Home Treasury Govtic Slt Form and InstructionsTIC SLT Form and InstructionsU S Department of the Treasury 2022

Understanding the IRS Instructions Residency

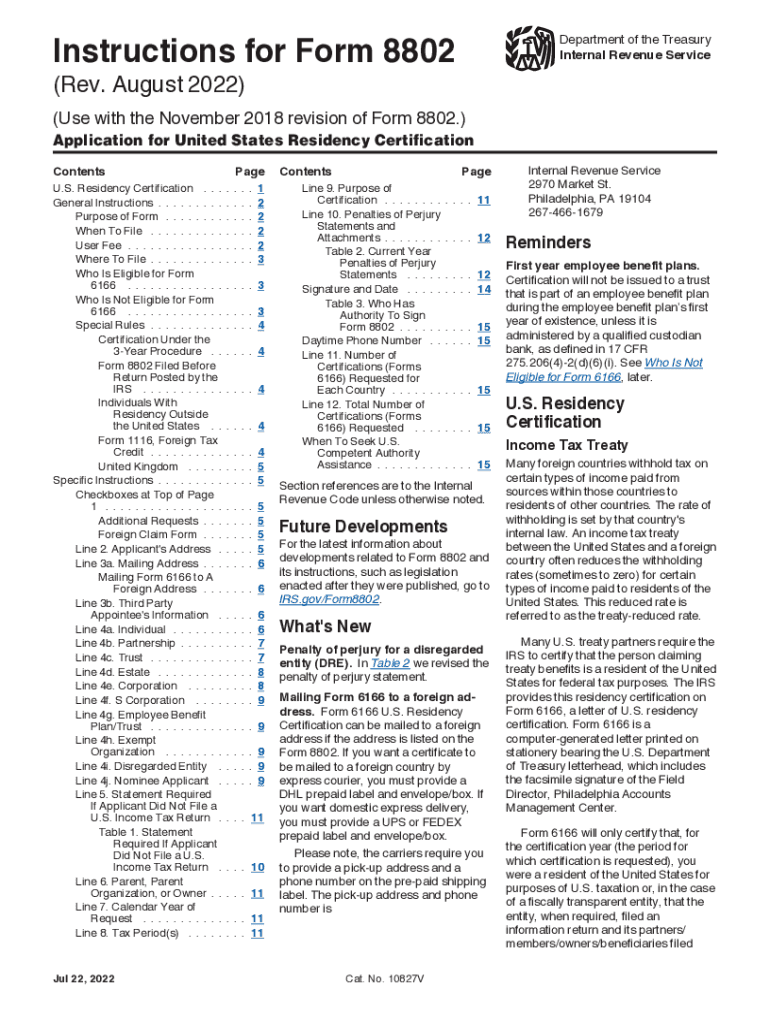

The IRS instructions residency form, often referred to as the 8802 instructions, is essential for individuals seeking to obtain a certification of residency for tax purposes. This form is particularly relevant for those who need to claim tax treaty benefits or avoid double taxation. Understanding the specific requirements and guidelines outlined in the 8802 instructions is crucial for successful completion and submission.

Steps to Complete the 8802 Instructions Application

Completing the 8802 instructions application involves several steps to ensure accuracy and compliance. Begin by gathering all necessary personal information, including your Social Security number and relevant tax identification numbers. Next, fill out the form carefully, ensuring that all sections are completed as per the guidelines. Review the form for any errors before submission. It is advisable to keep a copy of the completed application for your records.

Required Documents for the 8802 Instructions Form

When filling out the 8802 instructions form, you will need to provide specific documents to support your application. Commonly required documents include proof of residency, such as tax returns or utility bills, and any relevant identification. Ensure that all documents are current and clearly legible to avoid delays in processing your application.

Legal Use of the 8802 Instructions Form

The legal use of the 8802 instructions form is governed by IRS regulations, which stipulate that the form must be completed accurately to be considered valid. This form allows individuals to certify their residency status, which is crucial for tax treaty claims. Failure to adhere to the guidelines may result in penalties or delays in processing, emphasizing the importance of understanding the legal implications of your submission.

Filing Deadlines for the 8802 Instructions

It is important to be aware of the filing deadlines associated with the 8802 instructions form. Generally, applications should be submitted well in advance of any tax deadlines to ensure timely processing. Specific deadlines may vary based on individual circumstances, so it is advisable to check the IRS guidelines for the most accurate information regarding your situation.

Form Submission Methods for the 8802 Instructions

The 8802 instructions form can be submitted through various methods, including online submission, mail, or in-person delivery. Each method has its own advantages, such as faster processing times for online submissions. When choosing a submission method, consider your personal preferences and the urgency of your application to ensure it is handled appropriately.

Quick guide on how to complete hometreasurygovtic slt form and instructionstic slt form and instructionsus department of the treasury

Effortlessly Prepare Home treasury govtic slt form and instructionsTIC SLT Form And InstructionsU S Department Of The Treasury on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly and without delays. Manage Home treasury govtic slt form and instructionsTIC SLT Form And InstructionsU S Department Of The Treasury on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Method to Edit and eSign Home treasury govtic slt form and instructionsTIC SLT Form And InstructionsU S Department Of The Treasury with Ease

- Find Home treasury govtic slt form and instructionsTIC SLT Form And InstructionsU S Department Of The Treasury and click Get Form to begin.

- Use the tools available to complete your document.

- Highlight important sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Edit and eSign Home treasury govtic slt form and instructionsTIC SLT Form And InstructionsU S Department Of The Treasury while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hometreasurygovtic slt form and instructionstic slt form and instructionsus department of the treasury

Create this form in 5 minutes!

People also ask

-

What are the basic instructions residency details for using airSlate SignNow?

To get started with airSlate SignNow, users need to create an account, upload their documents, and follow the provided instructions residency to send them for eSignature. The platform offers a user-friendly interface that simplifies document management and signing processes. With clear prompts and helpful tips, users can navigate the signing process easily.

-

How much does airSlate SignNow cost and what are the pricing instructions residency?

airSlate SignNow offers several pricing tiers tailored to fit different business needs, with clear instructions residency available on the pricing page. Each plan includes various features, such as document templates and custom branding. Customers can choose a plan that best fits their budget and requirements.

-

What features does airSlate SignNow provide for electronic signatures?

AirSlate SignNow includes features like customizable templates, advanced security options, and workflow automation— all vital instructions residency for an efficient signing process. Users can track document statuses, send reminders, and integrate with other tools for seamless operations. These features enhance productivity and ensure compliance.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow supports numerous integrations with popular software such as Google Drive and Salesforce. Clear instructions residency on how to connect these tools can be found in the integration section of the website. This flexibility allows businesses to streamline their workflows and enhance document management.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides businesses with a cost-effective, efficient way to manage eSignatures. The platform reduces time spent on paperwork and increases workflow efficiency, aligning perfectly with the instructions residency for modern businesses. With enhanced tracking and security features, it offers peace of mind and improved operational agility.

-

Are there any specific instructions residency for document security?

Absolutely! airSlate SignNow employs robust security protocols, including encryption and compliance with industry standards, ensuring safe handling of documents. The platform provides instructions residency on its security features, so users can confidently manage sensitive information. Regular audits and user access controls further enhance document protection.

-

How can I get support if I have questions about the instructions residency?

airSlate SignNow offers several support options, including a comprehensive knowledge base, live chat, and email support. Users can find detailed instructions residency for troubleshooting common issues and accessing help. The dedicated support team is available to assist with any specific queries, ensuring that users make the most out of the platform.

Get more for Home treasury govtic slt form and instructionsTIC SLT Form And InstructionsU S Department Of The Treasury

- Warranty deed from husband and wife to a trust new mexico form

- Health form request change

- Warranty deed from husband to himself and wife new mexico form

- Quitclaim deed from husband to himself and wife new mexico form

- New mexico workers form

- New mexico authorization form

- Quitclaim deed from husband and wife to husband and wife new mexico form

- Nm husband wife form

Find out other Home treasury govtic slt form and instructionsTIC SLT Form And InstructionsU S Department Of The Treasury

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online