Download ILovePDF Latest Version Softonic Form

IRS Guidelines

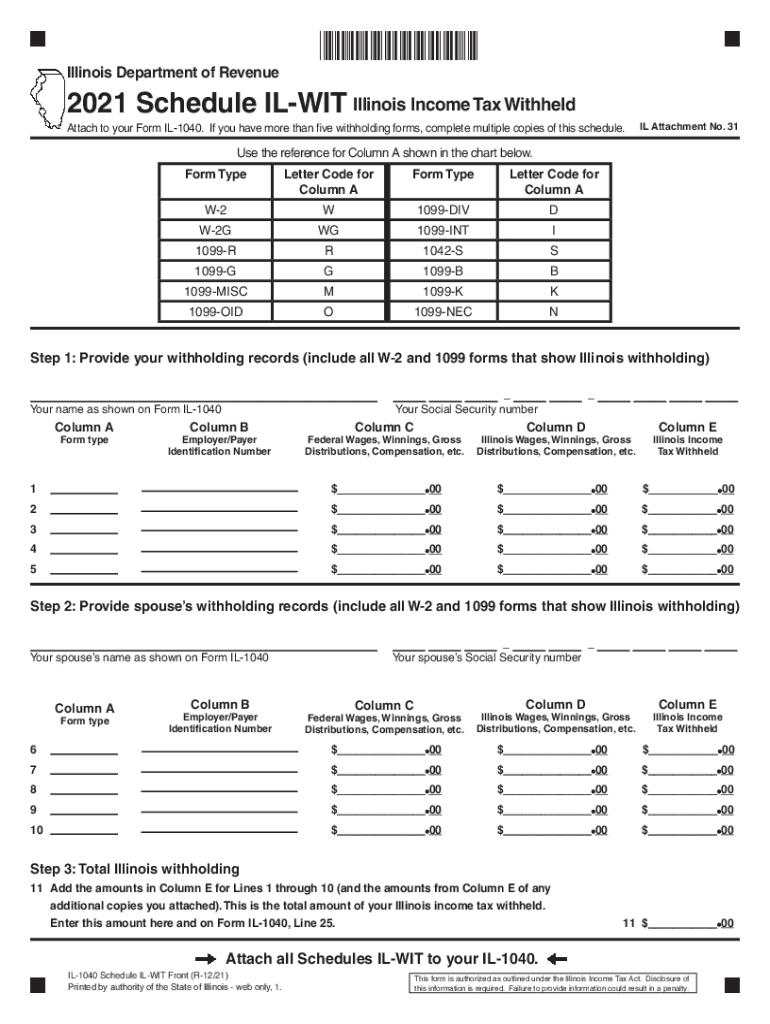

The IRS provides clear guidelines for completing tax forms, including the Illinois Schedule IL-WIT. Understanding these guidelines is essential for ensuring compliance and avoiding penalties. The IRS mandates that all forms must be filled out accurately and submitted by the specified deadlines. Taxpayers should familiarize themselves with the specific requirements for each form, including necessary information and documentation.

Filing Deadlines / Important Dates

Filing deadlines for tax forms, including the Illinois Schedule IL-WIT, are crucial for taxpayers to meet. Typically, individual tax returns must be filed by April 15 each year. However, if that date falls on a weekend or holiday, the deadline may be extended to the next business day. It's important to stay informed about any changes to these dates, as well as any extensions that may be available.

Required Documents

When completing the Illinois Schedule IL-WIT, certain documents are required to ensure accuracy and compliance. Taxpayers should gather all relevant financial records, including W-2 forms, 1099 forms, and any other income documentation. Additionally, having previous tax returns on hand can assist in accurately filling out the current year's forms.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Illinois Schedule IL-WIT. Forms can be filed electronically through approved e-filing services, which is often the quickest method. Alternatively, taxpayers may choose to mail their completed forms to the appropriate state address. In-person submission may also be available at designated tax offices, providing an option for those who prefer face-to-face assistance.

Penalties for Non-Compliance

Failing to comply with the filing requirements for the Illinois Schedule IL-WIT can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal consequences. It is essential for taxpayers to understand the importance of timely and accurate filing to avoid these repercussions.

Eligibility Criteria

Eligibility for filing the Illinois Schedule IL-WIT is determined by specific criteria set forth by the state. Generally, individuals who have had Illinois income tax withheld from their wages or other payments are eligible to file this form. Understanding the eligibility requirements is vital to ensure that taxpayers can claim any refunds due to over-withholding.

Application Process & Approval Time

The application process for the Illinois Schedule IL-WIT involves completing the form accurately and submitting it by the deadline. Once submitted, taxpayers can expect a processing time that varies based on the method of submission. Electronic filings are typically processed faster than paper submissions. Keeping track of the submission status can help ensure that any issues are addressed promptly.

Quick guide on how to complete download ilovepdf free latest version softonic

Finalize Download ILovePDF Latest Version Softonic easily on any device

Digital document handling has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed materials, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Download ILovePDF Latest Version Softonic on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Download ILovePDF Latest Version Softonic with ease

- Find Download ILovePDF Latest Version Softonic and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or a shareable link, or download it to your computer.

Say goodbye to lost or overlooked files, cumbersome form searching, or errors that necessitate the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and eSign Download ILovePDF Latest Version Softonic and ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow for 2021 il?

In 2021 il, airSlate SignNow offers an array of key features, including document sharing, customizable templates, real-time tracking, and secure cloud storage. These features empower businesses to streamline their signing processes and enhance collaboration. Whether you're a small business or a large enterprise, these capabilities make airSlate SignNow an effective e-signature solution.

-

How does airSlate SignNow ensure document security in 2021 il?

Security is a top priority for airSlate SignNow in 2021 il. The platform utilizes advanced encryption standards to protect your documents during transmission and storage. Additionally, it complies with industry regulations, ensuring that your sensitive information remains safe and secure at all times.

-

What is the pricing structure for airSlate SignNow in 2021 il?

In 2021 il, airSlate SignNow provides a variety of pricing plans to suit different business needs. These plans range from basic options for startups to comprehensive packages for large organizations. Each plan is cost-effective, ensuring that businesses can find an affordable solution that meets their e-signature requirements.

-

Can I integrate airSlate SignNow with other applications in 2021 il?

Absolutely! In 2021 il, airSlate SignNow supports integration with numerous applications, including CRM systems, document management tools, and cloud storage services. This interoperability allows businesses to automate workflows and enhance productivity by seamlessly incorporating e-signatures into their existing processes.

-

What benefits does airSlate SignNow offer for remote teams in 2021 il?

For remote teams in 2021 il, airSlate SignNow provides the convenience of signing documents from anywhere, at any time. The platform's user-friendly interface simplifies collaboration among team members, regardless of their location. This accessibility not only speeds up the signing process but also fosters a more efficient remote work environment.

-

Is airSlate SignNow user-friendly for non-technical users in 2021 il?

Yes, airSlate SignNow is designed to be highly user-friendly, making it accessible for non-technical users in 2021 il. The intuitive interface allows anyone to create, send, and sign documents without any prior experience. This ease of use is a key benefit that encourages widespread adoption within organizations.

-

How does airSlate SignNow improve workflow efficiency in 2021 il?

In 2021 il, airSlate SignNow enhances workflow efficiency by automating the document signing process. By eliminating manual tasks and reducing the time spent on paperwork, businesses can focus on more critical activities. The platform also allows for real-time updates, helping teams stay on track and collaborate more effectively.

Get more for Download ILovePDF Latest Version Softonic

- Demand to record satisfaction individual iowa form

- Quitclaim deed from individual to corporation iowa form

- Warranty deed from individual to corporation iowa form

- Demand to record satisfaction by corporation or llc iowa form

- Acknowledgment of satisfaction for individual iowa form

- Quitclaim deed from individual to llc iowa form

- Warranty deed from individual to llc iowa form

- Acknowledgment of satisfaction for corporation iowa form

Find out other Download ILovePDF Latest Version Softonic

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe