Form 89 350 1 000 Rev MISSISSIPPI EMPLOYEE'S

Understanding the Mississippi Employee Withholding Form (Form 89-350)

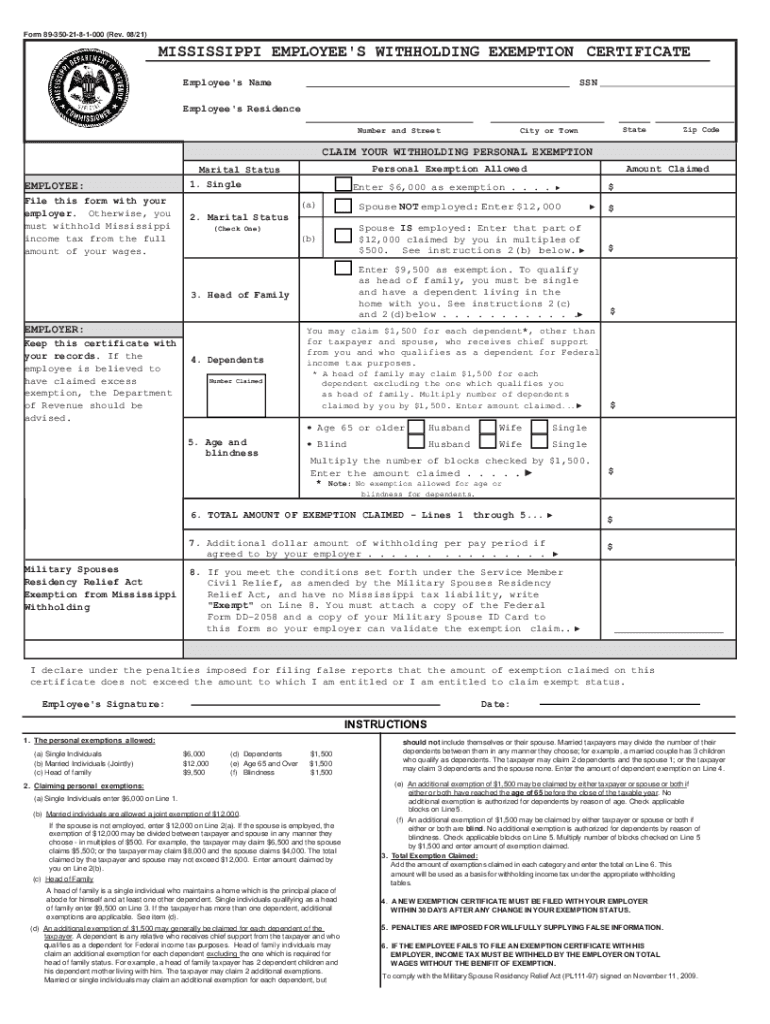

The Mississippi Employee Withholding Form, also known as Form 89-350, is essential for employers in Mississippi to accurately withhold state income taxes from their employees' wages. This form allows employees to indicate their filing status and the number of allowances they wish to claim, which directly impacts the amount of state tax withheld from their paychecks. Understanding the purpose and requirements of this form is crucial for both employers and employees to ensure compliance with state tax laws.

Steps to Complete the Mississippi Employee Withholding Form

Completing the Mississippi Employee Withholding Form involves several straightforward steps:

- Obtain the form: The form can be downloaded from the Mississippi Department of Revenue website or obtained from your employer.

- Fill in personal information: Enter your name, address, and Social Security number accurately.

- Select filing status: Choose your filing status, which can be single, married, or head of household.

- Claim allowances: Indicate the number of allowances you wish to claim based on your tax situation.

- Sign and date: Ensure you sign and date the form to validate your information.

Once completed, the form should be submitted to your employer for processing.

Legal Use of the Mississippi Employee Withholding Form

The Mississippi Employee Withholding Form is legally binding and must be filled out accurately to comply with state tax regulations. Employers are required to withhold the appropriate amount of state income tax based on the information provided on this form. Failure to comply with withholding requirements can lead to penalties for both employers and employees. It is important to keep the form updated, especially after significant life changes such as marriage or the birth of a child, which may affect your tax situation.

How to Obtain the Mississippi Employee Withholding Form

To obtain the Mississippi Employee Withholding Form, you can:

- Visit the Mississippi Department of Revenue website where the form is available for download.

- Request a copy from your employer, who should have the form readily available for new hires.

- Contact the Mississippi Department of Revenue directly if you have difficulty accessing the form online.

Having the correct and most recent version of the form is crucial for accurate tax withholding.

Filing Deadlines and Important Dates

Understanding the filing deadlines for the Mississippi Employee Withholding Form is essential to avoid penalties. Typically, the form should be submitted to your employer upon starting a new job or whenever there is a change in your tax situation. Employers must ensure that withholding is adjusted accordingly and reported on a regular basis, usually in conjunction with payroll schedules. Keeping track of these deadlines helps maintain compliance with state tax laws.

Key Elements of the Mississippi Employee Withholding Form

The Mississippi Employee Withholding Form includes several key elements that are important for accurate tax withholding:

- Personal Information: This section requires your name, address, and Social Security number.

- Filing Status: You must select your filing status, which influences your tax rate.

- Allowances: The number of allowances you claim affects the amount withheld from your paycheck.

- Signature: Your signature certifies that the information provided is accurate and complete.

Each of these elements plays a critical role in ensuring that the correct amount of state income tax is withheld from your earnings.

Quick guide on how to complete form 89 350 1 000 rev mississippi employees

Effortlessly Prepare Form 89 350 1 000 Rev MISSISSIPPI EMPLOYEE'S on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Manage Form 89 350 1 000 Rev MISSISSIPPI EMPLOYEE'S on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

The easiest method to modify and eSign Form 89 350 1 000 Rev MISSISSIPPI EMPLOYEE'S seamlessly

- Find Form 89 350 1 000 Rev MISSISSIPPI EMPLOYEE'S and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 89 350 1 000 Rev MISSISSIPPI EMPLOYEE'S to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the ms state withholding form for?

The ms state withholding form is essential for employees to report the amount of state income tax withheld from their paychecks. This form ensures that the correct amount of taxes is withheld based on your income level and tax situation in Mississippi.

-

How can I obtain the ms state withholding form using airSlate SignNow?

You can easily obtain the ms state withholding form through airSlate SignNow by accessing our templates library. Simply select the document you need, fill it out online, and send it for eSignature efficiently.

-

Is there a cost associated with using airSlate SignNow for the ms state withholding form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that allows unlimited access to important documents like the ms state withholding form at a reasonable rate.

-

What are the main features of airSlate SignNow when handling the ms state withholding form?

airSlate SignNow provides features like customizable templates, eSignature capabilities, and cloud storage for easy access to your ms state withholding form. This makes managing your documents efficient and secure.

-

How does airSlate SignNow ensure the security of my ms state withholding form?

With airSlate SignNow, your ms state withholding form is protected through advanced encryption methods and secure cloud hosting. This ensures that your sensitive information remains confidential and accessible only to authorized users.

-

Can I integrate airSlate SignNow with other applications for the ms state withholding form?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage your ms state withholding form alongside your other business tools. This ensures a smooth workflow and efficient document handling.

-

What benefits do I get from using airSlate SignNow for my ms state withholding form?

By using airSlate SignNow for your ms state withholding form, you gain a streamlined process for document management, faster turnaround times for signatures, and improved compliance. These benefits contribute to enhanced productivity for your business.

Get more for Form 89 350 1 000 Rev MISSISSIPPI EMPLOYEE'S

Find out other Form 89 350 1 000 Rev MISSISSIPPI EMPLOYEE'S

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure

- Sign Virginia Lodger Agreement Template Safe

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template