Massachusetts Department of Revenue Form M 1310 StatementMassachusetts Department of Revenue Form M 1310 StatementWhat is IRS Fo

Understanding the Alabama Form 1310A

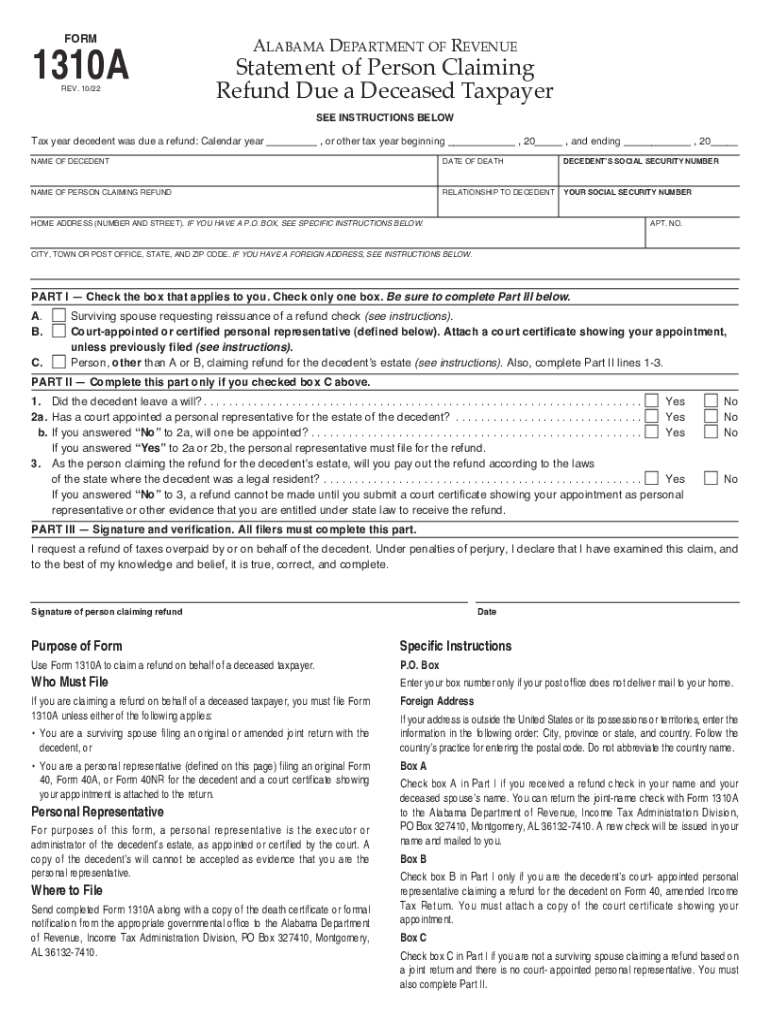

The Alabama Form 1310A is a crucial document used for claiming a refund on behalf of a deceased taxpayer. This form is specifically designed for individuals who need to file a claim for a refund that is due to a deceased person. It serves as a formal request to the Alabama Department of Revenue to process the refund and is essential for ensuring that the rightful beneficiaries receive any funds owed. Understanding the purpose and requirements of this form is vital for anyone involved in managing the estate of a deceased taxpayer.

Steps to Complete the Alabama Form 1310A

Completing the Alabama Form 1310A requires careful attention to detail. Here are the main steps to ensure accuracy:

- Gather necessary information about the deceased taxpayer, including their Social Security number and tax details.

- Fill out the form with the required personal information of the claimant, including name, address, and relationship to the deceased.

- Provide the reason for the claim and any supporting documentation, such as a death certificate.

- Review the form for completeness and accuracy before submission.

Required Documents for Filing Form 1310A

When submitting the Alabama Form 1310A, certain documents must accompany the form to validate the claim. These typically include:

- A copy of the death certificate to confirm the taxpayer's passing.

- Proof of the claimant's identity and relationship to the deceased, such as a marriage certificate or birth certificate.

- Any previous tax returns that may support the claim for a refund.

Legal Considerations for the Alabama Form 1310A

The Alabama Form 1310A must be completed in accordance with state laws governing tax refunds for deceased individuals. It is essential to ensure compliance with all legal requirements to avoid delays or rejections of the claim. The form must be signed by the claimant, who is typically the executor or administrator of the deceased's estate. Understanding the legal implications of the form helps protect the rights of both the claimant and the beneficiaries.

Filing Methods for the Alabama Form 1310A

There are several methods available for submitting the Alabama Form 1310A. Claimants can choose to file the form:

- Online through the Alabama Department of Revenue's official website, if electronic filing is supported.

- By mail, sending the completed form and required documents to the appropriate address.

- In person at a local Department of Revenue office, where assistance may be available.

Common Scenarios for Using the Alabama Form 1310A

The Alabama Form 1310A is often used in various scenarios, such as:

- When a taxpayer passes away before receiving a refund from their last filed tax return.

- When the estate of the deceased needs to reclaim taxes paid in excess.

- When beneficiaries are seeking to settle the financial affairs of the deceased.

Quick guide on how to complete massachusetts department of revenue form m 1310 statementmassachusetts department of revenue form m 1310 statementwhat is irs

Effortlessly Prepare Massachusetts Department Of Revenue Form M 1310 StatementMassachusetts Department Of Revenue Form M 1310 StatementWhat Is IRS Fo on Any Device

Online document management has become increasingly prevalent among companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Massachusetts Department Of Revenue Form M 1310 StatementMassachusetts Department Of Revenue Form M 1310 StatementWhat Is IRS Fo from any device with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The simplest way to edit and eSign Massachusetts Department Of Revenue Form M 1310 StatementMassachusetts Department Of Revenue Form M 1310 StatementWhat Is IRS Fo with ease

- Find Massachusetts Department Of Revenue Form M 1310 StatementMassachusetts Department Of Revenue Form M 1310 StatementWhat Is IRS Fo and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all information and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Massachusetts Department Of Revenue Form M 1310 StatementMassachusetts Department Of Revenue Form M 1310 StatementWhat Is IRS Fo and facilitate excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Alabama 1310a and how can it benefit my business?

Alabama 1310a is an essential tool for businesses looking to streamline their document signing process. By utilizing airSlate SignNow's features, you can easily send, eSign, and manage documents, resulting in increased efficiency and reduced turnaround times.

-

How much does it cost to use Alabama 1310a?

The pricing for Alabama 1310a through airSlate SignNow is competitive and tailored to suit the needs of businesses of all sizes. With various pricing plans available, companies can select the one that fits their budget while benefiting from an easy-to-use eSigning solution.

-

What features does Alabama 1310a offer?

Alabama 1310a includes a variety of features such as mobile access, real-time tracking, customizable templates, and secure storage. These features ensure that you can manage your eSigning workflow efficiently and safely.

-

Is Alabama 1310a secure for signing sensitive documents?

Yes, Alabama 1310a prioritizes security with advanced encryption methods and compliance with industry standards. This ensures that your sensitive documents are protected throughout the eSigning process, giving you peace of mind.

-

Can Alabama 1310a integrate with other software I use?

Absolutely! Alabama 1310a seamlessly integrates with various applications and platforms, enhancing your existing workflows. You can connect it to CRM systems, cloud storage, and more to maximize productivity.

-

How does Alabama 1310a improve document turnaround time?

By using Alabama 1310a, businesses can signNowly reduce document turnaround time through automated reminders and quick access to eSigning functionality. This results in faster processes and improved customer satisfaction.

-

Is training available for users of Alabama 1310a?

Yes, airSlate SignNow offers comprehensive training and support for new users of Alabama 1310a. Our resources ensure that you and your team can maximize the benefits of the platform efficiently.

Get more for Massachusetts Department Of Revenue Form M 1310 StatementMassachusetts Department Of Revenue Form M 1310 StatementWhat Is IRS Fo

Find out other Massachusetts Department Of Revenue Form M 1310 StatementMassachusetts Department Of Revenue Form M 1310 StatementWhat Is IRS Fo

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement