Missouri Form MO 1041 Missouri Fiduciary Income ReturnInstructions for Form 1041 and Schedules A, B, G, J, and KMissouri Form MO

Understanding the Missouri Form MO 1041

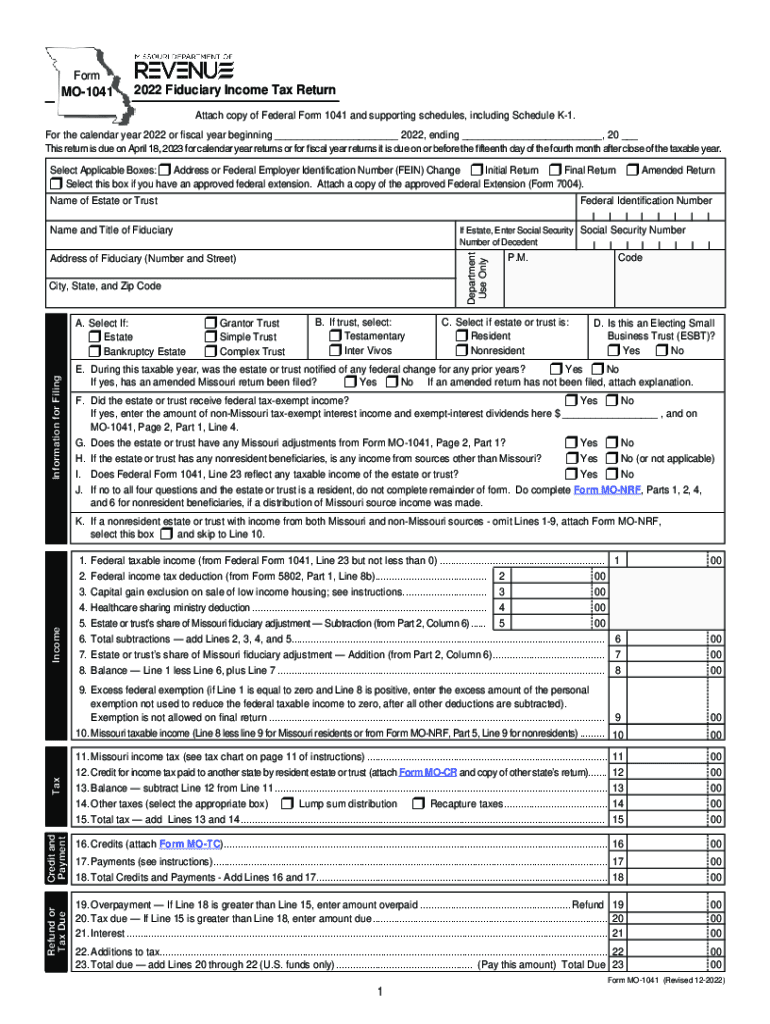

The Missouri Form MO 1041, also known as the Missouri Fiduciary Income Return, is a tax document used by fiduciaries to report income earned by estates and trusts. This form is essential for ensuring compliance with state tax laws and is required for the proper reporting of income generated by the assets held in a fiduciary capacity. Fiduciaries, such as executors or trustees, must accurately complete this form to reflect the income, deductions, and credits applicable to the estate or trust.

Steps to Complete the Missouri Form MO 1041

Completing the Missouri Form MO 1041 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial information related to the estate or trust, including income statements, deductions, and any applicable credits. Follow these steps:

- Fill out the identification section with the fiduciary's name, address, and taxpayer identification number.

- Report income from various sources, such as interest, dividends, and rental income, in the appropriate sections.

- Deduct allowable expenses, including administrative costs and distributions to beneficiaries.

- Calculate the total tax liability based on the net income reported.

- Sign and date the form before submission.

Legal Use of the Missouri Form MO 1041

The legal use of the Missouri Form MO 1041 is governed by state tax regulations. This form must be filed to report income generated by estates and trusts, ensuring that fiduciaries meet their tax obligations. Proper execution of this form establishes a clear record of income and expenses, which is critical in case of audits or inquiries from the Missouri Department of Revenue. It is essential that all information is accurate and complete to avoid potential legal issues.

Filing Deadlines for the Missouri Form MO 1041

Timely filing of the Missouri Form MO 1041 is crucial to avoid penalties. The form is typically due on the fifteenth day of the fourth month following the close of the estate or trust's tax year. For estates and trusts operating on a calendar year basis, this means the form is generally due by April fifteenth. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Fiduciaries should be aware of these deadlines to ensure compliance and avoid late fees.

Required Documents for Filing the Missouri Form MO 1041

To complete the Missouri Form MO 1041, fiduciaries must gather specific documents that provide the necessary financial information. These documents typically include:

- Income statements for the estate or trust, including K-1 forms from partnerships or S corporations.

- Records of expenses related to the management of the estate or trust.

- Documentation of distributions made to beneficiaries.

- Any relevant tax credits or deductions that may apply.

Obtaining the Missouri Form MO 1041

The Missouri Form MO 1041 can be obtained from the Missouri Department of Revenue's website or through authorized tax preparation software. It is important to ensure that the most current version of the form is used to comply with any recent changes in tax law. Fiduciaries can also consult with tax professionals for assistance in obtaining and completing the form accurately.

Quick guide on how to complete missouri form mo 1041 missouri fiduciary income returninstructions for form 1041 and schedules a b g j and kmissouri form mo

Complete Missouri Form MO 1041 Missouri Fiduciary Income ReturnInstructions For Form 1041 And Schedules A, B, G, J, And KMissouri Form MO effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to acquire the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Missouri Form MO 1041 Missouri Fiduciary Income ReturnInstructions For Form 1041 And Schedules A, B, G, J, And KMissouri Form MO on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Missouri Form MO 1041 Missouri Fiduciary Income ReturnInstructions For Form 1041 And Schedules A, B, G, J, And KMissouri Form MO with ease

- Locate Missouri Form MO 1041 Missouri Fiduciary Income ReturnInstructions For Form 1041 And Schedules A, B, G, J, And KMissouri Form MO and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device of your preference. Edit and eSign Missouri Form MO 1041 Missouri Fiduciary Income ReturnInstructions For Form 1041 And Schedules A, B, G, J, And KMissouri Form MO and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2022 MO1041 income form used for?

The 2022 MO1041 income form is specifically designed for fiduciaries to report the income for estates and trusts in Missouri. It is essential for ensuring compliance with state tax laws. By accurately filing the 2022 MO1041 income, fiduciaries can avoid penalties and ensure that the trust or estate's taxes are settled properly.

-

How does airSlate SignNow facilitate the completion of the 2022 MO1041 income form?

airSlate SignNow simplifies the process of completing the 2022 MO1041 income form by providing easy-to-use templates that integrate legally binding electronic signatures. This ensures that all necessary signatures can be obtained quickly and efficiently, streamlining the filing process. Additionally, our platform supports collaboration among team members working on the tax documents.

-

What are the costs associated with using airSlate SignNow for the 2022 MO1041 income form?

The pricing for airSlate SignNow is competitive and designed to meet various business needs, making it a cost-effective solution for handling the 2022 MO1041 income form. With flexible subscription plans, users can choose a package that fits their budget. Additionally, our platform helps reduce costs associated with printing and mailing documents.

-

Can I integrate airSlate SignNow with my existing software for managing the 2022 MO1041 income?

Yes, airSlate SignNow offers robust integrations with various software applications to streamline the management of the 2022 MO1041 income. Whether you use accounting software or CRM tools, our platform can connect seamlessly for enhanced workflow efficiency. This integration ensures that all your documents are readily accessible and securely managed in one location.

-

What features does airSlate SignNow offer to manage the 2022 MO1041 income effectively?

airSlate SignNow offers a variety of features tailored to manage the 2022 MO1041 income efficiently, including customizable templates, automated reminders, and secure storage. These tools help ensure that your documents are filled out correctly and submitted on time. Furthermore, our eSigning capability allows you to obtain the necessary signatures without delays.

-

How secure is airSlate SignNow for submitting the 2022 MO1041 income form?

airSlate SignNow prioritizes security with measures such as end-to-end encryption and compliance with industry standards for data protection. When submitting your 2022 MO1041 income form through our platform, you can trust that your sensitive information is safeguarded. We also provide audit trails to ensure accountability and transparency throughout the signing process.

-

Are there any customer support options for help with the 2022 MO1041 income via airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive customer support to assist users with any questions related to the 2022 MO1041 income form. Whether you need help with technical issues or guidance on using our features, our dedicated support team is available through multiple channels, including chat, email, and phone. We are committed to ensuring your experience is seamless and satisfactory.

Get more for Missouri Form MO 1041 Missouri Fiduciary Income ReturnInstructions For Form 1041 And Schedules A, B, G, J, And KMissouri Form MO

- Assignment of mortgage by corporate mortgage holder new jersey form

- New jersey assignment form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property new jersey form

- Nj payment rent form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property new jersey form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential new jersey form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property new jersey form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property new 497319275 form

Find out other Missouri Form MO 1041 Missouri Fiduciary Income ReturnInstructions For Form 1041 And Schedules A, B, G, J, And KMissouri Form MO

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed