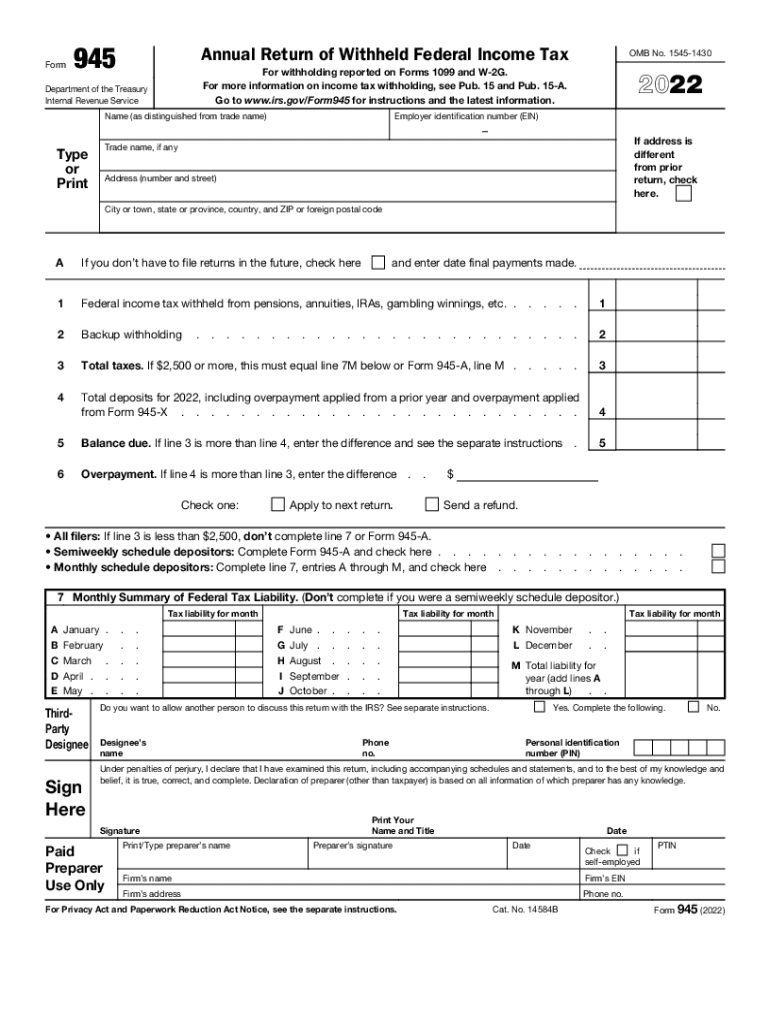

Form 945 Annual Return of Withheld Federal Income Tax

What is the Form 945 Annual Return Of Withheld Federal Income Tax

The Form 945 is an essential document used by employers and businesses in the United States to report withheld federal income tax from nonpayroll payments. This includes payments made to independent contractors, certain government payments, and other types of income. The purpose of this form is to ensure that the Internal Revenue Service (IRS) receives accurate information regarding the amount of federal income tax withheld throughout the year. It is crucial for compliance with federal tax regulations and helps maintain accurate financial records for both the payer and the payee.

Steps to complete the Form 945 Annual Return Of Withheld Federal Income Tax

Completing the Form 945 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the total amount of nonpayroll payments made during the year and the total federal income tax withheld. Next, accurately fill out the form, ensuring that all sections are completed, including the payer's information and the amounts withheld. Once the form is filled out, review it for any errors or omissions. Finally, submit the form to the IRS by the designated deadline, either electronically or by mail, depending on your preference and the requirements set forth by the IRS.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 945 is crucial for compliance. The form is typically due on January thirty-first of the year following the tax year being reported. If you are filing electronically, you may have an extended deadline. It is important to be aware of these dates to avoid penalties for late submission. Additionally, keep in mind that if you are making payments to the IRS, those may have different deadlines that should also be noted.

Legal use of the Form 945 Annual Return Of Withheld Federal Income Tax

The legal use of the Form 945 is governed by IRS regulations. It is essential that the form is filled out accurately and submitted on time to avoid any potential legal issues. The IRS requires that all withheld federal income taxes be reported correctly, and failure to do so can result in penalties or audits. Employers and businesses must ensure they are familiar with the legal requirements surrounding this form to maintain compliance and protect their interests.

Who Issues the Form

The Form 945 is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers understand their obligations regarding withheld federal income tax. It is important to refer to the official IRS website or publications for the most accurate and up-to-date information regarding the form and its requirements.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form 945 can result in significant penalties. The IRS may impose fines for late filing, inaccurate reporting, or failure to file altogether. These penalties can accumulate quickly, making it essential for businesses and employers to prioritize timely and accurate submission of the form. Understanding the potential consequences of non-compliance can help motivate timely action and ensure adherence to federal tax laws.

Quick guide on how to complete 2022 form 945 annual return of withheld federal income tax

Prepare Form 945 Annual Return Of Withheld Federal Income Tax effortlessly on any device

Web-based document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct version and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without complications. Manage Form 945 Annual Return Of Withheld Federal Income Tax on any platform with airSlate SignNow mobile applications for Android or iOS and simplify any document-related process today.

How to edit and eSign Form 945 Annual Return Of Withheld Federal Income Tax with ease

- Obtain Form 945 Annual Return Of Withheld Federal Income Tax and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using tools available specifically for this purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your delivery method for the form: via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your preference. Edit and eSign Form 945 Annual Return Of Withheld Federal Income Tax and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow related to the 2022 form 945 instructions?

airSlate SignNow offers a range of features that enhance the signing and document management process, specifically tailored for the 2022 form 945 instructions. Users can easily upload, send, and eSign documents while ensuring compliance with tax requirements. The platform also includes templates to expedite the completion of the form, making it user-friendly and efficient.

-

How can airSlate SignNow help with submitting the 2022 form 945?

With airSlate SignNow, users can efficiently prepare and submit the 2022 form 945 by utilizing electronic signatures for quicker processing. The platform facilitates a streamlined workflow that allows businesses to track document status and receive notifications upon sign-off. This ensures that your submissions of 2022 form 945 instructions are handled promptly and accurately.

-

Is airSlate SignNow cost-effective for businesses needing the 2022 form 945 instructions?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing support with the 2022 form 945 instructions. With flexible pricing plans to suit different organizational needs, companies can save time and resources while maintaining compliance. The savings on paper and postage alone make it a worthwhile investment for efficient document management.

-

What integrations does airSlate SignNow offer for managing the 2022 form 945?

airSlate SignNow integrates seamlessly with a variety of popular applications to enhance the management of the 2022 form 945 instructions. These integrations allow users to connect their existing workflows, whether through CRM systems, cloud storage, or accounting software. This ensures a cohesive experience and better management of all necessary documentation.

-

Can airSlate SignNow assist in tracking the status of the 2022 form 945?

Absolutely! airSlate SignNow allows users to track the status of the 2022 form 945 in real-time. You will receive notifications on document views, completions, and any required actions, ensuring that you remain informed throughout the signing process. This feature signNowly reduces the hassle involved in managing multiple submissions.

-

What benefits does airSlate SignNow provide for completing the 2022 form 945 instructions?

airSlate SignNow streamlines the completion of the 2022 form 945 instructions by providing a user-friendly interface and digital signing capabilities. The platform enhances efficiency by reducing paperwork and automating workflows. Additionally, using airSlate SignNow can help ensure compliance with IRS guidelines, reducing the risks of errors in submissions.

-

Is airSlate SignNow secure for handling sensitive information related to the 2022 form 945?

Yes, security is a top priority at airSlate SignNow. The platform employs advanced encryption and authentication protocols to safeguard sensitive information, including that related to the 2022 form 945 instructions. Users can have peace of mind knowing their documents and data are protected against unauthorized access.

Get more for Form 945 Annual Return Of Withheld Federal Income Tax

- Tenant welcome letter new jersey form

- Warning of default on commercial lease new jersey form

- Warning of default on residential lease new jersey form

- Landlord tenant closing statement to reconcile security deposit new jersey form

- Name change notification package for brides court ordered name change divorced marriage for new jersey new jersey form

- Name change notification form new jersey

- Commercial building or space lease new jersey form

- Nj legal documents 497319364 form

Find out other Form 945 Annual Return Of Withheld Federal Income Tax

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast