Taxpayer Bill of RightsInternal Revenue Service IRS Tax Forms

Understanding Form 911

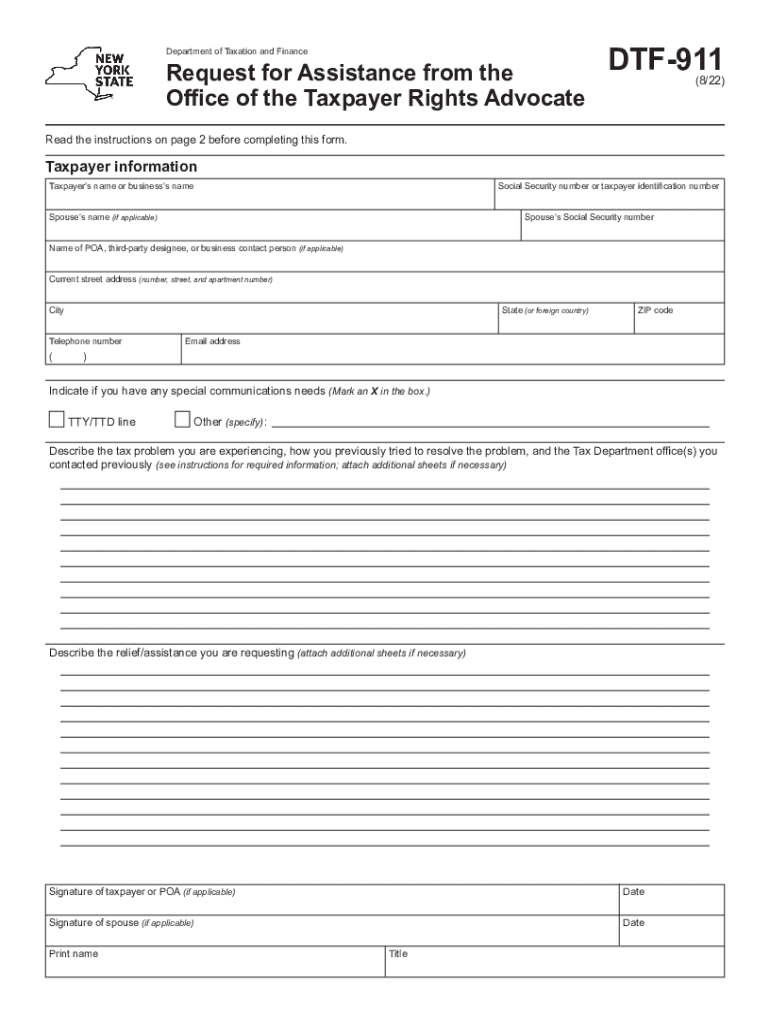

Form 911, also known as the Request for Taxpayer Advocate Service Assistance, is a crucial document for taxpayers in the United States who need help resolving issues with the Internal Revenue Service (IRS). This form allows individuals to seek assistance from the Taxpayer Advocate Service (TAS), which is an independent organization within the IRS dedicated to helping taxpayers navigate complex tax situations. Completing Form 911 can provide access to valuable resources and support, ensuring that taxpayers receive the help they need in a timely manner.

Steps to Complete Form 911

Filling out Form 911 involves several key steps to ensure that your request for assistance is processed efficiently. Begin by gathering all necessary personal and tax information, including your Social Security number, tax year in question, and a detailed description of your tax issue. Next, accurately fill out the form, providing clear and concise information about your situation. It is essential to explain why you believe your problem requires the assistance of the Taxpayer Advocate Service. Once completed, submit the form either online or via mail, depending on your preference.

Eligibility Criteria for Form 911

To qualify for assistance through Form 911, taxpayers must meet specific eligibility criteria. This includes experiencing significant hardship due to IRS actions, such as delays in processing tax returns or issues with tax refunds. Additionally, taxpayers should demonstrate that they have made reasonable attempts to resolve their issues directly with the IRS before seeking assistance from the Taxpayer Advocate Service. Understanding these criteria is vital to ensure that your request is valid and likely to be accepted.

Form Submission Methods

Taxpayers have multiple options for submitting Form 911. The form can be submitted online through the IRS website, which offers a streamlined process for those who prefer digital interactions. Alternatively, taxpayers can print the completed form and send it via mail to the appropriate Taxpayer Advocate Service office. It is important to check the IRS website for the most current mailing addresses and submission guidelines to ensure that your form reaches the right destination promptly.

Key Elements of Form 911

Form 911 includes several key elements that are essential for a successful submission. Taxpayers must provide their contact information, including phone numbers and addresses, to facilitate communication with the Taxpayer Advocate Service. Additionally, the form requires a detailed narrative explaining the taxpayer's situation, including the specific IRS actions that have led to the need for assistance. Providing thorough and accurate information will help the TAS understand the issue and expedite the resolution process.

Penalties for Non-Compliance

While there are no direct penalties for submitting Form 911, failing to address tax issues in a timely manner can lead to significant consequences, including additional tax liabilities, penalties, and interest. Taxpayers are encouraged to act promptly when facing challenges with the IRS to avoid complications. Utilizing Form 911 can help mitigate these risks by providing a structured avenue for seeking assistance and ensuring that taxpayers receive the necessary support to resolve their issues.

Quick guide on how to complete taxpayer bill of rightsinternal revenue service irs tax forms

Complete Taxpayer Bill Of RightsInternal Revenue Service IRS Tax Forms effortlessly on any device

Online document management has gained increasing popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, edit, and electronically sign your documents promptly without any hold-ups. Manage Taxpayer Bill Of RightsInternal Revenue Service IRS Tax Forms across any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

Effortless ways to edit and electronically sign Taxpayer Bill Of RightsInternal Revenue Service IRS Tax Forms

- Find Taxpayer Bill Of RightsInternal Revenue Service IRS Tax Forms and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Taxpayer Bill Of RightsInternal Revenue Service IRS Tax Forms and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it help with 911-related documents?

airSlate SignNow is an efficient electronic signature platform that simplifies the process of sending and signing documents. For businesses handling 911 protocols, SignNow streamlines the documentation process, ensuring that critical forms are signed and processed quickly, which can enhance overall response times.

-

How does airSlate SignNow ensure the security of 911 documents?

Security is a top priority for airSlate SignNow, especially for sensitive 911 documents. The platform employs industry-standard encryption and complies with various regulations, safeguarding your documents while ensuring that they remain accessible to authorized personnel only.

-

What are the pricing options for airSlate SignNow for organizations managing 911 services?

airSlate SignNow offers various pricing plans tailored to the needs of organizations including those managing 911 services. Each plan provides access to essential features, along with scalable options that can grow with your business, ensuring you only pay for what you need.

-

Can airSlate SignNow integrate with other tools used in 911 operations?

Yes, airSlate SignNow supports integration with a range of applications commonly used in 911 operations, including CRMs and document management systems. This seamless integration streamlines workflows and enhances collaboration among your team.

-

What are the benefits of using airSlate SignNow for 911 documentation?

Using airSlate SignNow for 911 documentation provides numerous benefits, including reduced turnaround times and improved accuracy in document handling. Its user-friendly interface ensures that personnel can swiftly eSign essential documents, facilitating faster response and operational efficiency.

-

Is it easy to train staff on how to use airSlate SignNow for 911 purposes?

Absolutely! airSlate SignNow has been designed for ease of use, meaning staff can quickly learn how to eSign and manage documents without extensive training. This is particularly beneficial in high-pressure 911 environments where time is critical.

-

What types of documents can I send and eSign using airSlate SignNow for 911 purposes?

You can send a variety of documents using airSlate SignNow, including incident reports, consent forms, and compliance documents essential for 911 operations. The platform accommodates diverse document types, allowing for efficient management of all your critical paperwork.

Get more for Taxpayer Bill Of RightsInternal Revenue Service IRS Tax Forms

- North carolina deed form

- Warranty deed husband and wife to three individuals north carolina form

- Nc special warranty form

- Interrogatories sample form

- Discovery interrogatories from defendant to plaintiff with production requests north carolina form

- Nc interrogatories form

- North carolina deed 497316826 form

- North carolina special warranty deed form

Find out other Taxpayer Bill Of RightsInternal Revenue Service IRS Tax Forms

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed