Form MO 1040V Individual Income Tax Payment Voucher

What is the Form MO 1040V Individual Income Tax Payment Voucher

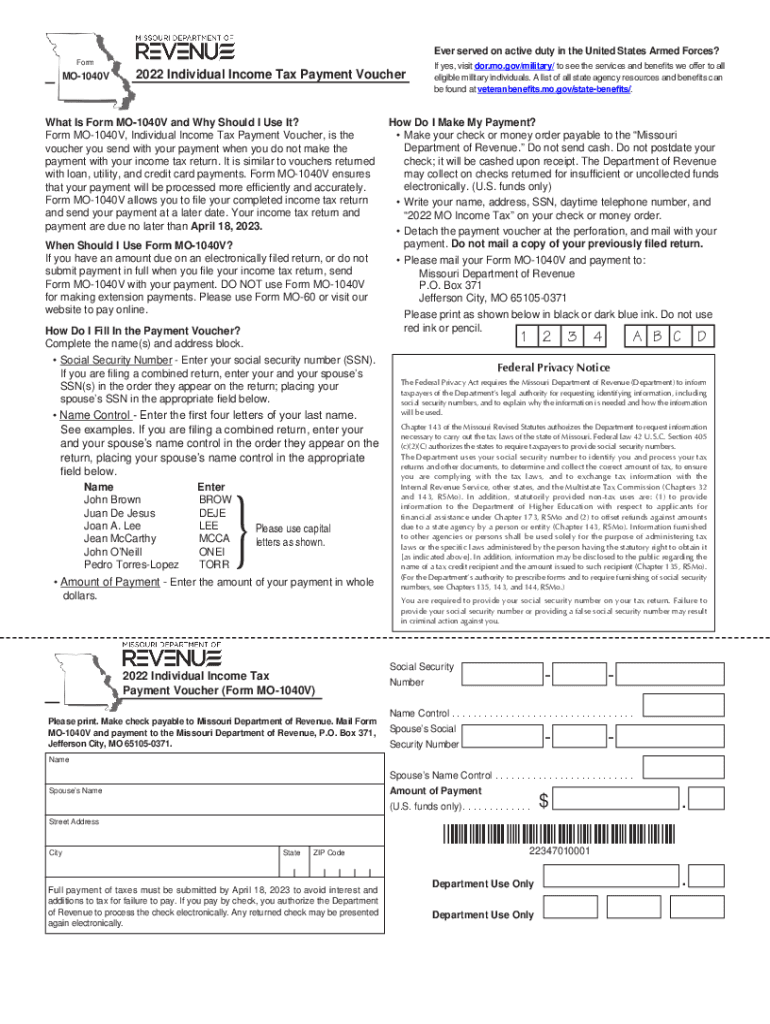

The Form MO 1040V is an essential document used by individuals in Missouri to submit their income tax payments. This voucher accompanies the payment of state income tax and is specifically designed for taxpayers who prefer to pay by check or money order. It ensures that the payment is properly credited to the correct account and tax year. The MO 1040V is particularly useful for those who may not file their tax returns electronically but still wish to meet their tax obligations promptly.

How to use the Form MO 1040V Individual Income Tax Payment Voucher

Using the Form MO 1040V is straightforward. First, download or print the form from the Missouri Department of Revenue's website. Fill in your personal information, including your name, address, and Social Security number. Indicate the amount you are paying and the tax year for which the payment applies. Once completed, attach your check or money order made out to the Missouri Department of Revenue. Finally, mail the voucher and payment to the address specified on the form to ensure it is processed correctly.

Steps to complete the Form MO 1040V Individual Income Tax Payment Voucher

Completing the Form MO 1040V involves several key steps:

- Download the form from the Missouri Department of Revenue's website.

- Fill in your personal details, including your name, address, and Social Security number.

- Specify the payment amount and the tax year it pertains to.

- Attach your payment, ensuring it is a check or money order made out to the Missouri Department of Revenue.

- Mail the completed form and payment to the address indicated on the form.

Key elements of the Form MO 1040V Individual Income Tax Payment Voucher

The Form MO 1040V includes several critical elements that taxpayers must complete accurately. These elements are:

- Taxpayer Information: This includes your name, address, and Social Security number.

- Payment Amount: Clearly state the amount you are submitting for payment.

- Tax Year: Indicate the specific tax year for which the payment is being made.

- Signature: While not always required, signing the form can help validate your submission.

Legal use of the Form MO 1040V Individual Income Tax Payment Voucher

The Form MO 1040V is legally recognized as a valid means of submitting income tax payments in Missouri. To ensure its legal standing, it must be completed accurately and submitted by the appropriate deadlines. The use of this form helps maintain compliance with state tax regulations. Additionally, retaining a copy of the completed voucher and payment confirmation can serve as proof of payment in case of any disputes with the Missouri Department of Revenue.

Form Submission Methods (Online / Mail / In-Person)

The Form MO 1040V can be submitted by mail, which is the most common method. Taxpayers should ensure they send the form to the correct address provided on the form to avoid any delays. Currently, there is no option for electronic submission of the MO 1040V, meaning that payments must be sent via postal service. It is advisable to use a reliable mailing method and keep a record of the submission for personal records.

Quick guide on how to complete form mo 1040v 2022 individual income tax payment voucher

Prepare Form MO 1040V Individual Income Tax Payment Voucher effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without holdups. Manage Form MO 1040V Individual Income Tax Payment Voucher on any device using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The simplest method to alter and eSign Form MO 1040V Individual Income Tax Payment Voucher effortlessly

- Find Form MO 1040V Individual Income Tax Payment Voucher and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to deliver your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form MO 1040V Individual Income Tax Payment Voucher and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an MO tax payment voucher?

The MO tax payment voucher is a document used by taxpayers in Missouri to submit their tax payments to the state. This voucher ensures that your payment is properly processed and linked to your tax account. Utilizing tools like airSlate SignNow can simplify the process of filling out and submitting your MO tax payment voucher.

-

How can airSlate SignNow assist with MO tax payment vouchers?

airSlate SignNow streamlines the creation and submission of your MO tax payment voucher by allowing you to easily fill out, sign, and send documents electronically. Our platform provides a user-friendly interface that keeps your tax documents organized. With airSlate SignNow, you can ensure that your MO tax payment voucher is submitted quickly and securely.

-

Are there any costs associated with using airSlate SignNow for MO tax payment vouchers?

Yes, airSlate SignNow offers a cost-effective solution with various pricing plans tailored to meet your business needs. Our pricing includes features that allow you to manage and send your MO tax payment voucher efficiently. Additionally, we offer a free trial, so you can explore the benefits before committing.

-

Can I integrate airSlate SignNow with other tax software for managing my MO tax payment voucher?

Absolutely! airSlate SignNow can seamlessly integrate with various tax software and applications. This allows you to automate your workflow and manage your MO tax payment voucher alongside other tax documents, enhancing efficiency and accuracy in your filing process.

-

What are the benefits of using airSlate SignNow for my MO tax payment vouchers?

The primary benefits of using airSlate SignNow for your MO tax payment vouchers include convenience, security, and speed. You can sign and send documents anytime, anywhere, reducing the need for physical paperwork. Additionally, our built-in security features protect your sensitive tax information throughout the process.

-

Is there customer support available for questions about MO tax payment vouchers?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions regarding your MO tax payment voucher. Our team is available through multiple channels, including email and live chat, ensuring that you receive prompt and helpful responses. We are committed to helping you navigate your tax needs effectively.

-

How can I track the status of my MO tax payment voucher after submission?

airSlate SignNow offers tracking features that allow you to monitor the status of your MO tax payment voucher after it's been sent. You’ll receive notifications upon signing and submission, keeping you informed throughout the process. This feature provides peace of mind that your payment is being processed.

Get more for Form MO 1040V Individual Income Tax Payment Voucher

- Interrogatories to plaintiff for motor vehicle occurrence new jersey form

- Interrogatories to defendant for motor vehicle accident new jersey form

- Llc notices resolutions and other operations forms package new jersey

- Nj disclosure statement form

- Notice of dishonored check civil keywords bad check bounced check new jersey form

- Notice check bounced form

- Mutual wills containing last will and testaments for unmarried persons living together with no children new jersey form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children new jersey form

Find out other Form MO 1040V Individual Income Tax Payment Voucher

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF