New Mexico Net Operating Loss Carryforward Schedule for Corporate Income Tax Form

Understanding the New Mexico Net Operating Loss Carryforward Schedule for Corporate Income Tax

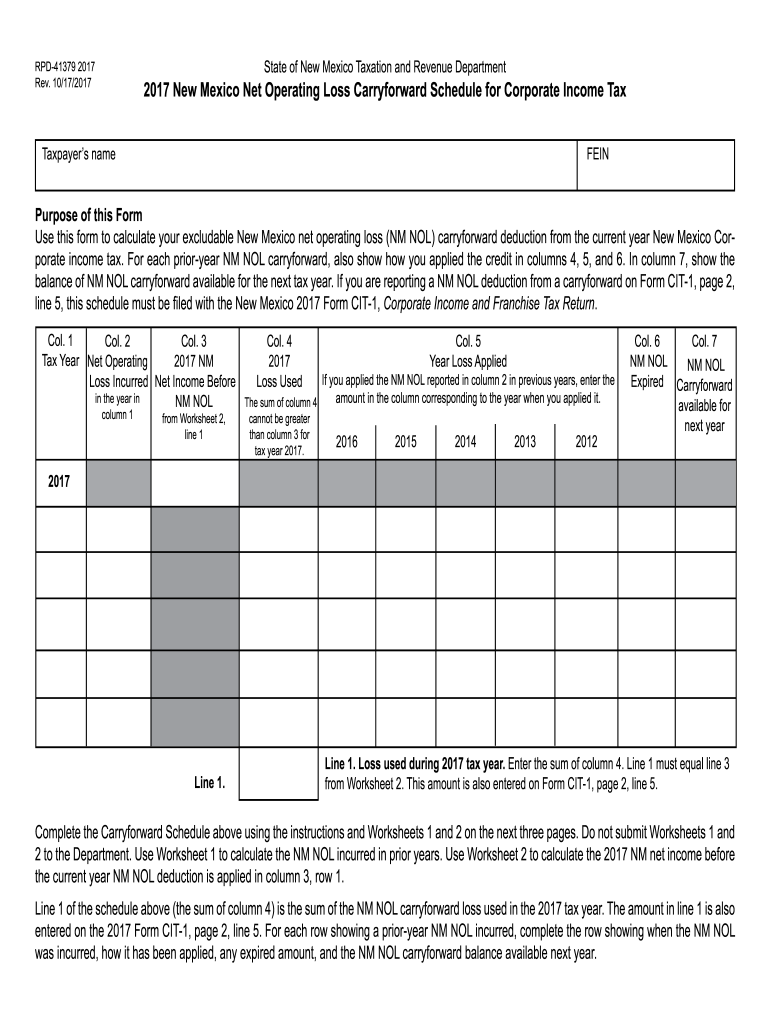

The New Mexico Net Operating Loss Carryforward Schedule is a crucial document for businesses that have incurred net operating losses. This schedule allows corporations to apply their losses to future taxable income, potentially reducing their tax liability. By utilizing this schedule, businesses can carry forward losses for up to 20 years, which can significantly impact their overall financial health and tax strategy.

Steps to Complete the New Mexico Net Operating Loss Carryforward Schedule for Corporate Income Tax

Completing the New Mexico Net Operating Loss Carryforward Schedule involves several key steps:

- Gather relevant financial documents, including prior year tax returns and income statements.

- Calculate the total net operating loss for the current tax year.

- Fill out the schedule by entering the calculated loss in the appropriate sections.

- Ensure that all supporting documentation is attached to substantiate the reported losses.

- Review the completed schedule for accuracy before submission.

Eligibility Criteria for the New Mexico Net Operating Loss Carryforward Schedule

To qualify for the New Mexico Net Operating Loss Carryforward Schedule, businesses must meet specific eligibility criteria:

- The business must be a corporation operating in New Mexico.

- Net operating losses must be calculated according to New Mexico tax laws.

- The losses must be carried forward from a tax year in which the business was subject to taxation.

Legal Use of the New Mexico Net Operating Loss Carryforward Schedule for Corporate Income Tax

The legal use of the New Mexico Net Operating Loss Carryforward Schedule is governed by state tax regulations. Proper completion and submission of this schedule ensure compliance with tax laws, allowing businesses to benefit from loss carryforwards. Failure to adhere to legal requirements may result in penalties or disallowance of the loss carryforward.

Filing Deadlines for the New Mexico Net Operating Loss Carryforward Schedule

Timely filing of the New Mexico Net Operating Loss Carryforward Schedule is essential. The schedule must be submitted along with the corporate income tax return by the due date, which is typically the 15th day of the fourth month following the close of the tax year. Extensions may be available, but it is crucial to check the specific guidelines to avoid penalties.

Examples of Using the New Mexico Net Operating Loss Carryforward Schedule for Corporate Income Tax

Businesses can benefit from the New Mexico Net Operating Loss Carryforward Schedule in various scenarios. For instance, a corporation that experiences a significant loss in one year can apply that loss against future profits, reducing taxable income. This strategy can be especially beneficial for startups or companies in cyclical industries that may face fluctuations in income.

Quick guide on how to complete 2017 new mexico net operating loss carryforward schedule for corporate income tax

Prepare New Mexico Net Operating Loss Carryforward Schedule For Corporate Income Tax effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without interruptions. Manage New Mexico Net Operating Loss Carryforward Schedule For Corporate Income Tax on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign New Mexico Net Operating Loss Carryforward Schedule For Corporate Income Tax without hassle

- Locate New Mexico Net Operating Loss Carryforward Schedule For Corporate Income Tax and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Alter and eSign New Mexico Net Operating Loss Carryforward Schedule For Corporate Income Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is net operating income and why is it important for businesses?

Net operating income (NOI) is a key financial metric that reflects the profitability of an income-producing property. It accounts for all revenues generated from operations minus operating expenses. Understanding NOI is crucial for businesses as it helps in assessing financial performance and making informed investment decisions.

-

How does airSlate SignNow help in calculating net operating income?

AirSlate SignNow streamlines document management processes, allowing users to quickly gather and organize data necessary for calculating net operating income. With our easy-to-use eSignature solution, you can ensure that all necessary contracts and agreements are processed efficiently, aiding in accurate financial reporting and assessments.

-

What features does airSlate SignNow offer that relate to financial documentation?

AirSlate SignNow offers features like document templates, automated workflows, and an easy-to-use editor for creating financial reports and agreements. These tools enable users to manage documentation related to net operating income effectively, ensuring accuracy and compliance in financial statements.

-

How can airSlate SignNow support my team in managing net operating income effectively?

By providing an intuitive platform for eSigning and document management, airSlate SignNow enables teams to collaborate seamlessly on financial documents. This enhances transparency in financial operations, which is essential for effectively tracking net operating income and making strategic decisions.

-

What are the pricing plans available for airSlate SignNow, and do they cater to financial professionals?

AirSlate SignNow offers cost-effective pricing plans suitable for businesses of all sizes, including specialized solutions for financial professionals. Each plan provides essential features for managing documents and workflows that relate to net operating income, enabling users to choose one that best fits their needs and budget.

-

Can airSlate SignNow integrate with other financial software to enhance net operating income analysis?

Yes, airSlate SignNow integrates with various financial software tools, allowing users to streamline their data management processes. These integrations help in collecting and analyzing information needed for computing net operating income, enhancing overall financial efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for real estate professionals focused on net operating income?

For real estate professionals, airSlate SignNow simplifies the management of rental agreements and financial contracts. By facilitating seamless eSigning and document tracking, users can efficiently monitor expenses and revenue streams, which are vital for calculating net operating income.

Get more for New Mexico Net Operating Loss Carryforward Schedule For Corporate Income Tax

- Complex will with credit shelter marital trust for large estates north carolina form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts where 497317113 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497317114 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately 497317115 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497317116 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective 497317117 form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497317118 form

- Nc do 2 form

Find out other New Mexico Net Operating Loss Carryforward Schedule For Corporate Income Tax

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast