Information About Your Notice, Penalty and Interest IRS Tax Forms

Understanding IRS Penalty Interest

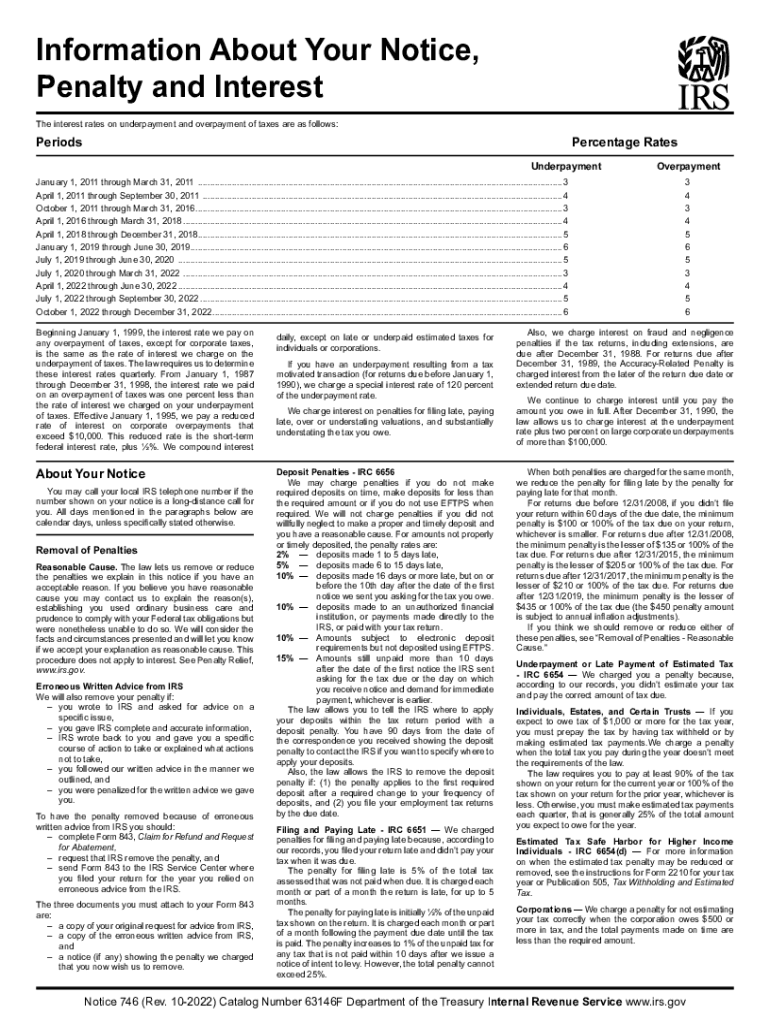

The IRS imposes penalty interest on unpaid taxes, which can accumulate quickly. This interest is calculated based on the federal short-term rate plus three percentage points. For the 2022 IRS penalty interest, the rate was set at six percent, reflecting the IRS's commitment to ensure timely tax payments. Taxpayers should be aware that the interest compounds daily, meaning the longer one waits to pay their tax obligations, the more the penalty interest will grow.

Steps to Complete the IRS Penalty Form

Completing the IRS penalty form requires careful attention to detail. Here are the steps to follow:

- Gather relevant documents, including your tax return and any notices received from the IRS.

- Fill out the form accurately, ensuring all information matches your records.

- Calculate the total amount owed, including any penalty interest that has accrued.

- Review the form for errors before submission.

- Submit the form to the appropriate IRS address or electronically, depending on the form type.

Legal Use of IRS Penalty Interest Information

Understanding the legal implications of IRS penalty interest is crucial for taxpayers. This information is not only essential for compliance but also for making informed decisions regarding tax payments. Taxpayers can use this knowledge to negotiate payment plans or seek relief options if they are unable to pay their taxes in full. It is advisable to consult a tax professional for guidance on how to navigate these legal aspects effectively.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is vital to avoid additional penalty interest. The IRS typically sets specific dates for tax filings, including extensions. For individual taxpayers, the standard deadline is April 15, while businesses may have different deadlines based on their structure. It is important to mark these dates on your calendar and ensure all forms are submitted on time to prevent incurring further penalties.

Penalties for Non-Compliance

Failure to comply with IRS regulations can result in significant penalties, including increased interest rates on unpaid taxes. Non-compliance may also lead to additional fines and legal action from the IRS. Understanding these penalties can motivate taxpayers to meet their obligations promptly. It is essential to address any notices received from the IRS, such as the IRS Notice 746, which outlines the penalties incurred and the steps to resolve them.

Examples of IRS Penalty Interest Scenarios

Several scenarios can illustrate how IRS penalty interest applies. For instance, if a taxpayer owes one thousand dollars and fails to pay by the due date, they will start accruing penalty interest immediately. If they delay payment for six months, the accumulated interest could add a significant amount to their total debt. Another example includes self-employed individuals who may face higher penalties due to estimated tax payment discrepancies. Understanding these scenarios can help taxpayers anticipate potential costs and plan accordingly.

Quick guide on how to complete information about your notice penalty and interest irs tax forms

Effortlessly Prepare Information About Your Notice, Penalty And Interest IRS Tax Forms on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents quickly and without delays. Manage Information About Your Notice, Penalty And Interest IRS Tax Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to Modify and eSign Information About Your Notice, Penalty And Interest IRS Tax Forms with Ease

- Obtain Information About Your Notice, Penalty And Interest IRS Tax Forms and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Information About Your Notice, Penalty And Interest IRS Tax Forms and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is IRS penalty interest and how does it affect my tax situation?

IRS penalty interest refers to the additional charges incurred when a taxpayer fails to pay their taxes on time. This interest accrues daily on any unpaid tax balance, increasing the total amount owed to the IRS. Understanding how IRS penalty interest works can help you stay compliant and reduce potential costs.

-

How can airSlate SignNow help me manage documents related to IRS penalty interest?

With airSlate SignNow, you can easily send and eSign documents related to IRS penalty interest, such as payment plans or correspondence with the IRS. Our platform streamlines the document management process, ensuring that all important forms are delivered efficiently and securely. This can help reduce the stress associated with managing IRS penalty interest documentation.

-

Are there any features in airSlate SignNow that assist in calculating IRS penalty interest?

While airSlate SignNow primarily focuses on electronic signatures and document management, it integrates with various accounting and tax software that can help you calculate IRS penalty interest. By connecting these solutions, you can effectively manage your finances and ensure accurate calculations regarding any penalties incurred. This integration provides a seamless experience in addressing IRS penalty interest.

-

What are the pricing options for airSlate SignNow when dealing with IRS-related documents?

airSlate SignNow offers a variety of pricing plans tailored to meet your business needs, even when dealing with IRS-related documents. The cost-effective solutions enable you to efficiently manage your document signing process without breaking the bank. You can choose a plan that fits your budget while ensuring all IRS paperwork is handled promptly.

-

Can I use airSlate SignNow to dispute IRS penalty interest charges?

Yes, you can use airSlate SignNow to create and send documents needed to dispute IRS penalty interest charges. Our platform simplifies the process of preparing and signing necessary forms, enhancing your ability to communicate effectively with the IRS. Quick and organized document management can signNowly help in addressing any disputes over penalty charges.

-

Is airSlate SignNow secure for handling sensitive IRS documents?

Absolutely! airSlate SignNow employs state-of-the-art security measures to ensure that your sensitive IRS documents are protected. This includes encryption, secure data storage, and compliance with regulatory standards, allowing you to manage documents related to IRS penalty interest with complete peace of mind.

-

What benefits does airSlate SignNow provide for small businesses facing IRS penalty interest?

For small businesses dealing with IRS penalty interest, airSlate SignNow offers numerous benefits, such as cost-effective document management and seamless eSigning capabilities. By streamlining the process of sending and signing IRS documents, small businesses can save time and reduce errors, thereby minimizing any potential penalties or interest.

Get more for Information About Your Notice, Penalty And Interest IRS Tax Forms

- 7 day notice to pay rent or lease terminates nonresidential or commercial new hampshire form

- New hampshire lease 497318682 form

- New hampshire termination form

- 30 day notice to terminate lease for other than nonpayment of rent residential new hampshire form

- 7 day notice to pay rent or lease terminates residential new hampshire form

- Nh 7 day form

- 7 day notice 497318687 form

- New hampshire notice form

Find out other Information About Your Notice, Penalty And Interest IRS Tax Forms

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure