Rev State La UsHome Page Louisiana Department of Revenue 2022-2026

Understanding the Louisiana R-1085 Form

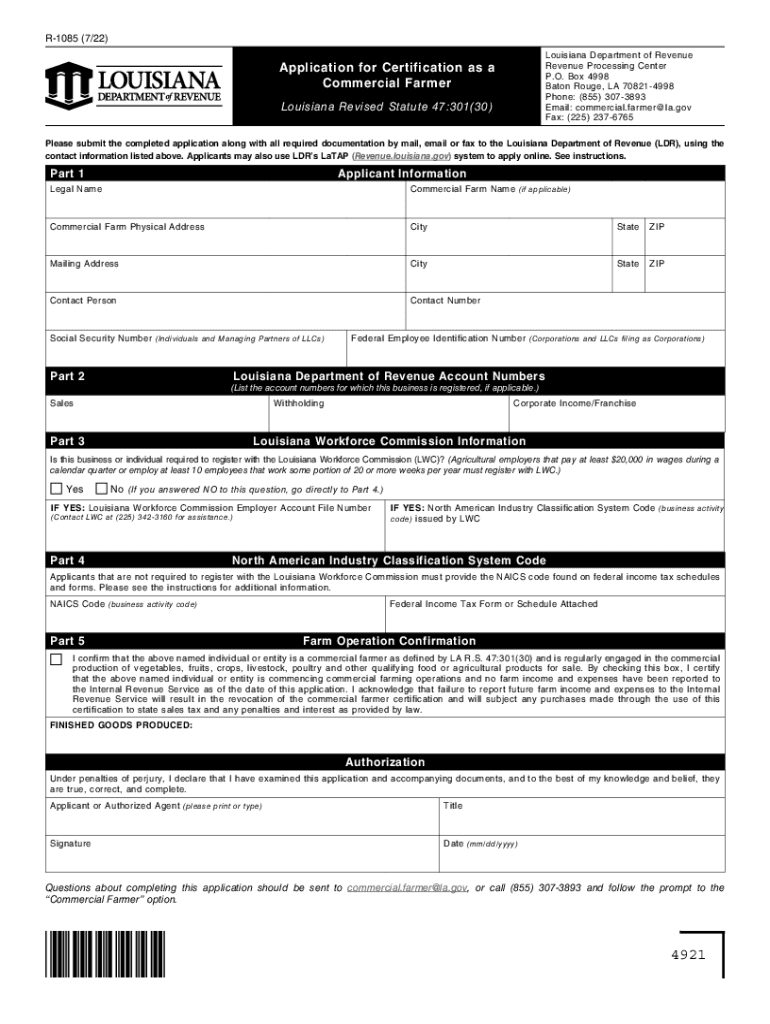

The Louisiana R-1085 form is essential for farmers in Louisiana, serving as a certification document that verifies their status as a commercial farmer. This form is particularly important for those seeking various tax benefits, exemptions, and compliance with state regulations. By accurately completing the R-1085 form, a louisiana farmer can ensure they meet the necessary criteria set by the Louisiana Department of Revenue.

Steps to Complete the Louisiana R-1085 Form

Completing the Louisiana R-1085 form involves several key steps. First, gather all required information, including personal identification details, farming operation specifics, and any relevant financial data. Next, accurately fill out each section of the form, ensuring that all information is complete and correct. Once the form is filled out, review it for accuracy before submission. This careful attention to detail helps prevent delays in processing and ensures compliance with state regulations.

Required Documents for the R-1085 Application

To successfully submit the Louisiana R-1085 application, certain documents are necessary. These may include proof of farming operations, such as sales receipts, tax returns, or other financial statements that demonstrate the applicant's status as a commercial farmer. Additionally, identification documents may be required to verify the applicant's identity and residency in Louisiana. Ensuring all required documents are included with the application can streamline the approval process.

Eligibility Criteria for the R-1085 Form

Eligibility for the Louisiana R-1085 form is primarily based on the applicant's status as a commercial farmer. This status is determined by the scale of farming operations, types of crops or livestock raised, and adherence to state agricultural regulations. Applicants must demonstrate that their farming activities contribute to the agricultural economy of Louisiana. Understanding these criteria is crucial for potential applicants to ensure they qualify for the benefits associated with the R-1085 form.

Form Submission Methods for the R-1085

The Louisiana R-1085 form can be submitted through various methods, providing flexibility for applicants. Farmers can choose to submit the form online via the Louisiana Department of Revenue's website, which offers a streamlined process for digital submissions. Alternatively, applicants can mail the completed form to the appropriate department or deliver it in person at designated locations. Each submission method has its own requirements and processing times, so it is important to select the method that best suits the applicant's needs.

Penalties for Non-Compliance with the R-1085

Failure to comply with the requirements associated with the Louisiana R-1085 form can result in significant penalties. These may include fines, loss of tax exemptions, or other legal repercussions. It is essential for louisiana farmers to stay informed about their obligations under state law and ensure timely and accurate submission of the R-1085 form. Understanding the potential consequences of non-compliance can motivate farmers to adhere to all necessary regulations.

Digital vs. Paper Version of the R-1085 Form

Farmers have the option to complete the Louisiana R-1085 form in either digital or paper format. The digital version offers advantages such as easier access, quicker submission, and immediate confirmation of receipt. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods or lack reliable internet access. Regardless of the format chosen, it is crucial to ensure that the form is completed accurately to maintain compliance with state regulations.

Quick guide on how to complete revstatelaushome page louisiana department of revenue

Complete Rev state la usHome Page Louisiana Department Of Revenue effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct format and securely preserve it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your files quickly and without delays. Manage Rev state la usHome Page Louisiana Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Rev state la usHome Page Louisiana Department Of Revenue easily

- Locate Rev state la usHome Page Louisiana Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form-finding, and mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Rev state la usHome Page Louisiana Department Of Revenue and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revstatelaushome page louisiana department of revenue

Create this form in 5 minutes!

People also ask

-

How can airSlate SignNow benefit a Louisiana farmer?

AirSlate SignNow streamlines the document signing process for a Louisiana farmer, allowing them to quickly and securely eSign contracts, agreements, and forms online. This efficiency can save valuable time and reduce paperwork clutter, enabling farmers to focus more on their agricultural tasks. Additionally, the platform is designed to be user-friendly, making it accessible for farmers of all tech skill levels.

-

What pricing options are available for Louisiana farmers using airSlate SignNow?

AirSlate SignNow offers competitive pricing plans that cater to the needs of a Louisiana farmer. These plans include monthly and annual subscriptions, ensuring that farmers can select the option that best fits their budget. The platform also provides a free trial, allowing farmers to explore its features before committing to a subscription.

-

What key features of airSlate SignNow are essential for a Louisiana farmer?

Essential features of airSlate SignNow for a Louisiana farmer include customizable templates, automated workflows, and easy document tracking. These tools enable farmers to create and manage documents tailored to their specific needs efficiently. Moreover, the ability to integrate with popular software enhances productivity by centralizing all documentation efforts.

-

Is airSlate SignNow user-friendly for a Louisiana farmer with limited tech experience?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for a Louisiana farmer with any level of tech experience. The intuitive interface guides users through the eSigning process, ensuring that even those who are not tech-savvy can utilize the platform. Comprehensive support and tutorials are also available to assist users as needed.

-

Can airSlate SignNow integrate with other software that Louisiana farmers use?

Absolutely! airSlate SignNow supports integrations with various popular software applications that many Louisiana farmers may be using, such as CRM systems, accounting software, and cloud storage solutions. This seamless integration helps farmers maintain their existing workflows while enhancing document management and eSigning capabilities. Such compatibility is crucial for maximizing operational efficiency.

-

How secure is the document signing process for a Louisiana farmer using airSlate SignNow?

airSlate SignNow prioritizes security, implementing industry-standard encryption to ensure that documents are safe during the signing process for a Louisiana farmer. Each eSignature is legally binding and complies with electronic signature laws, providing peace of mind. Additionally, user authentication methods help safeguard sensitive information, which is vital for any farmer managing confidential documents.

-

What benefits does eSigning provide to Louisiana farmers?

E-signing through airSlate SignNow provides numerous benefits to Louisiana farmers, including faster turnaround times for contracts and agreements. This efficiency can lead to quicker decisions and improved cash flow for farming operations. Additionally, reducing paper usage through eSigning supports sustainable farming practices, aligning with eco-conscious business goals.

Get more for Rev state la usHome Page Louisiana Department Of Revenue

Find out other Rev state la usHome Page Louisiana Department Of Revenue

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online