4669 Form 2022-2026

What is the 4669 Form

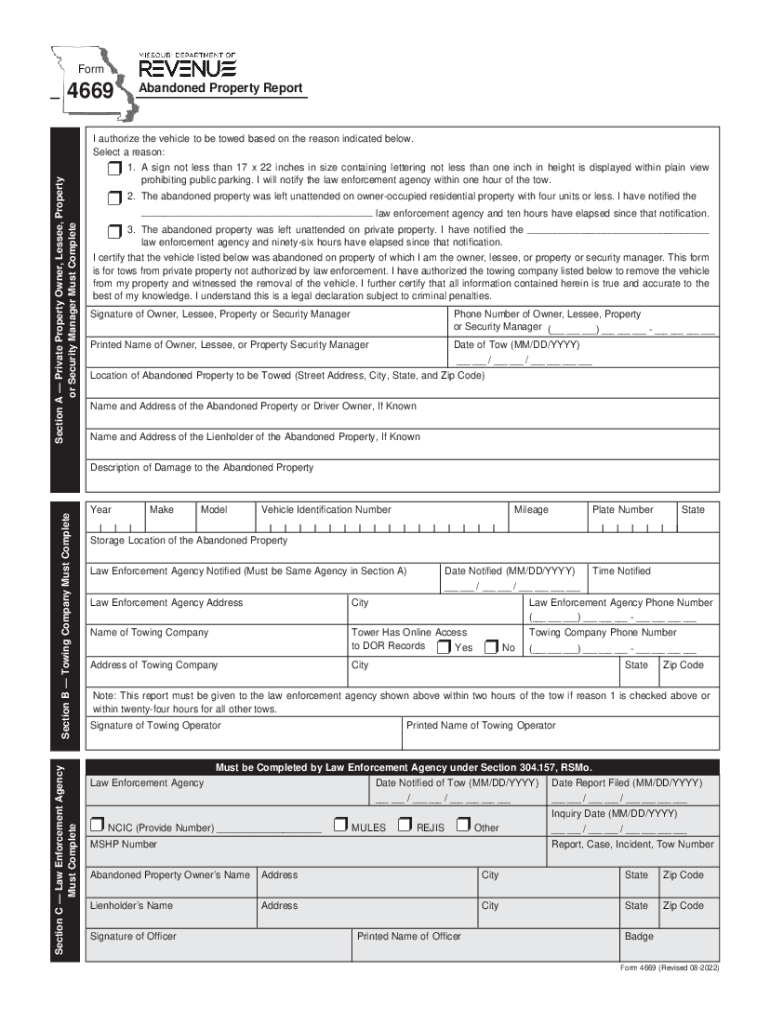

The 4669 form, also known as the Missouri Abandoned Property Report, is a document used to report unclaimed property to the Missouri Department of Revenue. This form is essential for businesses and organizations that hold property, such as bank accounts, insurance policies, or uncashed checks, that has remained inactive for a specified period. Completing the 4669 form accurately ensures compliance with state regulations regarding unclaimed property.

How to use the 4669 Form

Using the 4669 form involves several key steps. First, gather all relevant information about the unclaimed property, including the owner's name, last known address, and the type of property. Next, fill out the form with accurate details, ensuring that all required fields are completed. After completing the form, submit it to the Missouri Department of Revenue by the specified deadline to avoid penalties. It's important to keep a copy of the submitted form for your records.

Steps to complete the 4669 Form

Completing the 4669 form requires careful attention to detail. Follow these steps:

- Gather necessary information about the unclaimed property.

- Download the 4669 form from the Missouri Department of Revenue website.

- Fill in the form with accurate details, including property type and owner information.

- Review the form for any errors or omissions.

- Submit the completed form by mail or electronically, as per the guidelines.

Legal use of the 4669 Form

The 4669 form serves a legal purpose by facilitating the reporting of unclaimed property to the state. When properly completed and submitted, it helps protect businesses from potential legal issues related to unclaimed assets. Compliance with state laws is crucial, as failure to report or incorrectly reporting unclaimed property can result in penalties or fines.

Key elements of the 4669 Form

Several key elements are essential when completing the 4669 form. These include:

- Owner Information: Full name and last known address of the property owner.

- Property Details: Type of property, such as cash, checks, or securities.

- Reporting Period: The time frame during which the property has been inactive.

- Holder Information: Name and contact details of the business or organization holding the property.

Filing Deadlines / Important Dates

Filing deadlines for the 4669 form are crucial to ensure compliance. The Missouri Department of Revenue typically requires that the form be submitted by November 1st of each year. It is important to stay informed about any changes in deadlines or requirements to avoid penalties for late submissions.

Quick guide on how to complete 4669 form

Complete 4669 Form effortlessly on any device

Web-based document management has gained traction among enterprises and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, since you can easily locate the appropriate form and safely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without any holdups. Manage 4669 Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign 4669 Form without hassle

- Find 4669 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form—via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate the printing of new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign 4669 Form and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4669 form

Create this form in 5 minutes!

People also ask

-

What is the 4669 form and how can I use it with airSlate SignNow?

The 4669 form is an important document that can be easily managed using airSlate SignNow. By utilizing our platform, you can quickly eSign and send the 4669 form, streamlining your workflow and ensuring compliance. With our user-friendly interface, you'll find it easy to complete and manage this form.

-

What features does airSlate SignNow offer for managing the 4669 form?

airSlate SignNow offers several features to enhance the management of the 4669 form, including customizable templates, automatic reminders, and secure cloud storage. These features ensure that you can create, send, and sign the 4669 form efficiently. The platform also provides real-time tracking so you can monitor the signing process.

-

Is there a pricing plan for using airSlate SignNow with the 4669 form?

Yes, airSlate SignNow offers flexible pricing plans tailored to suit different business needs, including those utilizing the 4669 form. You can choose from various tiers, ensuring you only pay for the features you require. Additionally, we provide a free trial, allowing you to explore how the 4669 form integrates into your workflow without any initial investment.

-

Can I integrate airSlate SignNow with other applications for the 4669 form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, facilitating the use of the 4669 form across platforms. This means you can sync data from CRM systems, cloud storage, and more, enhancing your overall document management process. Our integration capabilities help you streamline tasks and improve efficiency.

-

What are the benefits of using airSlate SignNow for the 4669 form?

Using airSlate SignNow for the 4669 form provides numerous benefits such as increased efficiency, reduced paperwork, and improved compliance. The platform allows you to sign documents electronically, minimizing delays and errors typically associated with manual processes. Moreover, you gain access to analytics and tracking to optimize your document workflows.

-

Is it safe to send the 4669 form with airSlate SignNow?

Yes, sending the 4669 form with airSlate SignNow is safe and secure. Our platform uses advanced encryption and complies with industry standards to protect your data. You can confidently manage sensitive information knowing that airSlate SignNow prioritizes security and confidentiality.

-

What support does airSlate SignNow provide for users of the 4669 form?

airSlate SignNow offers comprehensive support for all users, including those handling the 4669 form. Our customer service team is available to assist with any questions or issues you may encounter. Additionally, we provide extensive online resources, tutorials, and documentation to help you maximize your experience with the platform.

Get more for 4669 Form

- Unconditional waiver and release of lien upon final payment nebraska 497318046 form

- Assignment of lien individual nebraska form

- Quitclaim deed from husband and wife to llc nebraska form

- Warranty deed from husband and wife to llc nebraska form

- Assignment of lien corporation or llc nebraska form

- Nebraska notice form

- Letter from landlord to tenant as notice to remove wild animals in premises nebraska form

- Ne landlord tenant form

Find out other 4669 Form

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed