Exemption Taxes Form

What is the Exemption Taxes

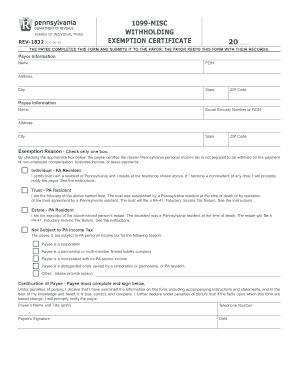

The exemption taxes in Pennsylvania refer to specific tax provisions that allow certain individuals or entities to reduce or eliminate their tax liability under specific circumstances. These exemptions can apply to various tax types, including income taxes and withholding taxes, and are designed to provide financial relief to eligible taxpayers. Understanding these exemptions is crucial for individuals and businesses to ensure compliance and optimize their tax obligations.

How to use the Exemption Taxes

Using exemption taxes involves identifying the specific exemptions for which you qualify and applying them correctly on your tax forms. For Pennsylvania withholding taxes, taxpayers must complete the appropriate forms, such as the REV-1832, to claim their exemptions. This process typically requires providing detailed information about your income, tax status, and any applicable deductions. Ensuring accurate completion of these forms is essential to avoid delays or penalties.

Steps to complete the Exemption Taxes

Completing the exemption taxes in Pennsylvania involves several key steps:

- Determine your eligibility for specific exemptions based on your income level, employment status, and other criteria.

- Gather necessary documentation, including income statements and previous tax returns, to support your exemption claim.

- Fill out the required forms, such as the withholding form Pennsylvania, ensuring all information is accurate and complete.

- Submit the completed forms to the appropriate tax authority, either online or via mail, before the specified deadlines.

Legal use of the Exemption Taxes

The legal use of exemption taxes is governed by Pennsylvania state tax laws and regulations. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Pennsylvania Department of Revenue. This includes understanding which exemptions are applicable, maintaining accurate records, and filing the necessary forms correctly. Failure to comply with these regulations can result in penalties or disqualification from claiming exemptions.

Filing Deadlines / Important Dates

Filing deadlines for Pennsylvania withholding taxes and exemption forms are crucial for maintaining compliance. Typically, taxpayers must submit their forms by April 15 for individual tax returns. However, specific deadlines may vary based on the type of exemption claimed or changes in tax regulations. It is important to stay informed about these dates to avoid late fees or penalties.

Required Documents

To successfully claim exemption taxes in Pennsylvania, certain documents are required. These may include:

- Completed exemption forms, such as the REV-1832.

- Proof of income, such as W-2 forms or pay stubs.

- Previous tax returns to verify your tax status.

- Any additional documentation that supports your eligibility for the claimed exemptions.

Penalties for Non-Compliance

Non-compliance with Pennsylvania's exemption tax regulations can lead to significant penalties. Taxpayers who fail to file their exemption forms on time or provide inaccurate information may face fines, interest on unpaid taxes, or even legal action. It is essential to understand these potential consequences and ensure that all tax filings are completed accurately and punctually to avoid such issues.

Quick guide on how to complete exemption taxes

Easily prepare Exemption Taxes on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required for you to create, update, and eSign your documents quickly and without interruptions. Manage Exemption Taxes on any platform using airSlate SignNow apps for Android or iOS, and streamline any document-related task today.

The simplest way to modify and eSign Exemption Taxes effortlessly

- Obtain Exemption Taxes and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or mask sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred delivery method for your form, either via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Exemption Taxes and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Pennsylvania withholding taxes?

Pennsylvania withholding taxes are the state income taxes that employers withhold from employees' wages and remit to the state. This ensures that employees are paying their state taxes gradually throughout the year. Understanding these taxes is crucial for businesses operating in Pennsylvania to remain compliant.

-

How does airSlate SignNow help with Pennsylvania withholding taxes?

airSlate SignNow streamlines the documentation process related to Pennsylvania withholding taxes. By allowing businesses to send and sign necessary forms electronically, it helps ensure that all required tax documents are completed and submitted on time, reducing compliance risks.

-

What features does airSlate SignNow offer for managing Pennsylvania withholding taxes?

AirSlate SignNow offers features such as customizable templates, automated workflows, and secure document storage that are essential for managing Pennsylvania withholding taxes efficiently. These tools simplify the document management process, helping businesses focus on their core operations while ensuring tax compliance.

-

Is airSlate SignNow cost-effective for businesses handling Pennsylvania withholding taxes?

Yes, airSlate SignNow is a cost-effective solution for businesses managing Pennsylvania withholding taxes. With its competitive pricing structure, companies can save time and money through streamlined processes while ensuring they meet their tax obligations affordably.

-

Can I integrate airSlate SignNow with my payroll system for Pennsylvania withholding taxes?

Absolutely! airSlate SignNow easily integrates with popular payroll systems, which simplifies your ability to manage Pennsylvania withholding taxes. This integration ensures that all your tax-related documents are seamlessly created and processed within your existing payroll framework.

-

How secure are the documents related to Pennsylvania withholding taxes with airSlate SignNow?

Security is a top priority for airSlate SignNow, especially for sensitive documents related to Pennsylvania withholding taxes. With advanced encryption and compliance with industry standards, businesses can trust that their tax documents are protected throughout the signing and storage process.

-

What benefits can I expect from using airSlate SignNow for Pennsylvania withholding taxes?

Using airSlate SignNow for Pennsylvania withholding taxes offers numerous benefits, including reduced paperwork, faster processing times, and enhanced compliance. By automating document management, businesses can minimize errors and ensure that tax responsibilities are met efficiently.

Get more for Exemption Taxes

- Petition third party form

- Order on motion for extension permanency order georgia form

- Order of adjudication and disposition permanency order georgia form

- Ga juvenile court form

- Status hearing form

- Name change instructions and forms package for a family georgia

- Georgia filing information

- Ga acknowledgment form

Find out other Exemption Taxes

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy