QUARTERLY TAX and WAGE REPORT DEPARTMENT of LABOR and Form

Understanding the TX13 Tax Form

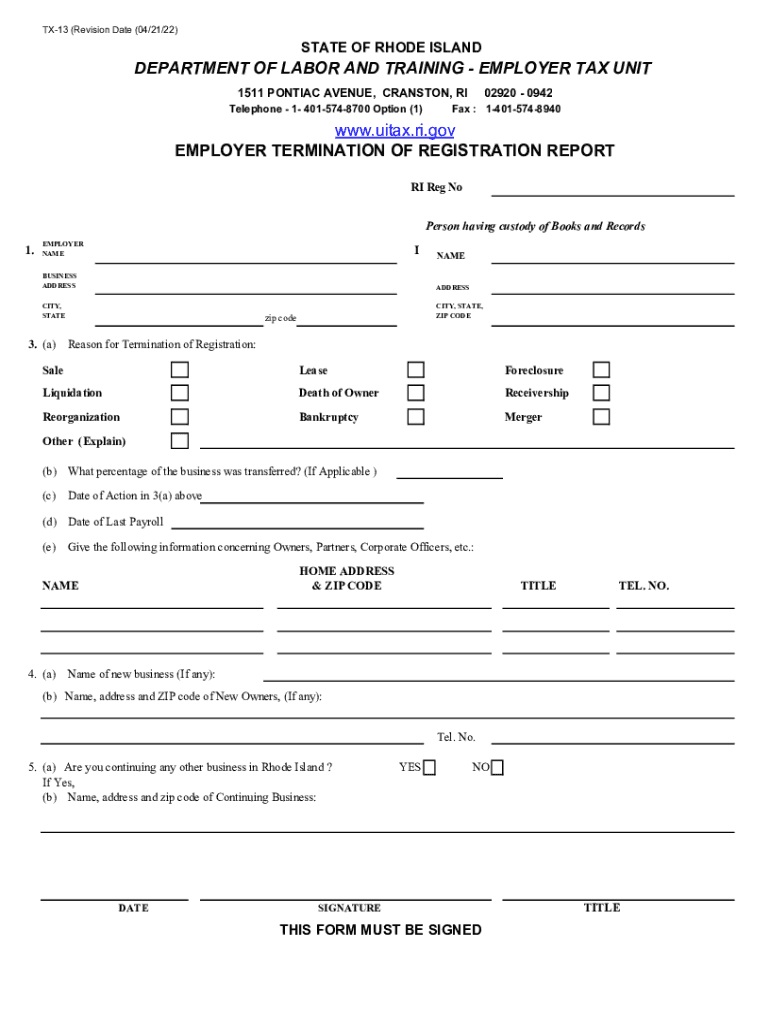

The TX13 tax form, also known as the Rhode Island Tax Termination Registration, is a crucial document for businesses in Rhode Island. It is specifically used to report the termination of a business entity's tax obligations. This form is essential for ensuring that all tax responsibilities are settled before closing a business, preventing future liabilities. Understanding the purpose and requirements of the TX13 tax form is vital for compliance with state tax laws.

Steps to Complete the TX13 Tax Form

Completing the TX13 tax form involves several key steps. First, gather all necessary information regarding your business, including the legal name, address, and tax identification number. Next, accurately fill out the form, ensuring that all sections are completed, including the reason for termination. After filling out the form, review it thoroughly for any errors or omissions. Finally, submit the completed TX13 tax form to the Rhode Island Division of Taxation, either online or via mail, depending on your preference.

Filing Deadlines for the TX13 Tax Form

Timely submission of the TX13 tax form is critical to avoid penalties. The form must be filed within a specific timeframe after the business ceases operations. Typically, businesses should submit the TX13 form by the end of the quarter in which the termination occurs. It is important to check for any updates or changes to deadlines by consulting the Rhode Island Division of Taxation's official guidelines.

Legal Use of the TX13 Tax Form

The TX13 tax form serves a legal purpose in documenting the cessation of a business's tax obligations. Filing this form properly ensures that the business is officially recognized as terminated by the state, which can protect owners from future tax liabilities. Additionally, maintaining a copy of the submitted form is advisable for record-keeping and potential future reference.

Required Documents for Filing the TX13 Tax Form

To successfully file the TX13 tax form, certain documents may be required. These typically include the business's tax identification number, a copy of the final tax return, and any relevant documentation proving the business's closure. Ensuring that all required documents are included with the TX13 form can facilitate a smoother filing process and help avoid delays.

Penalties for Non-Compliance with the TX13 Tax Form

Failure to file the TX13 tax form can result in significant penalties. Businesses that neglect to submit this form may face fines and continued tax obligations, which can complicate the termination process. It is crucial for business owners to understand the importance of compliance with this requirement to avoid unnecessary financial burdens.

Quick guide on how to complete quarterly tax and wage report department of labor and

Effortlessly Prepare QUARTERLY TAX AND WAGE REPORT DEPARTMENT OF LABOR AND on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Handle QUARTERLY TAX AND WAGE REPORT DEPARTMENT OF LABOR AND on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign QUARTERLY TAX AND WAGE REPORT DEPARTMENT OF LABOR AND with Ease

- Find QUARTERLY TAX AND WAGE REPORT DEPARTMENT OF LABOR AND and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive details using features that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow meets your needs in document management, allowing you to edit and electronically sign QUARTERLY TAX AND WAGE REPORT DEPARTMENT OF LABOR AND in just a few clicks from your preferred device. Ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is RI termination registration?

RI termination registration is a process required for businesses in Rhode Island to officially end their business operations. It involves submitting the necessary documentation to the state to ensure that all legal obligations are met. Utilizing services like airSlate SignNow can streamline this process and make it hassle-free.

-

How does airSlate SignNow simplify the RI termination registration process?

airSlate SignNow offers an easy-to-use platform that allows users to prepare, sign, and send termination documents electronically. By providing templates and an intuitive interface, businesses can efficiently complete their RI termination registration without extensive paperwork. This saves time and reduces administrative burdens.

-

What are the costs associated with RI termination registration using airSlate SignNow?

The pricing for using airSlate SignNow for RI termination registration is competitive and varies based on the chosen subscription plan. Users can take advantage of different pricing tiers that fit their needs and budget. The platform is designed to provide cost-effective solutions, ensuring that businesses can effectively manage their document needs.

-

Are there any specific features of airSlate SignNow that support RI termination registration?

Yes, airSlate SignNow includes features like document templates, eSignature capabilities, and secure storage that specifically enhance the RI termination registration process. These features allow users to easily customize their documents and ensure compliance with all necessary regulations. This comprehensive solution helps facilitate smooth business closures.

-

Can airSlate SignNow integrate with other software systems for RI termination registration?

Yes, airSlate SignNow offers seamless integrations with many popular business software applications, making it easier to manage the RI termination registration process. This integration allows you to link existing workflows and enhance efficiency without disrupting your current systems. Businesses can connect their tools for a unified approach.

-

What are the main benefits of using airSlate SignNow for RI termination registration?

Using airSlate SignNow for RI termination registration provides numerous benefits, including increased efficiency, reduced processing times, and improved compliance. The platform helps businesses avoid potential legal issues by ensuring that all documents are properly executed and stored securely. It is an essential tool for any business planning to terminate operations.

-

Is airSlate SignNow user-friendly for managing RI termination registration?

Absolutely! airSlate SignNow is designed with user experience in mind, offering an intuitive interface that makes managing RI termination registration straightforward. Users of all tech skill levels can navigate the platform easily, ensuring that they can complete their documents quickly and efficiently without needing extensive training.

Get more for QUARTERLY TAX AND WAGE REPORT DEPARTMENT OF LABOR AND

- Mutual wills or last will and testaments for man and woman living together not married with minor children north carolina form

- Nc cohabitation form

- Paternity law and procedure handbook north carolina form

- Bill of sale in connection with sale of business by individual or corporate seller north carolina form

- North carolina divorce 497317014 form

- Divorce with no form

- Office lease agreement north carolina form

- North carolina service form

Find out other QUARTERLY TAX AND WAGE REPORT DEPARTMENT OF LABOR AND

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form