Instructions for Form 8867 11Internal Revenue Service

Understanding the Instructions for Form 8867

The Instructions for Form 8867 are essential for taxpayers claiming the Head of Household (HOH) filing status. This form is used to determine eligibility for certain tax benefits, including the Earned Income Tax Credit (EITC). It provides detailed guidelines on how to accurately complete the form, ensuring compliance with IRS regulations. Understanding these instructions is crucial for maximizing tax benefits and avoiding potential penalties.

Steps to Complete Form 8867

Completing Form 8867 involves several key steps to ensure that all necessary information is accurately reported. First, gather all relevant documentation, including proof of residency and dependent information. Next, carefully follow the instructions provided on the form, ensuring that each section is filled out completely. It is important to double-check for accuracy and completeness before submission, as errors can lead to delays or penalties. Finally, submit the form electronically or by mail, depending on your preference and the requirements of your tax preparation process.

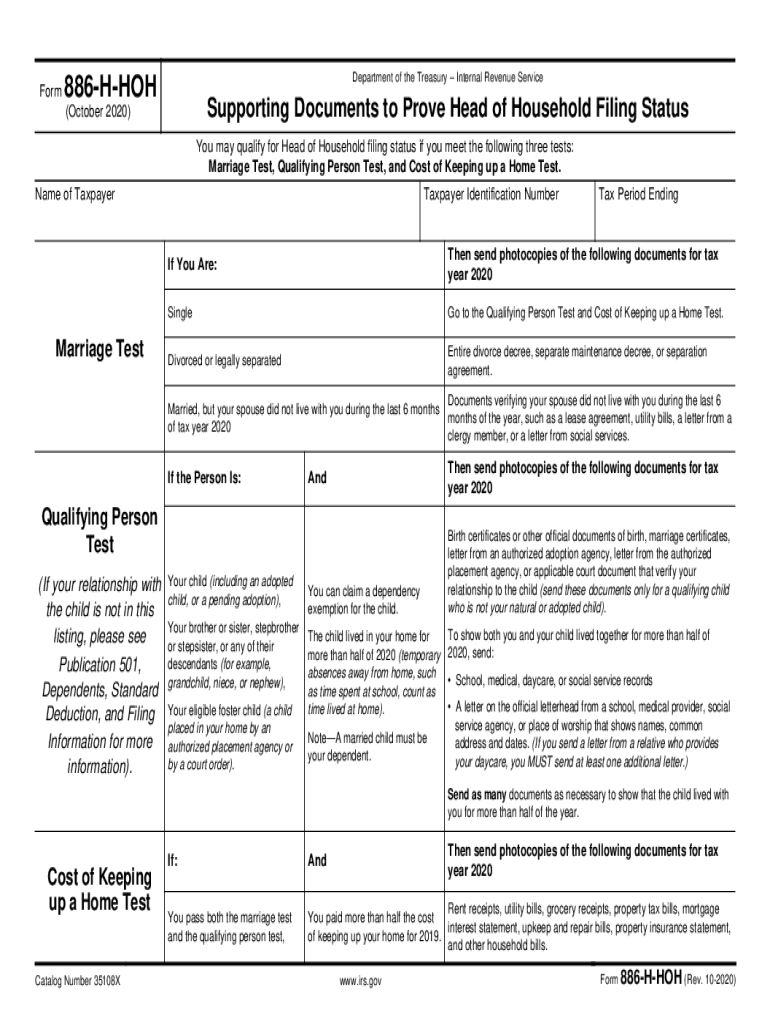

Eligibility Criteria for Head of Household Status

To qualify for Head of Household status, specific eligibility criteria must be met. You must be unmarried or considered unmarried on the last day of the tax year. Additionally, you must have paid more than half the cost of maintaining a home for the year, which includes rent, mortgage interest, utilities, and property taxes. Furthermore, a qualifying person, such as a child or dependent relative, must have lived with you for more than half the year. Meeting these criteria is essential for claiming the HOH filing status and associated tax benefits.

Required Documents for Filing

When filing for Head of Household status using Form 8867, certain documents are necessary to support your claim. These typically include proof of residency for the qualifying person, such as school records or medical documents, and documentation of income and expenses related to maintaining the household. Collecting these documents in advance can streamline the filing process and help ensure that your application is complete and accurate.

Filing Deadlines and Important Dates

It is important to be aware of filing deadlines when submitting Form 8867. The standard deadline for filing your federal tax return, including any associated forms, is April 15. However, if you require additional time, you can file for an extension, which typically grants an extra six months. Keep in mind that any taxes owed are still due by the original deadline to avoid penalties and interest.

Penalties for Non-Compliance

Failure to comply with the requirements for Form 8867 can result in significant penalties. If the IRS finds that you have incorrectly claimed Head of Household status or failed to provide necessary documentation, you may face fines or disqualification from certain tax credits. It is crucial to understand the implications of non-compliance and to ensure that all information submitted is accurate and complete to avoid these consequences.

Quick guide on how to complete instructions for form 8867 112022internal revenue service

Effortlessly prepare Instructions For Form 8867 11Internal Revenue Service on any device

Digital document handling has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate template and securely store it online. airSlate SignNow equips you with all necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Instructions For Form 8867 11Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign Instructions For Form 8867 11Internal Revenue Service seamlessly

- Find Instructions For Form 8867 11Internal Revenue Service and click Get Form to begin.

- Utilize the tools available to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your delivery method for your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that necessitate printing additional copies. airSlate SignNow fulfills your document management needs with just a few clicks from your preferred device. Edit and eSign Instructions For Form 8867 11Internal Revenue Service and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is head household filing?

Head household filing is a tax status that allows qualifying individuals to benefit from lower tax rates and higher deductions. To qualify, you must have a dependent living with you, and you must pay more than half of the household expenses. This status can signNowly reduce your taxable income and increase your refund.

-

How can airSlate SignNow help with head household filing?

airSlate SignNow provides an intuitive platform for managing important documents related to head household filing. You can easily sign and send tax forms with our secure eSignature feature. Our solution ensures that all your documents are organized and accessible, simplifying your tax filing process.

-

What are the benefits of using airSlate SignNow for head household filing?

Using airSlate SignNow for head household filing offers numerous benefits, including enhanced document security and intuitive eSigning capabilities. With our platform, you can streamline your document management, saving time and reducing stress during tax season. Additionally, our cost-effective solution makes it easy for individuals and businesses alike.

-

Is there a cost associated with using airSlate SignNow for head household filing?

Yes, airSlate SignNow offers several pricing plans tailored to different needs, making it an affordable option for those looking to manage head household filing documents. We offer a free trial so you can experience the features before committing financially. Our pricing is designed to provide great value for the services offered.

-

What features does airSlate SignNow offer for document management related to head household filing?

airSlate SignNow comes packed with features that enhance document management for head household filing. You can easily create, edit, and send documents for signing while ensuring compliance with legal requirements. Our platform also offers templates and document tracking to keep you organized throughout the filing process.

-

Can airSlate SignNow integrate with other financial software for head household filing?

Yes, airSlate SignNow integrates seamlessly with various financial and accounting software. This allows you to manage your head household filing tasks more efficiently by connecting your eSignature solutions to the tools you already use. Our integrations simplify your workflow and enhance collaboration with your financial advisors.

-

Is airSlate SignNow suitable for both individuals and small businesses filing as head household?

Absolutely! airSlate SignNow is designed to cater to both individuals and small businesses handling documents for head household filing. Whether you are filing your personal tax returns or managing documents for your business, our platform provides easy-to-use tools that scale with your needs.

Get more for Instructions For Form 8867 11Internal Revenue Service

- Apartment lease rental application questionnaire new jersey form

- Residential rental lease application new jersey form

- Salary verification form for potential lease new jersey

- New jersey landlord form

- Notice of default on residential lease new jersey form

- Nj lease agreement form

- Application for sublease new jersey form

- Inventory and condition of leased premises for pre lease and post lease new jersey form

Find out other Instructions For Form 8867 11Internal Revenue Service

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online