves several key steps:

- Gather necessary information, including the seller’s and buyer’s details, motorboat description, and sale price.

- Indicate the applicable sales tax rate based on the location of the sale.

- Calculate the total sales tax due by applying the tax rate to the sale price.

- Review all entered information for accuracy before submission.

- Sign and date the form to validate it.

How to obtain the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB

The Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB can be obtained through the Nebraska Department of Revenue's official website. It is typically available as a downloadable PDF file, which can be printed and filled out manually or completed electronically. Additionally, local tax offices may provide physical copies of the form for those who prefer in-person assistance.

Legal use of the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB

This form is legally binding when completed correctly and submitted in accordance with Nebraska state laws. To ensure its legal validity, it must be signed by the appropriate parties and submitted within the required time frame. Compliance with all relevant tax regulations is crucial to avoid penalties and ensure that the transaction is recognized by state authorities.

Key elements of the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB

Several key elements must be included in the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB:

- Seller and buyer identification, including names and addresses.

- Detailed description of the motorboat, including make, model, and year.

- Sale price of the motorboat.

- Applicable sales tax rate and total tax calculation.

- Signatures of both parties to validate the transaction.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB. Typically, the form must be submitted within a specific time frame following the sale of the motorboat. Failure to file by the deadline may result in penalties or interest charges on the unpaid tax amount. Keeping track of these dates ensures compliance and helps avoid unnecessary financial burdens.

Quick guide on how to complete nebraska sales and use tax statement for motorboat sales 6mb

Finish Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any delays. Manage Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB without hassle

- Obtain Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB and click on Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that task.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information carefully and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors necessitating new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska sales and use tax statement for motorboat sales 6mb

Create this form in 5 minutes!

People also ask

-

What is the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB?

The Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB is a specific document required for reporting sales and use tax related to motorboat transactions in Nebraska. This statement ensures compliance with state tax regulations and helps sellers accurately report their sales.

-

How can airSlate SignNow help with the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB. With our tools, you can streamline your paperwork process and ensure that your documents are securely signed and efficiently managed.

-

What are the key features of airSlate SignNow for handling the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB?

Key features include customizable templates, secure eSignature options, and automated workflows specifically for managing the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB. These features make it easy to create and manage your documents, saving you time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs when handling the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB. We provide cost-effective solutions that allow businesses of all sizes to efficiently manage their documentation without breaking the bank.

-

Can I integrate airSlate SignNow with other software for the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB?

Absolutely! airSlate SignNow integrates seamlessly with various software applications. This facilitates the smooth handling of the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB alongside your existing business tools, enhancing overall efficiency.

-

What benefits does airSlate SignNow offer for businesses dealing with the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB?

Using airSlate SignNow for the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB improves accuracy in tax filing and ensures timely submissions. Additionally, the secure eSigning process enhances the integrity of your documents and provides peace of mind.

-

How secure is airSlate SignNow when it comes to the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB?

airSlate SignNow prioritizes security, offering encryption and compliance with industry standards for the Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB. Your documents are protected at every stage, ensuring that sensitive information remains confidential and secure.

Get more for Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB

- Final notice of default for past due payments in connection with contract for deed north carolina form

- North carolina assignment 497316762 form

- Notice of assignment of contract for deed north carolina form

- Nc purchase form

- Buyers home inspection checklist north carolina form

- Sellers information for appraiser provided to buyer north carolina

- Subcontractors agreement north carolina form

- Hpsebl form cs 1 a 609198780

Find out other Nebraska Sales And Use Tax Statement For Motorboat Sales 6MB

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later