Enhanced Form it 558, New York Adjustments Due ToEnhanced Form it 558, New York Adjustments Due ToForm it 558, NY State Adj Due 2022-2026

What is the Enhanced Form IT 558?

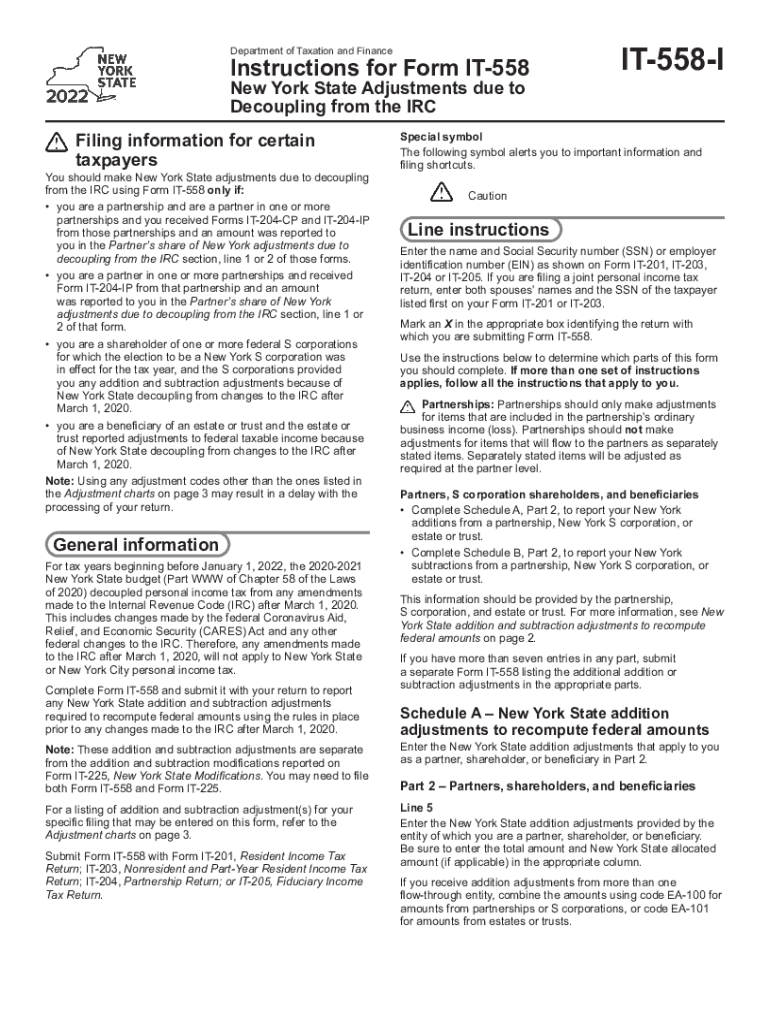

The Enhanced Form IT 558 is a tax form used by residents of New York State to report adjustments due to decoupling from the Internal Revenue Code (IRC). This form is essential for taxpayers who need to make specific adjustments on their state tax returns. The form is particularly relevant for those who have taken advantage of certain federal tax provisions that New York State does not conform to. Understanding the purpose of the Enhanced Form IT 558 is crucial for ensuring accurate tax reporting and compliance with state regulations.

Steps to Complete the Enhanced Form IT 558

Completing the Enhanced Form IT 558 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including your federal tax return and any relevant schedules. Next, carefully fill out the form by entering your personal information, income details, and the specific adjustments you are claiming. It is important to follow the instructions provided with the form to avoid errors. After completing the form, review it for accuracy before submitting it to the New York State Department of Taxation and Finance.

Legal Use of the Enhanced Form IT 558

The Enhanced Form IT 558 is legally recognized for reporting state tax adjustments. To ensure its legal validity, taxpayers must adhere to the guidelines set forth by New York State tax authorities. This includes providing accurate information and using the form in accordance with applicable tax laws. Failure to comply with these regulations may lead to penalties or issues with tax filings. Therefore, it is essential to understand the legal implications of using this form and to ensure all information is truthful and complete.

State-Specific Rules for the Enhanced Form IT 558

New York State has specific rules governing the use of the Enhanced Form IT 558. These rules dictate which adjustments can be claimed and the documentation required to support those claims. Taxpayers should be aware of any changes in state tax laws that may affect their eligibility to use this form. Additionally, understanding the deadlines for submission and any associated penalties for late filing is crucial for compliance. Staying informed about state-specific rules helps ensure that taxpayers can effectively navigate their tax obligations.

Filing Deadlines for the Enhanced Form IT 558

Filing deadlines for the Enhanced Form IT 558 align with the standard tax filing deadlines set by New York State. Typically, the form must be submitted by April fifteenth, unless an extension is granted. It is important for taxpayers to mark their calendars and prepare their documents ahead of time to avoid last-minute issues. Missing the filing deadline can result in penalties and interest on any taxes owed, making timely submission a priority for all taxpayers.

Examples of Using the Enhanced Form IT 558

Examples of utilizing the Enhanced Form IT 558 can include scenarios where taxpayers need to adjust their state income due to federal tax deductions that New York does not recognize. For instance, if a taxpayer claimed a federal deduction for business expenses that are not allowed under New York tax law, they would report this adjustment on Form IT 558. Understanding these examples can help taxpayers identify when they need to use the form and how to accurately report their adjustments.

Quick guide on how to complete enhanced form it 558 new york adjustments due toenhanced form it 558 new york adjustments due toform it 558 ny state adj due to

Prepare Enhanced Form IT 558, New York Adjustments Due ToEnhanced Form IT 558, New York Adjustments Due ToForm IT 558, NY State Adj Due effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to develop, modify, and eSign your documents quickly without delays. Manage Enhanced Form IT 558, New York Adjustments Due ToEnhanced Form IT 558, New York Adjustments Due ToForm IT 558, NY State Adj Due on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The most efficient way to edit and eSign Enhanced Form IT 558, New York Adjustments Due ToEnhanced Form IT 558, New York Adjustments Due ToForm IT 558, NY State Adj Due seamlessly

- Obtain Enhanced Form IT 558, New York Adjustments Due ToEnhanced Form IT 558, New York Adjustments Due ToForm IT 558, NY State Adj Due and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this task.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, and mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Enhanced Form IT 558, New York Adjustments Due ToEnhanced Form IT 558, New York Adjustments Due ToForm IT 558, NY State Adj Due to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to it558?

airSlate SignNow is a digital signature platform that simplifies the process of sending and electronically signing documents. The solution focuses on enhancing productivity and collaboration in businesses, making it a perfect choice for users looking for functionalities like those described in it558.

-

How much does airSlate SignNow cost compared to other solutions mentioned in it558?

The pricing for airSlate SignNow is competitive, making it a cost-effective alternative to other eSignature solutions discussed in it558. With various subscription plans, businesses can choose the one that fits their needs without breaking the bank.

-

What key features of airSlate SignNow address the needs highlighted in it558?

airSlate SignNow offers essential features such as secure eSigning, template creation, and real-time tracking. These capabilities align with the insights provided in it558 about improving document workflow and efficiency in organizations.

-

How can airSlate SignNow improve my business processes as mentioned in it558?

By utilizing airSlate SignNow, businesses can streamline their document signing processes, reducing turnaround time signNowly. This aligns with the recommendations in it558 for enhancing operational efficiency and ensuring a smoother workflow.

-

Does airSlate SignNow integrate with other tools as indicated in it558?

Yes, airSlate SignNow offers integrations with various business tools, such as CRMs and cloud storage services, discussed in it558. This ensures that your document management process remains seamless and efficient, adapting to your existing technology stack.

-

Is airSlate SignNow secure enough for sensitive documents as described in it558?

Absolutely, airSlate SignNow employs stringent security measures like encryption and compliance with industry standards to protect sensitive documents. This focus on security aligns with the requirements outlined in it558 for businesses handling private information.

-

What benefits can I expect from using airSlate SignNow, according to it558?

Users of airSlate SignNow can expect increased efficiency, reduced paperwork, and faster turnaround times. These benefits are consistent with the insights shared in it558, which emphasize the importance of digital transformation in business operations.

Get more for Enhanced Form IT 558, New York Adjustments Due ToEnhanced Form IT 558, New York Adjustments Due ToForm IT 558, NY State Adj Due

- Guardianship handbook oklahoma form

- Oklahoma guardianship fillable form

- Oklahoma district forms

- Ok western district form

- Oklahoma northern district forms

- Bill of sale with warranty by individual seller oklahoma form

- Bill of sale with warranty for corporate seller oklahoma form

- Bill of sale without warranty by individual seller oklahoma form

Find out other Enhanced Form IT 558, New York Adjustments Due ToEnhanced Form IT 558, New York Adjustments Due ToForm IT 558, NY State Adj Due

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament