Www SignNow Comfill and Sign PDF Form113901Oklahoma Form EF Oklahoma Income Tax Declaration for Fill

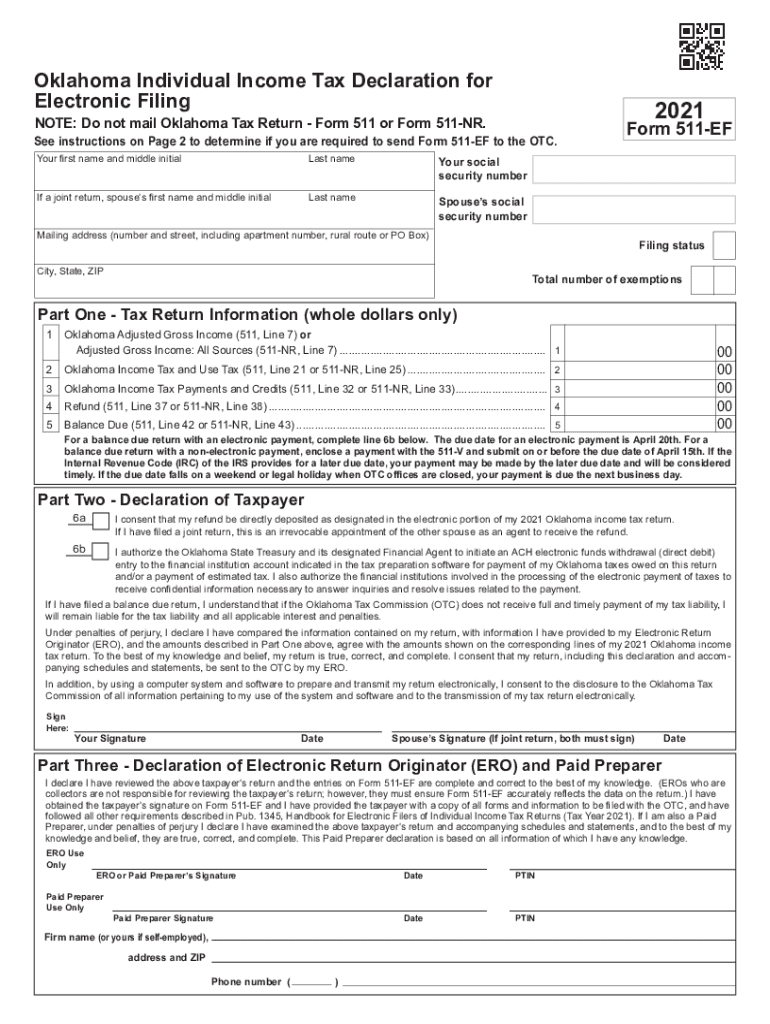

Understanding the Oklahoma Income Tax Declaration Form 511ef

The Oklahoma Income Tax Declaration Form 511ef is a crucial document for individuals filing their state income tax returns. This form allows taxpayers to declare their income and calculate the amount of tax owed to the state of Oklahoma. It is essential to complete this form accurately to ensure compliance with state tax laws and avoid potential penalties.

Steps to Complete the Oklahoma Income Tax Declaration Form 511ef

Filling out the 511ef form requires careful attention to detail. Here are the steps to ensure proper completion:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Provide your personal information, such as your name, address, and Social Security number.

- Report your total income for the year as indicated on your income statements.

- Calculate your deductions and credits to determine your taxable income.

- Complete the form by entering the calculated tax owed or refund due.

- Sign and date the form to validate your submission.

Legal Use of the Oklahoma Income Tax Declaration Form 511ef

The 511ef form is legally binding once completed and signed. It must be submitted to the Oklahoma Tax Commission by the specified deadline to ensure compliance with state tax regulations. Failure to submit this form on time can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines for the Oklahoma Income Tax Declaration Form 511ef

Taxpayers should be aware of the filing deadlines for the 511ef form to avoid late fees. Typically, the deadline for filing state income tax returns in Oklahoma aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day.

Required Documents for the Oklahoma Income Tax Declaration Form 511ef

To complete the 511ef form accurately, taxpayers need to gather specific documents:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Documentation for deductions, such as mortgage interest statements or charitable contributions.

Form Submission Methods for the Oklahoma Income Tax Declaration Form 511ef

The 511ef form can be submitted in several ways:

- Online through the Oklahoma Tax Commission's e-file system.

- By mail, sending the completed form to the appropriate address provided by the Tax Commission.

- In-person at local Tax Commission offices, if preferred.

Quick guide on how to complete wwwsignnowcomfill and sign pdf form113901oklahoma form ef oklahoma income tax declaration for fill

Accomplish Www signnow comfill and sign pdf form113901Oklahoma Form EF Oklahoma Income Tax Declaration For Fill effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents promptly without delays. Handle Www signnow comfill and sign pdf form113901Oklahoma Form EF Oklahoma Income Tax Declaration For Fill on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Www signnow comfill and sign pdf form113901Oklahoma Form EF Oklahoma Income Tax Declaration For Fill without any fuss

- Find Www signnow comfill and sign pdf form113901Oklahoma Form EF Oklahoma Income Tax Declaration For Fill and click on Get Form to begin.

- Use the features we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for such tasks.

- Create your eSignature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and hit the Done button to store your amendments.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require the printing of new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from the device of your choosing. Modify and eSign Www signnow comfill and sign pdf form113901Oklahoma Form EF Oklahoma Income Tax Declaration For Fill and guarantee excellent communication throughout the document preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Oklahoma declaration form?

An Oklahoma declaration form is a legal document used to outline important information and declarations regarding a specific subject matter. It may be utilized for various purposes, such as real estate transactions or financial disclosures. Using airSlate SignNow, you can easily create, send, and eSign Oklahoma declaration forms digitally.

-

How can I create an Oklahoma declaration form with airSlate SignNow?

Creating an Oklahoma declaration form with airSlate SignNow is simple. You can start from a blank template or utilize pre-built templates that suit your needs. Once your form is ready, you can customize it and share it for electronic signatures, ensuring a smooth workflow.

-

What features does airSlate SignNow offer for Oklahoma declaration forms?

AirSlate SignNow offers a variety of features for managing Oklahoma declaration forms, including customizable templates, drag-and-drop editing, and real-time tracking of signatures. Additionally, you can automate reminders for signatories and access powerful integrations to streamline your business processes.

-

Is airSlate SignNow a cost-effective solution for handling Oklahoma declaration forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for electronic document management, including Oklahoma declaration forms. The pricing plans are competitive, and the savings come from reduced printing, mailing, and administrative costs associated with traditional methods.

-

Can I integrate airSlate SignNow with other software for processing Oklahoma declaration forms?

Absolutely! AirSlate SignNow offers integrations with various third-party applications, including CRM systems and cloud storage solutions. This enables you to effortlessly manage Oklahoma declaration forms within your existing workflow and keep all your documents organized.

-

What benefits can I expect from using airSlate SignNow for Oklahoma declaration forms?

Using airSlate SignNow for Oklahoma declaration forms brings numerous benefits, such as enhanced efficiency, reduced turnaround time for signatures, and improved security. The platform ensures that your documents are encrypted and compliant with legal standards, providing peace of mind.

-

Is it legally binding to eSign an Oklahoma declaration form using airSlate SignNow?

Yes, eSigning an Oklahoma declaration form using airSlate SignNow is legally binding. The platform complies with federal e-signature laws, ensuring that electronic signatures hold the same weight as traditional pen-and-paper signatures. This makes it a reliable choice for your legal documentation needs.

Get more for Www signnow comfill and sign pdf form113901Oklahoma Form EF Oklahoma Income Tax Declaration For Fill

- Interrogatories to plaintiff for motor vehicle occurrence north carolina form

- Interrogatories to defendant for motor vehicle accident north carolina form

- Llc notices resolutions and other operations forms package north carolina

- North carolina accidents form

- Notice of dishonored check civil 1st notice keywords bad check bounced check north carolina form

- Notice dishonored form

- Mutual wills containing last will and testaments for man and woman living together not married with no children north carolina form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children north form

Find out other Www signnow comfill and sign pdf form113901Oklahoma Form EF Oklahoma Income Tax Declaration For Fill

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word