Revenue Louisiana GovTaxForms1060909oldFFarm Equipment Sales Tax Exemption Certificate Louisiana 2022-2026

Understanding the 1060 Tax Form

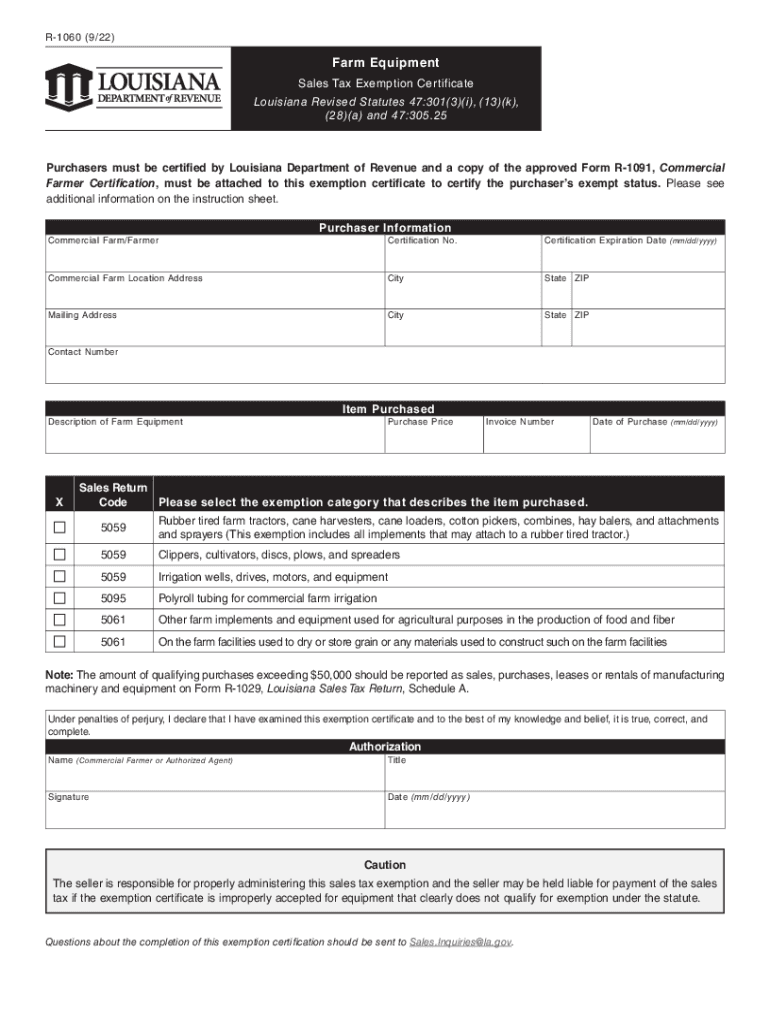

The 1060 tax form, also known as the Louisiana Farm Tax Exemption Form, is essential for farmers in Louisiana seeking to claim exemptions on sales tax for specific agricultural purchases. This form allows eligible farmers to avoid paying sales tax on certain equipment and supplies necessary for farming operations. Understanding the requirements and proper use of this form is crucial for compliance with state tax regulations.

Steps to Complete the 1060 Tax Form

Completing the 1060 tax form involves several key steps:

- Gather necessary information, including your business details and tax identification number.

- Identify the specific items for which you are claiming a sales tax exemption.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors before submission.

- Submit the completed form to the appropriate state department, either online or via mail.

Eligibility Criteria for the 1060 Tax Form

To qualify for the exemptions provided by the 1060 tax form, applicants must meet specific eligibility criteria. Generally, this includes:

- Being a registered farmer in Louisiana.

- Using the purchased items primarily for agricultural production.

- Providing proof of agricultural activity if requested by the state.

Legal Use of the 1060 Tax Form

The legal use of the 1060 tax form is governed by Louisiana state tax laws. It is important to ensure that the form is used solely for its intended purpose. Misuse of the form, such as claiming exemptions for non-qualifying purchases, can lead to penalties and legal repercussions.

Form Submission Methods

Farmers can submit the 1060 tax form through various methods, including:

- Online submission via the Louisiana Department of Revenue website.

- Mailing the completed form to the designated state office.

- In-person submission at local tax offices, if available.

Key Elements of the 1060 Tax Form

Key elements of the 1060 tax form include:

- Identification of the applicant and their farming operation.

- Detailed description of the items for which the exemption is claimed.

- Signature of the applicant, confirming the accuracy of the information provided.

IRS Guidelines Related to the 1060 Tax Form

While the 1060 tax form is specific to Louisiana, it is important to understand how it aligns with IRS guidelines. Farmers must ensure compliance with federal tax regulations regarding agricultural exemptions and reporting. This may include maintaining accurate records of purchases and usage of exempt items.

Quick guide on how to complete revenuelouisianagovtaxforms1060909oldffarm equipment sales tax exemption certificate louisiana

Complete Revenue louisiana govTaxForms1060909oldFFarm Equipment Sales Tax Exemption Certificate Louisiana effortlessly on any device

Managing documents online has gained traction with businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Revenue louisiana govTaxForms1060909oldFFarm Equipment Sales Tax Exemption Certificate Louisiana on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The simplest way to edit and eSign Revenue louisiana govTaxForms1060909oldFFarm Equipment Sales Tax Exemption Certificate Louisiana with ease

- Obtain Revenue louisiana govTaxForms1060909oldFFarm Equipment Sales Tax Exemption Certificate Louisiana and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere moments and carries the same legal validity as a traditional ink signature.

- Review all the information carefully and click on the Done button to save your changes.

- Choose how you'd like to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in a few clicks, from any device of your choosing. Modify and eSign Revenue louisiana govTaxForms1060909oldFFarm Equipment Sales Tax Exemption Certificate Louisiana and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenuelouisianagovtaxforms1060909oldffarm equipment sales tax exemption certificate louisiana

Create this form in 5 minutes!

People also ask

-

What is form 1060?

Form 1060 is a key document used in various business transactions. It streamlines the process of signing and managing important contracts, making it essential for efficiency. Utilizing toolsets like airSlate SignNow can enhance your experience with form 1060.

-

How can airSlate SignNow help with form 1060?

AirSlate SignNow simplifies the process of handling form 1060 by allowing businesses to eSign documents quickly and securely. Our intuitive platform ensures that you can manage your forms seamlessly, reducing administrative burdens. With robust tracking features, you can monitor the status of your form 1060 at any time.

-

Is there a cost associated with using airSlate SignNow for form 1060?

Yes, airSlate SignNow offers flexible pricing plans tailored to businesses of all sizes. Our subscription includes features specifically designed for managing documents like form 1060. You can select a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for form 1060?

AirSlate SignNow provides comprehensive features for managing form 1060, including customizable templates, eSigning capabilities, and secure cloud storage. These tools enhance collaboration and ensure that your documents are handled efficiently. Additionally, you can integrate with other platforms to simplify your workflows.

-

Can I integrate airSlate SignNow with other software while working on form 1060?

Absolutely! AirSlate SignNow supports integration with various software applications, enhancing your efficiency with form 1060. Whether you're using CRM systems or document management tools, you can ensure a seamless workflow. This interoperability helps in maintaining consistent processes across your organization.

-

What are the benefits of using airSlate SignNow for form 1060?

Using airSlate SignNow for form 1060 offers numerous benefits, including increased efficiency in document signing, enhanced security, and reduced paper waste. Our platform provides real-time tracking and reminders, which ensures timely completion of your forms. This way, you can focus on your core business activities.

-

How secure is airSlate SignNow when handling form 1060?

Security is a top priority at airSlate SignNow when dealing with form 1060. We utilize advanced encryption and authentication protocols to protect your documents. Additionally, regular audits and compliance with industry standards ensure that your data remains secure and confidential.

Get more for Revenue louisiana govTaxForms1060909oldFFarm Equipment Sales Tax Exemption Certificate Louisiana

- New york rental form

- Apartment lease rental application questionnaire new york form

- Residential rental lease application new york form

- Salary verification form for potential lease new york

- Landlord agreement tenant form

- Notice default lease form

- Landlord tenant lease co signer agreement new york form

- Application for sublease new york form

Find out other Revenue louisiana govTaxForms1060909oldFFarm Equipment Sales Tax Exemption Certificate Louisiana

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online