Box 12 Codes Form

What is the Box 12 Codes

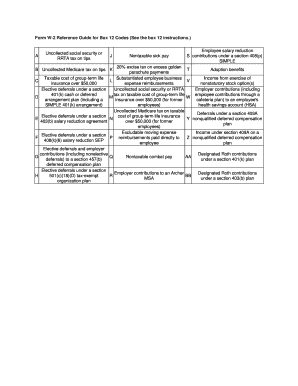

The Box 12 codes on a W-2 form are used to report various types of compensation and benefits that are not included in the employee's gross income. These codes are essential for tax purposes, as they help identify specific financial information that the IRS requires. Each code corresponds to a different type of income or deduction, providing clarity on the employee's earnings and tax liabilities. Understanding these codes is crucial for accurate tax filing and compliance.

How to use the Box 12 Codes

To use the Box 12 codes effectively, employees should first identify the codes listed on their W-2 form. Each code will have a corresponding description that explains what it represents. For example, a code 'D' indicates elective deferrals to a 401(k) plan, while a code 'P' signifies qualified moving expense reimbursements. When preparing tax returns, individuals must include the information from Box 12 in the appropriate sections of their tax forms to ensure accurate reporting and compliance with IRS regulations.

Steps to complete the Box 12 Codes

Completing the Box 12 codes on a W-2 form involves several steps:

- Review your W-2 form for the codes listed in Box 12.

- Refer to the IRS instructions for Form W-2 to understand the meaning of each code.

- Ensure that the amounts reported next to each code are accurate and reflect your financial situation.

- Include the relevant Box 12 information when filing your tax return, ensuring that all codes are reported correctly.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Box 12 codes on W-2 forms. Employers must ensure that the codes used are accurate and that the amounts reported align with the employee’s compensation and benefits. The IRS updates these guidelines periodically, so it is essential for both employers and employees to stay informed about any changes. Failure to comply with IRS regulations regarding Box 12 codes can lead to penalties and complications during tax filing.

Examples of using the Box 12 Codes

Examples of Box 12 codes include:

- D: Elective deferrals to a 401(k) plan.

- P: Qualified moving expense reimbursements.

- W: Employer contributions to a health savings account (HSA).

- DD: Cost of employer-sponsored health coverage.

Each of these codes provides specific information that can affect an employee's tax situation, making it essential to understand their implications.

Legal use of the Box 12 Codes

The legal use of Box 12 codes is governed by IRS regulations, which require accurate reporting of all compensation and benefits. Employers must correctly categorize and report these codes to avoid legal repercussions. Employees should also understand their rights and responsibilities regarding these codes to ensure compliance with tax laws. Misreporting or failing to report Box 12 information can lead to audits, penalties, and additional tax liabilities.

Quick guide on how to complete box 12 codes

Finalize Box 12 Codes effortlessly on any device

Digital document management has gained immense popularity with organizations and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without disruptions. Administer Box 12 Codes on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Box 12 Codes with ease

- Find Box 12 Codes and click on Get Form to commence.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to store your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign Box 12 Codes to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the box 12 codes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the form w 2 reference guide for box 12 codes?

The form w 2 reference guide for box 12 codes serves as an essential resource for understanding the different codes that employers use on W-2 forms. These codes indicate various types of compensation and benefits received by employees, helping in accurate tax reporting. Knowing these codes ensures both employers and employees can properly complete their tax forms.

-

How can the form w 2 reference guide for box 12 codes help my business?

By utilizing the form w 2 reference guide for box 12 codes, your business can ensure accurate reporting of employee income and benefits. This accuracy reduces the risk of tax penalties and improves compliance with IRS regulations. Additionally, it can enhance transparency between employers and employees regarding income details.

-

Where can I access the form w 2 reference guide for box 12 codes?

You can access the form w 2 reference guide for box 12 codes directly from the official IRS website or through dedicated payroll software solutions. Many financial service providers and tax professionals offer resources that include comprehensive guides as well. Ensure the source is reliable to maintain accuracy.

-

Does airSlate SignNow provide any features related to form w 2 reference guide for box 12 codes?

Yes, airSlate SignNow offers features that assist in the preparation and electronic signing of W-2 forms, including those that guide you through understanding the form w 2 reference guide for box 12 codes. This functionality streamlines the documentation process, ensuring compliance and reducing administrative burdens for your business.

-

What are the pricing options for airSlate SignNow related to W-2 form processing?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs, including solutions for W-2 form processing. Each plan is designed to provide cost-effective options while ensuring that features related to the form w 2 reference guide for box 12 codes are accessible to all users. Consider reviewing the pricing page to find a plan that best suits your business requirements.

-

Can airSlate SignNow integrate with existing payroll systems for W-2 processing?

Absolutely! airSlate SignNow integrates seamlessly with various payroll systems, which makes it easier to manage W-2 forms while utilizing the form w 2 reference guide for box 12 codes. This integration ensures a smooth workflow, allowing you to automate document signing and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for eSigning W-2 forms?

Using airSlate SignNow for eSigning W-2 forms offers numerous benefits, including improved efficiency, reduced turnaround times, and enhanced security. By coupling this service with the form w 2 reference guide for box 12 codes, you gain confidence that your forms are completed correctly. Additionally, eSigning eliminates the need for physical paperwork, streamlining the entire process.

Get more for Box 12 Codes

- Civil union marriage form

- Legal last will and testament form for married person with adult and minor children new jersey

- Last will testament blank form

- New jersey partner 497319736 form

- Mutual wills package with last wills and testaments for married couple with adult and minor children new jersey form

- Legal last will and testament form for a widow or widower with adult children new jersey

- Legal last will and testament form for widow or widower with minor children new jersey

- Legal last will form for a widow or widower with no children new jersey

Find out other Box 12 Codes

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract