Business Credit Application Montana Form

What is the Business Credit Application Montana

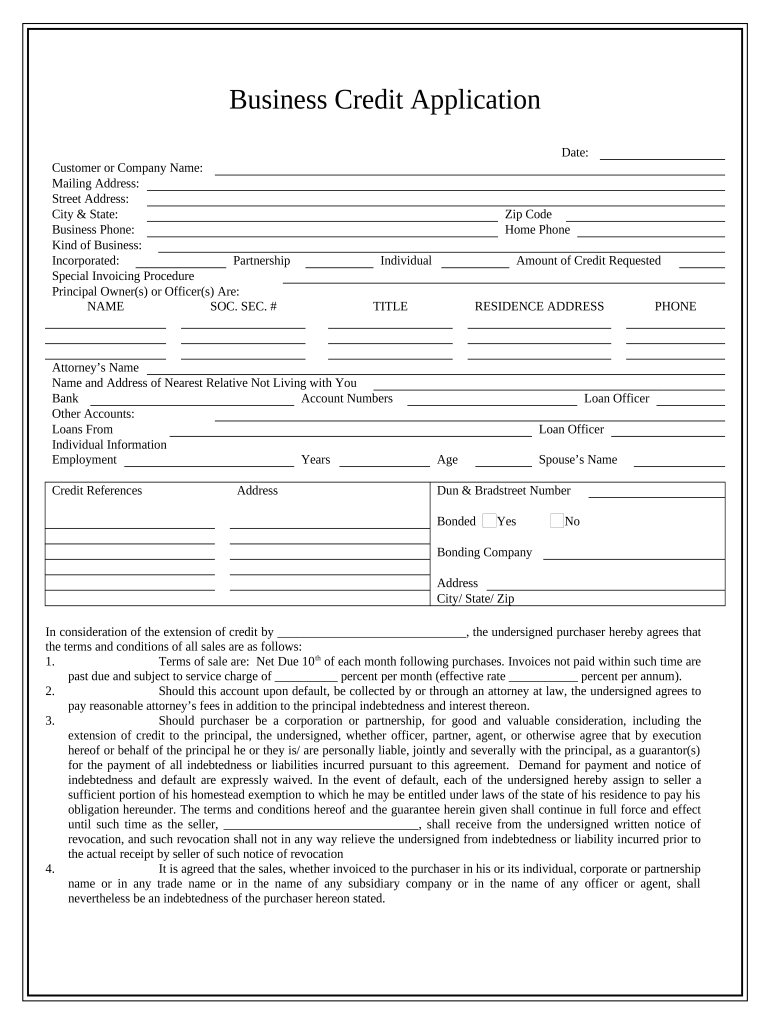

The Business Credit Application Montana is a formal document used by businesses in Montana to request credit from suppliers, lenders, or financial institutions. This application collects essential information about the business, including its legal structure, financial history, and creditworthiness. By providing this information, businesses can establish a credit line that facilitates purchasing goods and services on credit terms. The application is crucial for businesses looking to manage cash flow effectively and build a strong credit profile.

Key Elements of the Business Credit Application Montana

Understanding the key elements of the Business Credit Application Montana is essential for completing it accurately. The application typically includes the following components:

- Business Information: Name, address, and contact details of the business.

- Ownership Details: Information about the owners, including names and percentages of ownership.

- Financial Information: Details regarding annual revenue, net profit, and existing debts.

- Bank References: Information about the business's banking relationships.

- Trade References: Names and contact details of suppliers or creditors who can vouch for the business's creditworthiness.

Steps to Complete the Business Credit Application Montana

Completing the Business Credit Application Montana involves several key steps to ensure accuracy and completeness:

- Gather Required Information: Collect all necessary business and financial information before starting the application.

- Fill Out the Application: Enter the information clearly and accurately, ensuring that all required fields are completed.

- Review the Application: Double-check all entries for accuracy and completeness to avoid delays in processing.

- Submit the Application: Follow the specified submission method, whether online, by mail, or in person.

Legal Use of the Business Credit Application Montana

The legal use of the Business Credit Application Montana is governed by various laws and regulations that ensure the protection of both the applicant and the lender. It is important to understand that:

- The application must be filled out truthfully to avoid legal repercussions.

- Electronic submissions are legally binding if they comply with the ESIGN Act and UETA.

- Maintaining confidentiality of sensitive information is crucial, as it is protected under privacy laws.

Eligibility Criteria

Eligibility criteria for the Business Credit Application Montana typically include:

- The business must be registered and operating in Montana.

- Applicants may need to provide personal guarantees from business owners, depending on the lender's requirements.

- Businesses should have a minimum credit score or financial history to qualify for credit.

Form Submission Methods

The Business Credit Application Montana can be submitted through various methods, depending on the lender's preferences:

- Online Submission: Many lenders allow businesses to complete and submit the application electronically.

- Mail Submission: Applicants can print the completed form and send it via postal service.

- In-Person Submission: Some businesses may choose to deliver the application directly to the lender's office.

Quick guide on how to complete business credit application montana

Effortlessly Prepare Business Credit Application Montana on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Business Credit Application Montana on any device using airSlate SignNow applications for Android or iOS and enhance any document-focused operation today.

The Easiest Way to Modify and eSign Business Credit Application Montana with Minimal Effort

- Obtain Business Credit Application Montana and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive details using tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Business Credit Application Montana to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application Montana?

A Business Credit Application Montana is a document that businesses in Montana use to apply for credit from suppliers or lenders. It typically requires information about the business's financial history, ownership structure, and credit needs. Using airSlate SignNow, completing and signing this application becomes seamless and efficient.

-

How does airSlate SignNow facilitate the Business Credit Application Montana process?

airSlate SignNow simplifies the Business Credit Application Montana process by providing a user-friendly platform to create, send, and eSign documents. Users can easily integrate their applications into existing workflows, ensuring quick turnaround times and enhanced collaboration. This leads to faster credit approvals and better business opportunities.

-

What are the pricing options for using airSlate SignNow with the Business Credit Application Montana?

airSlate SignNow offers several pricing plans tailored to different business needs, including a free trial for first-time users. You can choose a plan that best fits your company's size and document usage frequency, especially when utilizing the Business Credit Application Montana. This cost-effective solution ensures you only pay for what you need.

-

Can I customize the Business Credit Application Montana template in airSlate SignNow?

Yes, airSlate SignNow allows users to customize their Business Credit Application Montana templates to meet specific requirements. You can add your branding, modify sections, and include fields relevant to your organization. This flexibility helps create a professional and personalized application experience for your clients.

-

What security features does airSlate SignNow offer for the Business Credit Application Montana?

airSlate SignNow prioritizes security with advanced features like encryption, secure cloud storage, and compliance with regulations such as GDPR. When utilizing the Business Credit Application Montana, your sensitive business information is protected, ensuring peace of mind for you and your clients alike. You can trust that your data remains confidential and secure.

-

Is airSlate SignNow compatible with other software for the Business Credit Application Montana?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow for the Business Credit Application Montana. Whether you use CRM systems, accounting software, or other tools, these integrations facilitate efficient data transfer and management, streamlining your application process.

-

What are the benefits of using airSlate SignNow for my Business Credit Application Montana?

Using airSlate SignNow for your Business Credit Application Montana offers numerous advantages, such as increased efficiency, reduced turnaround time, and improved organization. The eSigning feature allows signers to complete documents from anywhere, ensuring timely submissions. Additionally, the platform's automation capabilities save time, helping your business grow.

Get more for Business Credit Application Montana

- Cohen mansfield agitation inventory cmai long form wanderingnetwork co

- Nj mbe application form

- Hdfc mutual fund common application form editable

- Dr 0137b claim for refund of tax paid to vendors colorado gov colorado form

- Izjava o dodjeli ovlasti knjigovodstvenom servisu za rad otpbanka form

- Sch3u form

- Clean indoor air act exception renewal sales information form exception expiration date form must be received by exception type

- Medication log 55 pa code 3270133 3280133 3290133 form

Find out other Business Credit Application Montana

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile