How to File Excise Duty Return Online Form

What is the how to file excise duty return online

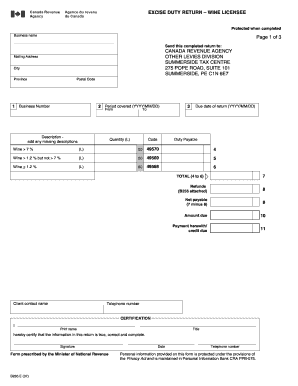

The how to file excise duty return online is a digital form used by businesses to report and pay excise taxes to the Internal Revenue Service (IRS). This form is essential for entities involved in the production, distribution, or sale of specific goods, such as alcohol, tobacco, and fuel. By filing online, businesses can streamline their reporting process, ensuring timely submissions and reducing the risk of errors associated with paper forms. The digital format also allows for easier record-keeping and access to past submissions.

Steps to complete the how to file excise duty return online

Completing the how to file excise duty return online involves several key steps:

- Gather necessary information, including business details, sales data, and applicable tax rates.

- Access the IRS online portal or designated e-filing service.

- Fill out the form with accurate data, ensuring all required fields are completed.

- Review the information for accuracy to avoid potential penalties.

- Submit the form electronically and retain confirmation of submission for your records.

Legal use of the how to file excise duty return online

The how to file excise duty return online is legally binding when completed in compliance with IRS regulations. To ensure validity, businesses must adhere to specific guidelines, including accurate reporting of taxable goods and timely submissions. Utilizing a reliable e-signature service can further enhance the legal standing of the document, as it provides a digital certificate that verifies the identity of the signer. Compliance with federal e-signature laws, such as ESIGN and UETA, is crucial for the form's acceptance.

Required documents for the how to file excise duty return online

To successfully complete the how to file excise duty return online, several documents are typically required:

- Business identification number (EIN).

- Records of sales and production of excise goods.

- Previous excise duty returns, if applicable.

- Documentation supporting any deductions or credits claimed.

Having these documents readily available will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Filing deadlines for the how to file excise duty return online

Filing deadlines for the how to file excise duty return online vary based on the type of excise tax being reported. Generally, businesses must submit their returns on a monthly or quarterly basis, depending on their tax liability. It is important to stay informed about specific deadlines to avoid late fees and penalties. The IRS provides a calendar outlining important dates for excise tax filings, which can be a valuable resource for businesses.

Penalties for non-compliance with the how to file excise duty return online

Failure to file the how to file excise duty return online on time or inaccuracies in reporting can result in significant penalties. The IRS may impose fines based on the amount of tax owed, and continued non-compliance can lead to further legal consequences. Businesses are encouraged to maintain accurate records and submit their returns promptly to mitigate these risks. Understanding the potential penalties associated with non-compliance can help businesses prioritize their filing responsibilities.

Quick guide on how to complete how to file excise duty return online

Complete How To File Excise Duty Return Online smoothly on any gadget

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage How To File Excise Duty Return Online across any platform with airSlate SignNow Android or iOS applications and simplify any document-related processes today.

The easiest way to modify and eSign How To File Excise Duty Return Online effortlessly

- Find How To File Excise Duty Return Online and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign How To File Excise Duty Return Online and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to file excise duty return online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to file an excise duty return online?

To file an excise duty return online, you can follow a straightforward process using airSlate SignNow. First, gather all necessary documents, then create your return using our platform. Once completed, you can easily eSign and submit your return online, ensuring compliance and accuracy.

-

How does airSlate SignNow simplify the excise duty return filing process?

airSlate SignNow simplifies how to file excise duty return online by providing an intuitive interface that guides you through the steps. The platform offers templates and automated tools to reduce manual entry and errors, making the filing process faster and more efficient.

-

What are the pricing plans for using airSlate SignNow for excise duty returns?

airSlate SignNow offers various pricing plans designed to fit different business needs. You can select from monthly or annual subscriptions based on your usage, ensuring you have access to all features needed to file your excise duty return online effectively.

-

Can I integrate airSlate SignNow with my accounting software for excise duty returns?

Yes, airSlate SignNow offers seamless integrations with popular accounting software, allowing you to manage your finances while learning how to file excise duty return online. These integrations help ensure that your financial records are up-to-date and accurate.

-

What features does airSlate SignNow provide for filing excise duty returns?

airSlate SignNow provides features such as customizable templates, eSigning, document tracking, and automated reminders to streamline the process of filing excise duty returns online. These tools ensure that you can file accurately and on time.

-

Is airSlate SignNow secure for filing sensitive excise duty returns?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that when you are filing your excise duty return online, your sensitive information is protected.

-

What support options are available if I encounter issues filing my excise duty return online?

airSlate SignNow offers robust customer support, including live chat, email support, and a comprehensive knowledge base. Should you encounter any issues while learning how to file excise duty return online, help is readily available at your fingertips.

Get more for How To File Excise Duty Return Online

- 32 form online subscription agreement

- Software distribution agreement secgov form

- 34 form agency licensing agreement

- 2011 introduction and penalty relief internal revenue service form

- Microsoft cloud agreementyorb form

- Create an end user license agreement eulalegal templates form

- Means this iphone developer program license agreement form

- Frequently asked questions about the gnu licenses gnu form

Find out other How To File Excise Duty Return Online

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe