Form 637 Rev April Application for Registration for Certain Excise Tax Activities

What is the Form 637 application for registration for certain excise tax activities?

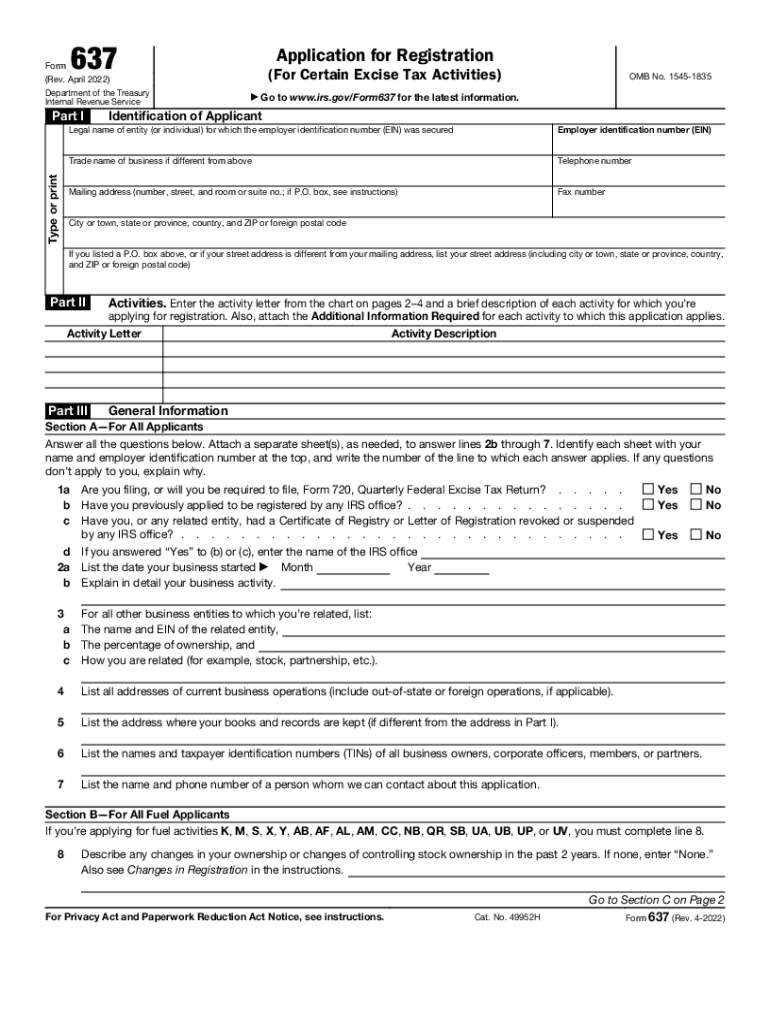

The Form 637 is an application utilized by businesses to register for specific excise tax activities with the IRS. This form is essential for entities involved in activities subject to federal excise taxes, allowing them to obtain the necessary authorization to operate legally. The 637 application ensures compliance with tax regulations and helps streamline the process of managing excise tax obligations.

Steps to complete the Form 637 application for registration for certain excise tax activities

Completing the Form 637 requires careful attention to detail to ensure accuracy and compliance. Here are the primary steps involved:

- Gather necessary information, including your business name, address, and Employer Identification Number (EIN).

- Identify the specific excise tax activities your business will engage in, as this will influence the registration process.

- Fill out the form, providing all required details accurately. Pay close attention to sections that pertain to your business type and the nature of your excise tax activities.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the IRS via the designated method, ensuring you keep a copy for your records.

Legal use of the Form 637 application for registration for certain excise tax activities

The legal use of the Form 637 involves adhering to the guidelines set forth by the IRS regarding excise tax registration. It is crucial for businesses to ensure that they are using the most current version of the form and that all information provided is accurate and complete. Failure to comply with these regulations can result in penalties or delays in processing the application.

Filing deadlines / important dates for the Form 637 application

Understanding the filing deadlines for the Form 637 is vital for businesses to maintain compliance with IRS regulations. Generally, applications should be submitted well in advance of the date when excise tax activities commence. Specific deadlines may vary based on the type of excise tax activity, so it is advisable to consult the IRS guidelines or a tax professional for the most accurate information.

Required documents for the Form 637 application for registration for certain excise tax activities

When completing the Form 637, certain documents may be required to support your application. These can include:

- Proof of business formation, such as articles of incorporation or partnership agreements.

- Tax identification numbers, including the Employer Identification Number (EIN).

- Any relevant licenses or permits associated with excise tax activities.

Having these documents ready can facilitate a smoother application process and ensure compliance with IRS requirements.

Application process & approval time for the Form 637

The application process for the Form 637 involves submitting the completed form along with any required documentation to the IRS. Once submitted, the approval time can vary based on the volume of applications the IRS is processing and the complexity of your submission. Typically, businesses can expect a response within a few weeks, but it is advisable to check the status of your application regularly to ensure timely compliance.

Quick guide on how to complete form 637 rev april 2022 application for registration for certain excise tax activities

Easily Prepare Form 637 Rev April Application For Registration For Certain Excise Tax Activities on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents promptly without any delays. Manage Form 637 Rev April Application For Registration For Certain Excise Tax Activities on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Edit and eSign Form 637 Rev April Application For Registration For Certain Excise Tax Activities Effortlessly

- Find Form 637 Rev April Application For Registration For Certain Excise Tax Activities and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, the hassle of searching for forms, or errors that necessitate printing new copies of documents. airSlate SignNow manages all your document management needs in just a few clicks from your chosen device. Edit and eSign Form 637 Rev April Application For Registration For Certain Excise Tax Activities to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a 637 form and why is it important?

The 637 form is a vital document used for various business transactions, primarily for tax purposes. It serves to validate certain financial activities and compliance with federal requirements. Understanding the 637 form is crucial for businesses looking to streamline their documentation processes.

-

How does airSlate SignNow simplify the 637 form signing process?

airSlate SignNow provides a user-friendly platform that allows businesses to easily prepare, send, and collect signatures on the 637 form. With its intuitive interface, users can manage document workflows effortlessly, ensuring that the form is completed quickly and efficiently. This capability helps enhance productivity and reduces the chances of errors.

-

What are the pricing plans for using airSlate SignNow for the 637 form?

airSlate SignNow offers flexible pricing plans tailored to suit different business needs when handling the 637 form. Whether you're a small business or a large enterprise, there’s a plan that can provide you with the necessary features. You can check our website for detailed pricing information and choose a plan that fits your budget.

-

Can I integrate airSlate SignNow with other software for handling the 637 form?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM systems, cloud storage solutions, and project management tools. This integration capability allows you to enhance your workflow when dealing with the 637 form. It promotes better collaboration and data management across different platforms.

-

What features does airSlate SignNow offer for managing documents like the 637 form?

airSlate SignNow comes equipped with features such as customizable templates, secure eSignatures, and real-time tracking for documents like the 637 form. These features ensure that you can manage your signing process efficiently and keep all stakeholders informed at every step. Additionally, you can easily store and access documents when needed.

-

Is it safe to use airSlate SignNow for the 637 form?

Absolutely! airSlate SignNow prioritizes the security of your documents, including the 637 form. We use advanced encryption methods and security measures to protect your sensitive information, ensuring compliance with industry standards. You can trust that your data is safe while using our platform.

-

How can airSlate SignNow enhance collaboration on the 637 form?

airSlate SignNow enhances collaboration by allowing multiple users to engage in the signing process of the 637 form simultaneously. With features like comments and assignment tracking, team members can efficiently work together to finalize documents. This collaborative environment minimizes delays and improves overall efficiency.

Get more for Form 637 Rev April Application For Registration For Certain Excise Tax Activities

- Nj settlement minor form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497319390 form

- Marital settlement form agreement

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497319392 form

- Nj marital settlement form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective 497319394 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497319395 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497319396 form

Find out other Form 637 Rev April Application For Registration For Certain Excise Tax Activities

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe