Illinois Form IL 941 X Amended Illinois Withholding Income Tax

What is the Illinois Form IL 941 X Amended Illinois Withholding Income Tax

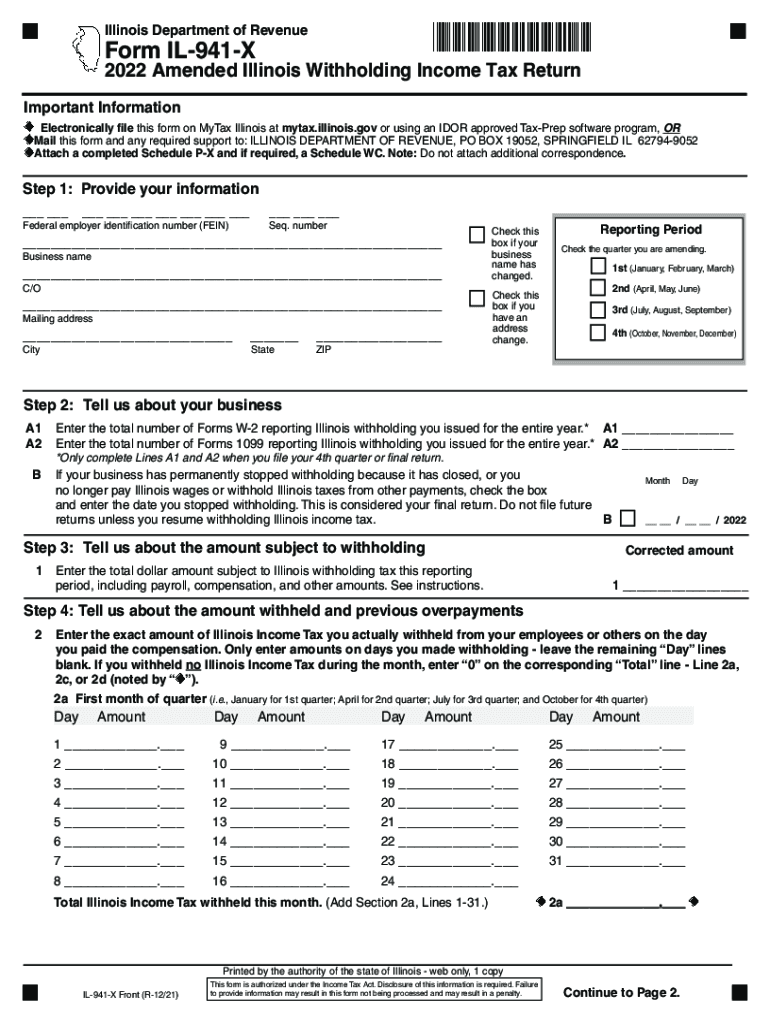

The Illinois Form IL 941 X is an amended version of the standard IL 941 form, which is used for reporting Illinois withholding income tax. This form allows employers to correct errors made on previously submitted IL 941 forms. It is essential for ensuring that the withholding amounts reported to the state are accurate, reflecting any adjustments needed for employee wages or tax withholdings. By using this form, employers can maintain compliance with state tax regulations and avoid potential penalties.

Steps to complete the Illinois Form IL 941 X Amended Illinois Withholding Income Tax

Completing the Illinois Form IL 941 X involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the original IL 941 forms and any supporting documentation that outlines the errors. Next, fill out the IL 941 X by indicating the specific corrections needed. Be sure to provide the correct amounts and explanations for the changes. After completing the form, review it thoroughly for any mistakes before submission. Finally, submit the amended form to the Illinois Department of Revenue either electronically or by mail, depending on your preference.

Legal use of the Illinois Form IL 941 X Amended Illinois Withholding Income Tax

The legal use of the Illinois Form IL 941 X is governed by state tax laws, which require employers to accurately report withholding tax amounts. This form serves as a legal document that can be used to rectify any discrepancies in previous filings. It is important to ensure that the corrections made on the IL 941 X are supported by valid documentation to avoid potential disputes with the Illinois Department of Revenue. Compliance with these legal requirements helps protect employers from penalties and ensures that employees' tax records are accurate.

Filing Deadlines / Important Dates

Filing deadlines for the Illinois Form IL 941 X are critical to avoid late penalties. Generally, amended returns should be filed as soon as an error is discovered. The Illinois Department of Revenue recommends submitting the IL 941 X within three years of the original filing date. It is also important to keep track of any updates or changes in deadlines that may occur annually, especially during tax season, to ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The Illinois Form IL 941 X can be submitted through various methods, providing flexibility for employers. The form can be filed electronically through the Illinois Department of Revenue's online portal, which is often the fastest method. Alternatively, employers may choose to mail the completed form to the appropriate address provided by the Department of Revenue. In-person submissions are also an option, although they may require an appointment. Each method has its own processing times, so it is advisable to choose one that aligns with your needs.

Key elements of the Illinois Form IL 941 X Amended Illinois Withholding Income Tax

Key elements of the Illinois Form IL 941 X include the identification of the employer, the tax period being amended, and the specific corrections being made. The form requires detailed information regarding the original amounts reported, the corrected amounts, and any explanations for the changes. It is crucial for employers to provide accurate and complete information to facilitate the processing of the amendment and to ensure compliance with state tax regulations.

Quick guide on how to complete illinois form il 941 x amended illinois withholding income tax

Complete Illinois Form IL 941 X Amended Illinois Withholding Income Tax seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Illinois Form IL 941 X Amended Illinois Withholding Income Tax on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign Illinois Form IL 941 X Amended Illinois Withholding Income Tax effortlessly

- Find Illinois Form IL 941 X Amended Illinois Withholding Income Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and eSign Illinois Form IL 941 X Amended Illinois Withholding Income Tax and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is il941 and how does it relate to airSlate SignNow?

il941 is a specific form used by businesses to report income and expenses related to taxes. airSlate SignNow provides an efficient way to eSign and send the il941 form securely, ensuring compliance and ease of use for all stakeholders.

-

How much does airSlate SignNow cost for businesses needing to eSign il941 forms?

The pricing for airSlate SignNow is competitive and offers various plans to suit your business size and needs. Depending on your requirements for eSigning documents like the il941, you can choose a plan that fits your budget without compromising on essential features.

-

What features does airSlate SignNow offer for managing il941 documents?

airSlate SignNow includes features such as customizable templates, audit trails, and secure sharing options specifically for documents like il941. This makes it easy to create, send, and store your forms while maintaining compliance and visibility.

-

How can airSlate SignNow improve the efficiency of handling il941 forms?

By using airSlate SignNow, businesses can signNowly reduce the time spent on paperwork related to the il941 form. The platform allows for quick eSigning and efficient document management, streamlining the entire process and enhancing productivity.

-

Can I integrate airSlate SignNow with other software to manage il941 forms?

Yes, airSlate SignNow integrates seamlessly with various software platforms that assist in accounting and tax management. This means you can synchronize data related to your il941 forms with other applications for improved efficiency and accuracy.

-

What are the security features of airSlate SignNow for il941 eSigning?

airSlate SignNow prioritizes security with end-to-end encryption, user authentication, and secure storage for your il941 forms. These measures ensure your sensitive information is protected while maintaining compliance with regulatory standards.

-

How does airSlate SignNow handle revisions of the il941 form?

airSlate SignNow allows for easy tracking and management of revisions for the il941 form. With features like version history and user comments, you can ensure all stakeholders have access to the latest updates and changes in real-time.

Get more for Illinois Form IL 941 X Amended Illinois Withholding Income Tax

- Letter from tenant to landlord about landlord using unlawful self help to gain possession new jersey form

- Letter from tenant to landlord about illegal entry by landlord new jersey form

- Letter from landlord to tenant about time of intent to enter premises new jersey form

- Letter notice rent 497319220 form

- Letter from tenant to landlord about sexual harassment new jersey form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children new jersey form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure new jersey form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497319224 form

Find out other Illinois Form IL 941 X Amended Illinois Withholding Income Tax

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure