Sales & Excise FormsRI Division of Taxation Rhode Island

Understanding the Rhode Island Sales Tax Reconciliation Form

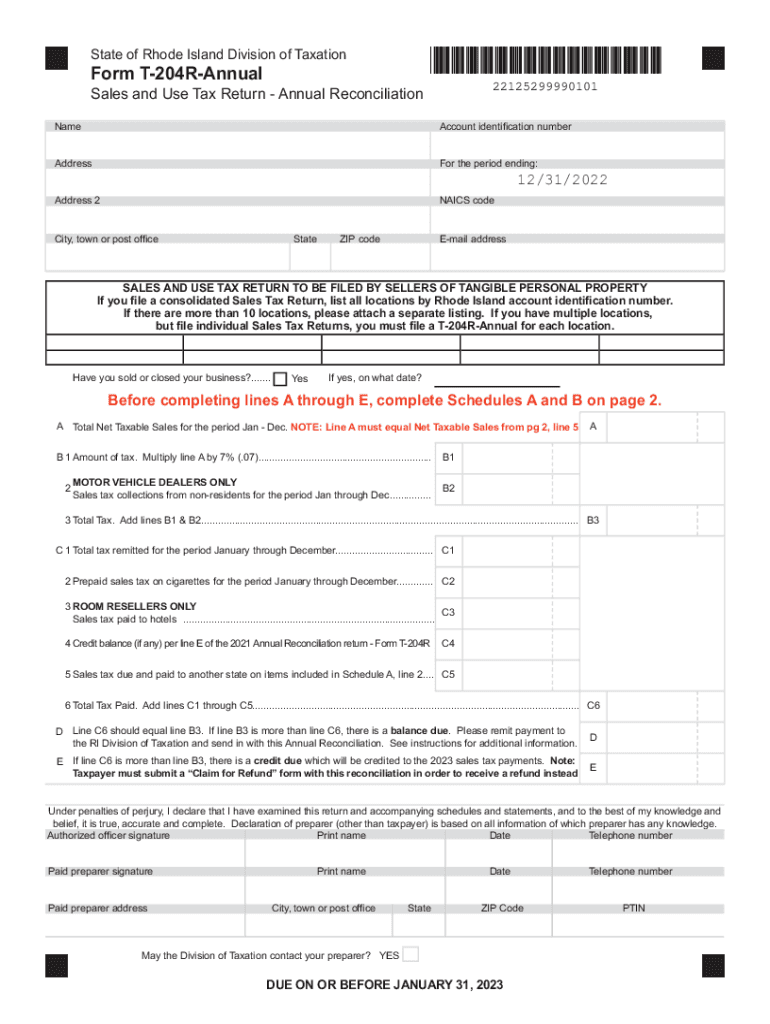

The Rhode Island annual sales tax reconciliation form, known as the T-204R, is essential for businesses to accurately report and reconcile their sales tax liabilities. This form allows taxpayers to summarize their sales tax collected and paid throughout the year, ensuring compliance with state tax regulations. Understanding the key components of the T-204R is crucial for accurate reporting and avoiding penalties.

Steps to Complete the Rhode Island Sales Tax Reconciliation Form

Completing the Rhode Island sales tax reconciliation form involves several important steps:

- Gather all sales records and receipts for the year.

- Calculate total sales and the corresponding sales tax collected.

- Determine any exemptions or deductions applicable to your sales.

- Fill out the T-204R form with accurate figures, including total sales, tax collected, and any adjustments.

- Review the completed form for accuracy before submission.

Filing Deadlines and Important Dates

Timely filing of the Rhode Island sales tax reconciliation form is critical. The T-204R must be submitted by the last day of the month following the end of the tax year. For most businesses, this means the form is due by January thirty-first. Keeping track of these deadlines helps avoid late fees and ensures compliance with state tax laws.

Required Documents for Submission

When preparing to submit the Rhode Island sales tax reconciliation form, certain documents are necessary:

- Sales records, including invoices and receipts.

- Documentation of any tax-exempt sales.

- Previous sales tax returns, if applicable.

- Any correspondence with the Rhode Island Division of Taxation regarding sales tax.

Penalties for Non-Compliance

Failure to file the Rhode Island sales tax reconciliation form on time can result in significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid sales tax liabilities.

- Potential audits by the Rhode Island Division of Taxation.

Digital vs. Paper Version of the Form

Businesses have the option to complete the Rhode Island sales tax reconciliation form digitally or via paper. The digital version offers benefits such as easier data entry, automatic calculations, and secure submission through platforms like signNow. The paper version, while still valid, may require additional time for mailing and processing.

Quick guide on how to complete sales ampamp excise formsri division of taxation rhode island

Effortlessly Prepare Sales & Excise FormsRI Division Of Taxation Rhode Island on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to easily access the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Sales & Excise FormsRI Division Of Taxation Rhode Island on any device with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The Easiest Way to Modify and Electronically Sign Sales & Excise FormsRI Division Of Taxation Rhode Island with Ease

- Locate Sales & Excise FormsRI Division Of Taxation Rhode Island and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight key sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just moments and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of submitting your form, whether by email, text message (SMS), an invite link, or downloading it to your computer.

Eliminate worries about lost or mislaid files, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and electronically sign Sales & Excise FormsRI Division Of Taxation Rhode Island to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Rhode Island annual sales tax reconciliation?

Rhode Island annual sales tax reconciliation is the process of ensuring that the total sales tax collected throughout the year matches what is reported to the state. It involves reviewing transactions and making adjustments as necessary. This process helps businesses comply with state regulations and avoid penalties.

-

How can airSlate SignNow help with Rhode Island annual sales tax reconciliation?

airSlate SignNow streamlines the documentation process needed for Rhode Island annual sales tax reconciliation. With our easy-to-use electronic signature capabilities, you can swiftly send and sign necessary tax documents. This efficiency supports accurate record-keeping and helps you stay compliant with state tax regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs. Our plans are designed to provide cost-effective solutions, whether you are a small business or a larger enterprise. Investing in airSlate SignNow can simplify your Rhode Island annual sales tax reconciliation process at a competitive rate.

-

Are there any features specifically for tax compliance in airSlate SignNow?

Yes, airSlate SignNow includes features that support tax compliance, such as secure document storage and audit trails. These features are valuable for Rhode Island annual sales tax reconciliation, providing a clear record of transactions. Additionally, our platform ensures that all signatures are legally binding, adding credibility to your documents.

-

Can airSlate SignNow integrate with accounting software for better tax management?

Absolutely! airSlate SignNow can integrate seamlessly with popular accounting software, enhancing your overall tax management. This integration is particularly beneficial for conducting a comprehensive Rhode Island annual sales tax reconciliation. With synced data, you can ensure accuracy in tax reporting and filing.

-

What benefits does eSigning provide for sales tax documents?

eSigning offers numerous benefits when dealing with sales tax documents, including increased speed and efficiency in obtaining signatures. For Rhode Island annual sales tax reconciliation, this means reducing the time spent on preparing and sending documents. Furthermore, it minimizes the chance of paperwork getting lost or delayed.

-

Is airSlate SignNow user-friendly for non-technical users?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for both technical and non-technical users. Our intuitive interface ensures that anyone can send, sign, and manage documents necessary for Rhode Island annual sales tax reconciliation with ease. Training and support are also readily available.

Get more for Sales & Excise FormsRI Division Of Taxation Rhode Island

- Property settlement agreement nc form

- North carolina property contract form

- North carolina judgment 497317020 form

- Notice hearing 497317021 form

- Nc divorce judgment form

- Divorce by summary judgment no children north carolina form

- Commercial sublease north carolina form

- Nc residential lease agreement form

Find out other Sales & Excise FormsRI Division Of Taxation Rhode Island

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document