Statistical Abstract of North Carolina Taxes NCDOR Form

Eligibility criteria for the 2022 property relief

To qualify for the 2022 property relief, applicants must meet specific eligibility criteria set by the North Carolina Department of Revenue. Generally, applicants must be property owners and may need to demonstrate financial need or meet age requirements. Common criteria include:

- Ownership of the property for which relief is sought.

- Meeting income limits as defined by state regulations.

- Being a senior citizen, disabled, or a veteran may provide additional eligibility.

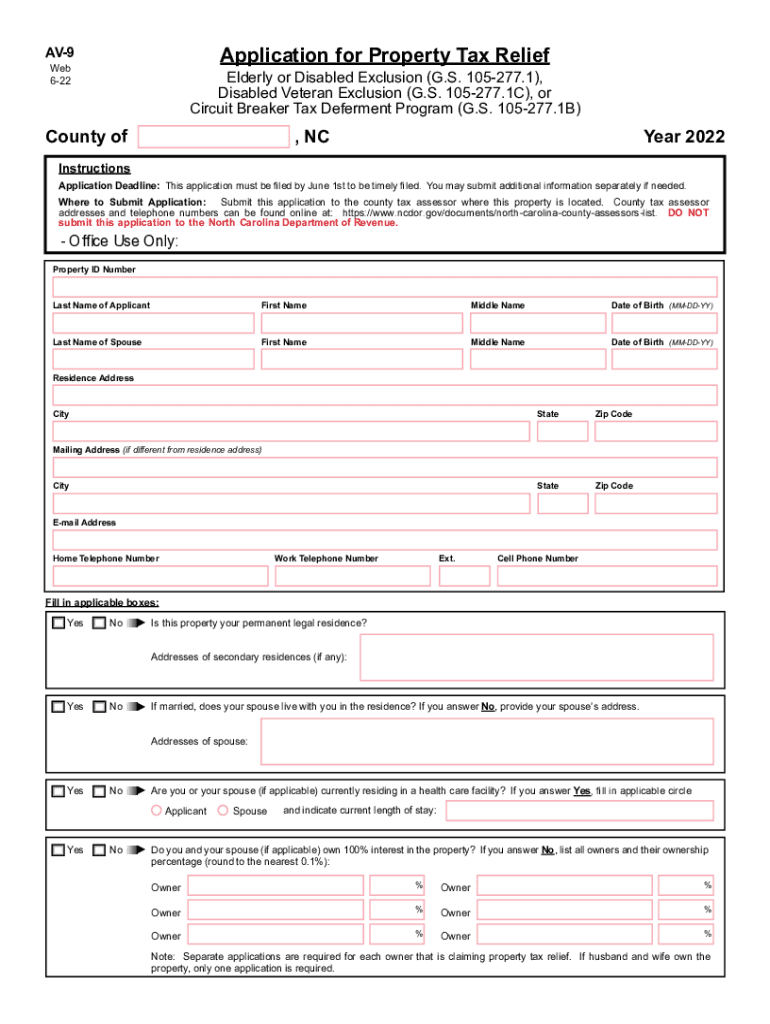

Steps to complete the 2022 property relief application

Completing the 2022 property relief application involves several steps to ensure accuracy and compliance with state requirements. Follow these steps for a successful application:

- Gather necessary documentation, including proof of income and property ownership.

- Obtain the 2022 application form, often referred to as the 2022 av9 form.

- Fill out the application thoroughly, ensuring all required fields are completed.

- Review the application for accuracy and completeness before submission.

- Submit the application by the designated deadline, either online or via mail.

Required documents for the 2022 property relief

When applying for the 2022 property relief, specific documents are required to support your application. These documents may include:

- Proof of income, such as tax returns or pay stubs.

- Documentation of property ownership, like a deed or property tax statement.

- Identification documents, such as a driver's license or Social Security card.

Form submission methods for the 2022 property relief

Applicants have several options for submitting their 2022 property relief application. Understanding these methods can help streamline the process:

- Online submission: Many applicants prefer to submit their applications electronically through the state’s online portal.

- Mail submission: Applications can be printed and sent via postal service to the appropriate local tax office.

- In-person submission: Applicants may also choose to deliver their applications directly to local tax offices.

Important deadlines for the 2022 property relief

Staying informed about key deadlines is crucial for a successful application. The following dates are typically important for the 2022 property relief process:

- Application deadline: Generally, applications must be submitted by a specific date in the spring.

- Notification of approval: Applicants can expect to receive notification of their application status within a few weeks after submission.

Penalties for non-compliance with the 2022 property relief guidelines

Failing to comply with the guidelines for the 2022 property relief can result in penalties. Understanding these consequences is important for applicants:

- Potential loss of property relief benefits for the year.

- Possible fines or penalties if the application is found to be fraudulent.

Quick guide on how to complete statistical abstract of north carolina taxes 2004 ncdor

Complete Statistical Abstract Of North Carolina Taxes NCDOR effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Statistical Abstract Of North Carolina Taxes NCDOR on any device using airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Statistical Abstract Of North Carolina Taxes NCDOR without hassle

- Locate Statistical Abstract Of North Carolina Taxes NCDOR and click on Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools offered by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Statistical Abstract Of North Carolina Taxes NCDOR and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is 2022 property relief and how does it work?

2022 property relief refers to the tax benefits available for property owners to help reduce their taxable income. By qualifying for the 2022 property relief, individuals can maximize deductions on their property taxes, potentially lowering their overall expenses. Understanding how to leverage this relief in your documentation can simplify the tax preparation process.

-

How can airSlate SignNow assist with documentation for 2022 property relief?

With airSlate SignNow, you can effortlessly send and eSign your property relief documents online. The platform's user-friendly interface allows you to manage all your paperwork efficiently, ensuring you meet deadlines related to 2022 property relief applications. This can save you both time and money during tax season.

-

What features does airSlate SignNow offer for managing property relief documents?

airSlate SignNow offers features such as eSignature, templates, and document management to streamline the process of filing for 2022 property relief. Additionally, the platform allows for secure storage and easy access to your documents anytime, ensuring compliance and organization. These features make it easier to keep track of your property relief applications.

-

Is there a cost associated with using airSlate SignNow for 2022 property relief?

Yes, airSlate SignNow provides various pricing plans tailored to fit different business needs, including those looking to manage 2022 property relief documents. The pricing is cost-effective, allowing you to pay only for the features you need. With the time and resources saved, your investment can prove beneficial when applying for property relief.

-

What benefits can I expect from using airSlate SignNow for property relief processes?

Using airSlate SignNow for your property relief documentation offers numerous benefits, including enhanced efficiency and reduced turnaround time for approvals. The ability to eSign documents quickly means that you can file for 2022 property relief sooner rather than later. Additionally, the platform provides real-time updates and reminders to keep you on track.

-

Does airSlate SignNow integrate with other software to support property relief applications?

Yes, airSlate SignNow integrates seamlessly with various software applications to enhance your property relief application process. This means you can connect it with your accounting software and other tools to keep all your information synchronized. Such integrations help ensure that all your data related to 2022 property relief is accurate and easily accessible.

-

How secure is airSlate SignNow in handling sensitive property relief documents?

airSlate SignNow prioritizes security by employing advanced encryption and secure access protocols for handling sensitive property relief documents. This ensures that your personal and financial information remains protected during the eSigning process. You can confidently use our platform knowing that your 2022 property relief documentation is safe.

Get more for Statistical Abstract Of North Carolina Taxes NCDOR

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children nevada form

- Nevada order protection form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497320488 form

- Nv purchase 497320489 form

- Nevada corporation 497320490 form

- Nv corporation form

- Pre incorporation agreement document form

- Nevada bylaws form

Find out other Statistical Abstract Of North Carolina Taxes NCDOR

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document