Taxes Form

What is the Taxes Form

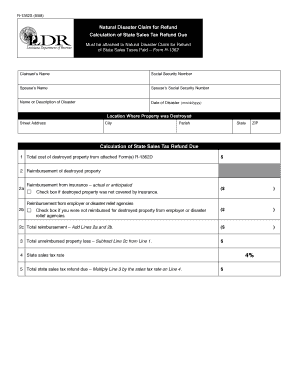

The Louisiana revenue state taxes form is a document used by individuals and businesses to report their income and calculate the amount of taxes owed to the state. This form is essential for compliance with state tax laws and is typically required annually. It includes sections for reporting various types of income, deductions, and credits that may apply to the taxpayer's situation. Understanding the purpose and structure of this form is crucial for accurate tax reporting.

Steps to Complete the Taxes Form

Completing the Louisiana revenue state taxes form involves several key steps:

- Gather necessary documentation, including W-2s, 1099s, and any other income statements.

- Review the instructions provided with the form to understand the requirements and sections.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income in the designated sections of the form.

- Claim any applicable deductions or credits to reduce your taxable income.

- Calculate the total tax owed or refund expected based on the information provided.

- Sign and date the form before submission.

Legal Use of the Taxes Form

The Louisiana revenue state taxes form is legally binding once signed and submitted. It is important to ensure that all information provided is accurate and truthful, as discrepancies can lead to penalties or audits. The form must be completed in accordance with state regulations, and eSignatures are considered valid under the law, provided they comply with the relevant legal frameworks.

Filing Deadlines / Important Dates

Taxpayers in Louisiana should be aware of important deadlines related to the revenue state taxes form. Typically, the filing deadline for individual income tax returns is May fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be mindful of any specific deadlines for estimated tax payments or extensions, which can vary based on individual circumstances.

Required Documents

To accurately complete the Louisiana revenue state taxes form, certain documents are required. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for deductions, such as mortgage interest statements or medical expenses

- Proof of any tax credits claimed

Having these documents on hand will streamline the process and help ensure that all income and deductions are reported correctly.

Form Submission Methods (Online / Mail / In-Person)

The Louisiana revenue state taxes form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through state tax websites, which often offer e-filing options for convenience.

- Mailing a paper copy of the completed form to the appropriate state tax office.

- In-person submission at designated state tax offices, which may be useful for those needing assistance.

Choosing the right submission method can depend on personal preferences and the complexity of the tax situation.

Quick guide on how to complete taxes form

Effortlessly prepare Taxes Form on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Taxes Form on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and electronically sign Taxes Form effortlessly

- Obtain Taxes Form and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and bears the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your adjustments.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, time-consuming form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements with just a few clicks from any device you choose. Modify and electronically sign Taxes Form and ensure seamless communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxes form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using airSlate SignNow for managing louisiana revenue state taxes?

Using airSlate SignNow simplifies the process of managing louisiana revenue state taxes. It allows businesses to securely eSign documents, improving efficiency and saving time. This platform also ensures compliance with state regulations, helping you navigate the complexities of tax documentation.

-

How does airSlate SignNow integrate with accounting software for louisiana revenue state taxes?

airSlate SignNow seamlessly integrates with popular accounting software, enabling businesses to manage their louisiana revenue state taxes more effectively. This integration allows for easy document sharing and signing within the tools you already use, streamlining your tax processes. With airSlate SignNow, you can ensure that all tax-related documents are organized and accessible.

-

What features does airSlate SignNow offer specifically for louisiana revenue state taxes?

airSlate SignNow offers features tailored for handling louisiana revenue state taxes, including customizable templates for tax forms and automated reminders for important deadlines. The platform ensures that all documents are securely stored and easily retrievable, facilitating a smoother review process. Additionally, electronic signatures are legally binding, providing assurance in your tax dealings.

-

Is airSlate SignNow cost-effective for businesses dealing with louisiana revenue state taxes?

Yes, airSlate SignNow is a cost-effective solution for businesses handling louisiana revenue state taxes. With competitive pricing structures, you can choose a plan that fits your needs without compromising on functionality. The efficiency gained through this service can save you time and resources, making it a valuable investment.

-

How does airSlate SignNow ensure compliance with louisiana revenue state taxes?

airSlate SignNow is designed with compliance in mind, particularly concerning louisiana revenue state taxes. The platform adheres to the latest legal standards for electronic signatures to ensure that all signed documents are valid and accepted by state authorities. Regular updates help users stay informed about any changes in tax laws and regulations.

-

Can airSlate SignNow help with the preparation of documents related to louisiana revenue state taxes?

Absolutely! airSlate SignNow helps simplify the preparation of documents for louisiana revenue state taxes by providing user-friendly tools for creating and editing tax forms. Its templates are designed to meet state requirements, ensuring that businesses have the necessary documents ready for submission. This streamlines the entire tax preparation process.

-

What security measures does airSlate SignNow implement for documents related to louisiana revenue state taxes?

Security is a top priority for airSlate SignNow, especially for sensitive documents related to louisiana revenue state taxes. The platform employs advanced encryption methods to protect all data, ensuring that your tax documents remain confidential and secure. Additionally, access controls help you manage who can view or edit specific documents.

Get more for Taxes Form

Find out other Taxes Form

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later