Form D1 XB "Business Income Tax Return Request for Extension

What is the Form D1 XB "Business Income Tax Return Request For Extension

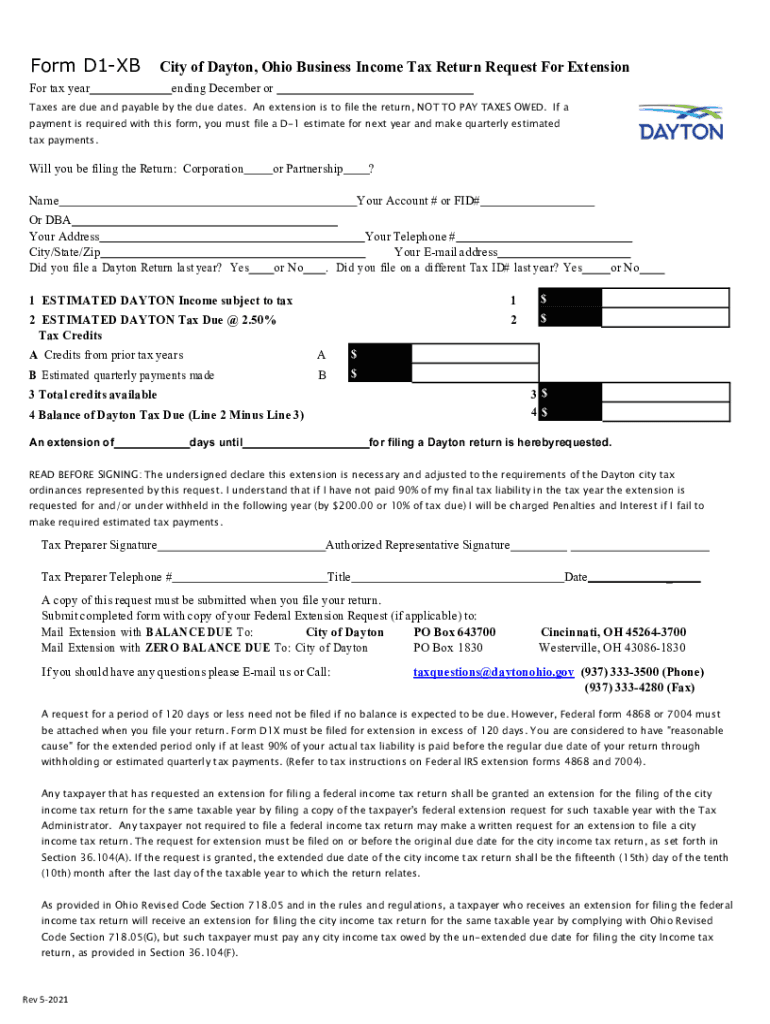

The Form D1 XB is a specific document used by businesses in Ohio to request an extension for filing their income tax returns. This form is essential for those who need additional time to prepare their tax documents, ensuring compliance with state regulations. By submitting this request, businesses can avoid penalties associated with late filing, provided they meet the necessary requirements.

How to use the Form D1 XB "Business Income Tax Return Request For Extension

To effectively use the Form D1 XB, businesses should first gather all relevant financial information and documentation. The form requires specific details about the business, including its name, address, and tax identification number. Once completed, the form can be submitted electronically or via mail, depending on the preferences of the business. It is crucial to ensure that the form is filled out accurately to avoid delays in processing.

Steps to complete the Form D1 XB "Business Income Tax Return Request For Extension

Completing the Form D1 XB involves several key steps:

- Gather necessary financial documents, including profit and loss statements.

- Fill in the business information, ensuring accuracy in the name and tax ID.

- Indicate the reason for the extension request, if applicable.

- Review the form for completeness and accuracy before submission.

- Submit the form electronically or by mail before the deadline.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form D1 XB is crucial for compliance. Typically, businesses must submit this form by the original due date of their income tax return. Extensions granted through this form generally provide an additional six months for filing the complete return. It is advisable to check the Ohio Department of Taxation's website for any updates or changes to these deadlines.

Penalties for Non-Compliance

Failure to file the Form D1 XB by the deadline can result in significant penalties for businesses. These penalties may include late fees and interest on any unpaid taxes. Additionally, not filing for an extension when needed can lead to further complications, such as audits or additional scrutiny from tax authorities. It is essential for businesses to adhere to the filing requirements to avoid these consequences.

Legal use of the Form D1 XB "Business Income Tax Return Request For Extension

The legal use of the Form D1 XB is governed by Ohio tax laws. To be considered valid, the form must be completed accurately and submitted on time. Electronic submissions are recognized as legally binding, provided they comply with the necessary eSignature laws. Businesses should ensure they maintain copies of submitted forms for their records, as this documentation may be required for future reference or audits.

Quick guide on how to complete form d1 xb ampquotbusiness income tax return request for extension

Complete Form D1 XB "Business Income Tax Return Request For Extension effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Form D1 XB "Business Income Tax Return Request For Extension across any platform with the airSlate SignNow Android or iOS applications and streamline any document-based workflow today.

The simplest way to modify and eSign Form D1 XB "Business Income Tax Return Request For Extension seamlessly

- Find Form D1 XB "Business Income Tax Return Request For Extension and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form D1 XB "Business Income Tax Return Request For Extension and ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for businesses in Ohio Dayton?

airSlate SignNow provides a range of features tailored for businesses in Ohio Dayton, including document templates, eSignature capabilities, and automated workflows. These tools help streamline your document processes, making it easy to send, sign, and manage paperwork efficiently. Additionally, the intuitive interface ensures that users can adopt the platform with minimal training.

-

How does airSlate SignNow benefit small businesses in Ohio Dayton?

For small businesses in Ohio Dayton, airSlate SignNow offers a cost-effective and user-friendly solution to manage documents electronically. By reducing the need for paper and in-person signatures, businesses can save time and reduce operational costs. This allows small business owners to focus on growth and customer service without being bogged down by administrative tasks.

-

What are the pricing plans for airSlate SignNow in Ohio Dayton?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes in Ohio Dayton. Whether you are a startup or an established enterprise, you can find a plan that meets your budget and needs. There are options for monthly and annual subscriptions, often with discounts for long-term commitments.

-

Can airSlate SignNow integrate with other tools used by businesses in Ohio Dayton?

Yes, airSlate SignNow seamlessly integrates with a variety of tools and platforms commonly used by businesses in Ohio Dayton. This includes CRM systems, payment processors, and cloud storage services, thereby streamlining your workflows. By connecting airSlate SignNow with your existing tools, you can enhance productivity and ensure a smooth document management process.

-

Is airSlate SignNow compliant with Ohio Dayton regulations?

airSlate SignNow is designed to be compliant with various regulations, including those specific to Ohio Dayton. The platform adheres to eSignature laws and security standards, ensuring that your documents are legally binding and secure. This gives peace of mind to businesses, knowing that their electronic transactions meet all necessary legal requirements.

-

What support options are available for airSlate SignNow users in Ohio Dayton?

Users in Ohio Dayton have access to a variety of support options with airSlate SignNow. This includes a comprehensive online knowledge base, FAQs, and customer support via chat and email. Whether you need technical assistance or have questions about features, the support team is ready to help, ensuring you can maximize your use of the platform.

-

How secure is airSlate SignNow for businesses in Ohio Dayton?

Security is a top priority for airSlate SignNow, especially for businesses operating in Ohio Dayton. The platform employs industry-standard encryption and security protocols to protect your sensitive documents and data. Regular security audits and compliance measures ensure that your information remains safe throughout the entire document lifecycle.

Get more for Form D1 XB "Business Income Tax Return Request For Extension

- Notice of pendency of action corporation or llc nevada form

- Nv lien 497320699 form

- Assignment of deed of trust by individual mortgage holder nevada form

- Nevada holder form

- Nevada 7 day form

- Nevada month to month lease form

- 7 day notice to terminate month to month lease residential from tenant to landlord nevada form

- Terminate tenant form

Find out other Form D1 XB "Business Income Tax Return Request For Extension

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement